1. INTRODUCTION

Small and medium sized enterprises (SMEs) are an important part of every national economy 1. In 2017, in the EU-28 non-financial business sector, SMEs accounted for over 99 % of enterprises, over 66% of employment and generated almost 57 % of total value added (European Commission, 2018:13). With regard to Croatia, in 2017 SMEs accounted for 99.7 % of total enterprises, employed 73.2 % of the workforce and contributed with a share of 59.6 % to the total income generated (Alpeza et al., 2018; FINA, 2018). Additionally, SMEs are important in terms of knowledge generation and research as well as their innovation potential (Leitner, Stehrer, 2015:1).

However, their own investments and development as well as their contribution to the economic growth can be limited by the obstacles SMEs face in their business. According to different surveys, one of the most relevant barriers for SMEs is access to finance which includes external financing under acceptable terms and in adequate amount (Vidučić et al., 2018:487). In a bank-oriented financial system such as the Croatian one, SMEs are more directed to traditional financing through financial intermediaries. Although the range of bank credits has broaden in recent years, many financial institutions consider lending to SMEs to be highly risky, primarily due to poor collateral, high failure rate and/or lack of information (Vidučić et al., 2018). This consequently results in inadequate financing in different phases of SMEs’ development, especially in the risky start-up phase or during the phase of intensive growth (Alpeza et al., 2018). It becomes even more pronounced in turbulent times.

In such circumstances, when SMEs cannot obtain a credit from a bank or can obtain it but only at high costs and after very complex procedures, trade credit or supplier financing becomes the valuable alternative. Recent evidence confirms the importance of trade credit financing for SMEs in the European Union - trade credit is one of the largest sources of financing, amounting to around 30 % of the GDP. It is the most important alternative to bank loans as it is the principal source of financing after sources through financial intermediaries, and it is present at all stages of a firm’s lifecycle (CantoCuevas et al., 2019:1).

Trade credit is an attractive financing source and it allows a customer (buyer) to obtain a product (or service) up front while the payment to supplier is deferred and will take place in the future, on a scheduled day, with no interest charged 2. The theoretical literature suggests various approaches and motives 3, 4 to explain the firms’ involvement in trade credit (“supply-side view” which focuses on trade credit granted to customers and is evident in the level of accounts receivable) and the advantages of the use of trade credit as a financing source (“demand-side view” shown in the buyer’s balance sheet level of accounts payable). Trade credit allows companies to reduce the transaction costs related to cash management and the process of paying invoices (Ferris, 1981;Emery, 1987) and to evaluate the product quality before payment (Lee, Stowe, 1993;Deloof, Jegers, 1996). In this way, it supports the sales policy, enables flexibility with respect to the variability in demand (Emery, 1984) and can strengthen the long-term relationship with customers (Wilson, Summers, 2002). Financial approach observes trade credit as an alternative to bank credit and other sources of financing, emphasizing market imperfections, such as transaction costs and information asymmetry. Market imperfections may result in credit rationing and, to overcome this problem, SMEs can choose trade credit as an important short-term financing instrument (Yazdanfar, Öhman, 2017), especially when credit from financial institutions is constrained (Elliehausen, Wolken, 1993;Petersen, Rajan, 1997) or when financial markets are less developed (Fisman, Love, 2003). In comparison to bank loans, trade credit provides a higher degree of financial flexibility (Huyghebaert et al., 2001).

However, if the discount for early payments is not used (Vidučić et al., 2018;Hill et al, 2017) 5 suppliers’ financing can be a very expensive source of financing with high opportunity costs. Although some studies suggest the opposite 6, the findings of a recent international study byHill etal. (2017) suggest that trade credit is used relatively less by larger, more liquid firms and firms with less volatile earnings, or, more generally, by firms with easier access to financial credit. These results, which are more pronounced in firms operating in emerging economies, support the position of trade credit as an expensive source of financing (Hill et al., 2017:2319). The aforementioned additionally justifies the investigation of the key factors that determine the use of expensive trade credit by SMEs in South-East European countries such as Croatia.

In recent years, the number of researches on different aspects of trade credit use and/or its implications on company performance (profitability, value, survival, etc.) have increased (Yazdanfar, Öhman, 2017:11). Additionally, after the last financial crisis, several studies examined whether trade credit is an alternative or a complement to other financing sources (and bank credit). Generally, the results support the role of trade credit as a complement to (short-term) bank financing (Andrieu et al., 2018;Yazdanfar, Öhman, 2017) but also as a substitute for long-term debt (Yazdanfar, Öhman, 2017). In other words, the results indicate a redistribution effect of trade credit during financial crisis denoting that as the SME’s access to finance from financial institutions was restricted, SMEs relied more on trade credit, which then increased the possibility of their survival during and after the crisis period (McGuinness et al., 2018). Thus, trade credit proved to be an important mechanism that helped SMEs to cope with the credit crisis (McGuinness, Hogan, 2014;McGuinness et al., 2018;Bussoli, Marino, 2018) as suppliers served as lenders of last resort (Carbo-Valverde et al., 2016).

All the above mentioned supports a deeper investigation of trade credit as an SME funding source, apart from solely bank financing. Therefore, the aim of this research is to empirically investigate the determinants of trade credit financing of SMEs in Croatia. The role of trade credit and the factors behind it, can be especially pronounced in the bank-oriented financial system like the Croatian one, where firms depend on limited and expensive bank financing. Additionally, financing through capital markets is unreachable and is therefore rarely used.

Firms’ access to finance depends not only on the characteristics of the firm itself, but also on the environment in which it operates.Beck et al. (2008) show in a research on a large set of developed and developing countries that the use of external sources strongly depends on the country’s level of financial and legal development. In developing countries where formal lenders are limited, financial markets are less developed and creditor protection is weak, trade credit plays an even more significant role in funding firm’s activities (Fishman, Love, 2003). With respect to the EU countries, despite economic and financial integration of new member states, both macroeconomic context and the structure of the banking sector still differ significantly between the member states (Leitner, Stehrer, 2015). According to SAFE survey, the financing patterns of SMEs differ substantially in EU-28 and Croatia due to differences in the financing resource availability and the SMEs’ needs (Harc et al., 2017). Furthermore, firms from Croatia have rarely been included 7 in the cross-country examination on trade credit use. To the authors’ knowledge, the only single-country research on trade credit determinants performed on a sample of Croatian companies is a study byDeari and Barbuta-Misu (2018). Their sample consisted of 26 non-financial firms listed on the Zagreb Stock Exchange during the observed period from 2007 to 2013. Our research differs from the mentioned study as it focuses on a larger sample of small and medium enterprises and for a longer and more recent period from 2008 to 2017. Apart from the firm-level determinants used in the study byDeari and Barbuta-Misu (2018), our analysis will be expanded to include institutional and macroeconomic characteristics that may affect firm’s financial decisions, such as the features of the financial system, legal environment and general macroeconomic circumstances. Additionally, our analysis is performed using dynamic panel methodology and the GMM estimator.

All the above mentioned raises the question of whether the trade credit use and its determinants, confirmed in other comparable studies, differ in the case of small and medium enterprises in a specific Croatian environment. Thus, the main hypothesis of the research is: firm-specific factors (internal) as well as institutional and macroeconomic (external) factors influence the use of trade credit as a financing source of SMEs in Croatia.

The paper is structured as follows: after the introduction, the second section briefly outlines the literature review on various factors that explain the use of trade credit financing. The third section describes the data, methodology and the research model. Empirical results and their discussion are presented in the fourth section, followed by the concluding remarks.

2. DETERMINANTS OF TRADE CREDIT - LITERATURE REVIEW

Many empirical investigations on trade credit use, its importance and influential factors have been carried out lately. Evidence is obtained using different approaches (microeconomic or macroeconomic), different variables and their measures, different methods, sources of data (survey results or firm-level accounting data), and different time spans.

Firm’s characteristics, such as creditworthiness, profitability, current asset investment, growth opportunities as well as access and availability of alternative financing sources, can influence the use of trade credit.

According to the Pecking order theory (Myers, Majluf, 1984;Myers 1984), which is based on the asymmetric information between the firm’s insiders and outsiders and results in adverse selection problem, firms prefer internal to external financing and debt over equity. Comparing internal financing and trade credit, it is concluded that internal financing is preferred because it is the cheapest source and it avoids all information asymmetry problems. Thus, firms with a better ability to generate funds internally have more resources available and need less funding from other sources, including suppliers. This negative relationship is confirmed in most previous studies conducted on SMEs (i.e.García-Teruel, Martínez Solano, 2010;Martinez-Sola et al., 2017;Canto-Cuevas et al., 2019).

Growth opportunities put pressure on the amount of working capital the firm needs to support sales growth. Thus, companies with a larger increase in sales demand more finance in general and trade credit in particular because of its flexibility to adjust to the customer’s operation dynamics. AsCuñat (2007) points out, high growth firms get a higher proportion of trade credit from their suppliers. Therefore, a positive relationship is expected between SMEs’ sales growth and trade credit financing, as confirmed byPalacin-Sánchez et al. (2018),Mättö and Niskanen (2019), andCanto-Cuevas et al. 2019).

In assessing a firm’s ability to obtain credit, its creditworthiness is of the highest importance. The size of the firm is one of the credit quality indicators and it can affect the demand for trade credit financing adversely. Firm size reflects the degree of information asymmetry and the ability to establish relationships with both banks and other credit suppliers (Yazdanfar, Öhman, 2017). Larger firms are considered more creditworthy and can therefore receive more credit from their suppliers (Petersen, Rajan, 1997). This positive relationship is supported by the results reported in studies conducted byYazdanfar and Öhman (2017),Barbuta-Misu (2018) andCanto Cuevas et al. (2019), who found that larger firms, with greater growth opportunities and greater investments in current assets, receive more financing from their suppliers. However, due to their better credit capacity and reputation, larger firms have easier access to financing through other credit channels and consequently need less trade credit (i.e.Niskanen, Niskanen, 2006;Bussoli, 2017).

The level of inventory and its management is a part of the firm’s working capital management. Firms that invest more in inventories, similarly to firms with a greater increase in sales, need more short-term financing. On the assumption that firms tend to match the maturity of assets and liabilities, in order to finance investments in working capital and satisfy the mentioned financing rule, it can be expected that the trade credit financing increases with the growth in inventories. Empirical results confirm this positive relationship (i.e.Garcia-Teruel, Martinez-Solano, 2010;Deari, Barbuta-Misu, 2018). However, inventories can serve as collateral for bank loans, thus reducing firm’s credit constraints (Atanasova, 2007) and decreasing the need for supplier financing. Moreover, a composition of inventories can also affect firm’s decision to use trade credit (i.e.Mateut et al., 2015) because different inventory categories 8 have different values from the liquidation perspective.

In line with the Pecking order theory, internal funds are the cheapest source of financing and are therefore preferred. Firms with higher profitability tend to have more internally generated funds that consequently reduce their need for more expensive trade credit financing. In most empirical studies, this negative relationship is evident (i.e.Canto-Cuevas et al. 2016,Yazdanfar, Öhman, 2016;Andrieu et al. 2018).

The financing motive behind the involvement in trade credit emphasises the advantages of supplier financing in the context of availability of other sources of financing, particularly bank credit. This implies a potential influence of, not only firm’s characteristics, but also of institutional features, such as the characteristics of a country’s financial system. Financial system has an important role in reducing market imperfections related to transaction costs, information asymmetry and conflict of interest and in providing external financing for companies. When considering banks as the main providers of firms’ financing, the relationship between bank credit and trade credit is explained by two opposing views. The first one sees trade credit as an alternative to bank loan 9. According toPagano (1993), in the process of funnelling savings from savers to borrowers, a part of the funds is lost due to covering the costs of financial intermediation. When banks are considered, these funds cover the spread between the lending and borrowing interest rates. It is a compensation for banking services. Although the spread is determined by various factors (e.g. market terms, taxation, regulation), it also reflects the bank’s efficiency. If banks are less efficient, the cost of financial intermediation is higher. From the firms’ perspective, this means higher cost of borrowing which results in higher trade credit financing. Additionally, due to limited amount of collateral, access to bank credit is especially limited for SMEs. Moreover, these companies have only a partial access to the financial markets. Thus, as it was stated in the seminal work byMeltzer (1960) and confirmed by numerous studies (e.g.McGuinness, Hogan, 2014;Carbó-Valverde et al., 2016;Palacín-Sánchez et al., 2018), with restricted banks’ financing sources, firms resort to trade credits. The tightening in banks’ lending, especially to SMEs, was evident in times of financial crises when firms used more trade credits (Casey, O’Toole 2014;McGuinness et al., 2017). However, there is the opposite evidence, too. More precisely, empirical studies confirm that during financial crises bank credit and trade credit move in the same direction (Taketa, Udell 2007;Psillaki, Eleftheriou, 2015). This is in line with the opposite view 10, which implies that the relationship between trade credit and bank credit is positive (Biais, Gollier, 1997). Banks are readier to lend if suppliers provide trade credits to their customers. In other words, trade credits by suppliers reduce information asymmetry for banks. In this way, as trade credits are increasing, bank lending is increasing, too. Additionally, with more access to bank financing, suppliers of trade credit are more able to provide financing to their customers. In this way, “non-financial corporations act as ‘agents’ for financial intermediaries” (Demirgüç-Kunt, Maksimovic, 2001:6). This is the case when suppliers are more efficient in gathering information and monitoring firms in comparison to financial institutions. Thus, these two types of financing are not alternative but are complementary to one another. Beside the above stated papers, there are additional studies that empirically confirm the second hypothesis (e.g.Agostino, Trivieri, 2014;Deloof, La Rocca, 2015;Andrieu et al., 2018;Hill et al., 2019).

Beside the above explained influences of company-level factors and the characteristics of the financial system, the use of trade credit can also be determined by the macroeconomic factors and the legal environment.

Macroeconomic conditions influence external financing (Demirgüç-Kunt, Maksimovic, 1998;Demirgüç-Kunt, Maksimovic, 2001). Among them, two main ones are GDP growth and inflation. When the economy is growing, firms need more financial resources. Thus, it is expected that economic growth positively affects trade credit. Since inflation reflects monetary instability, longterm financing is limited in times of high inflation implying that firms have access only to shortterm financing, and consequently to trade credit.Demirgüç-Kunt and Maksimovic (1998) found that long-term debt is negatively related to inflation. Therefore, a positive relationship between inflation and trade credit is anticipated.

A country’s legal system influences the availability of external sources of financing (DemirgüçKunt, Maksimovic, 1998). In countries with low level of creditor rights protection, lenders refrain from providing financial resources to firms. On the other hand, a more efficient legal system that protects creditor rights encourages repayment of both banks and trade credits. This could imply that a positive impact of the legal system on trade credit is expected. However, the legal system is likely to be more important for credits of financial intermediaries than for trade credits (DemirgüçKunt, Maksimovic, 2001). In the environment of an inefficient legal system, the suppliers of trade credit are more able to cope with the problem of credit repayment in comparison to banks. According toFishman and Love (2003:357) the advantages of trade creditors in comparison to financial institutions in countries with inefficient legal systems are information acquisition, the renegotiation/liquidation process and enforcement. For example, suppliers could suspend deliveries to their customers in the future and thus encourage the repayment of trade credit. This suggests that a negative relationship between the efficiency of the legal system and trade credit is expected (Demirgüç-Kunt, Maksimovic, 2001). The efficiency of the legal system as a determinant of trade credit is evidenced byDemirgüç-Kunt and Maksimovic (2001),Hill et al. (2017) andPalacín-Sánchez et al. (2018).

3. DATA AND METHODOLOGY

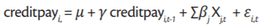

Data for the variables used in this analysis are collected for the 2008-2017 period from the Amadeus - Bureau van Dijk database. The analysed period represents the most recent available data that refer to small and medium enterprises in Croatia. Size classification is based on the Amadeus - Bureau van Dijk database criteria. Medium-sized enterprises are those that satisfy at least one of the following criteria: operating income ≥1 million EUR, total assets ≥2 million EUR, number of employees ≥15. When the indicators are lower than the previously stated ones, then the data refers to a small business. After excluding SMEs with missing data and applying the criteria that for each variable there should be data available for a minimum of 3 consecutive years, the final number of active companies represented in the analysis is 1,225, which represents 1.02% of the SME population in 2017. The advantage of panel data is based on the fact that they contain inter-individual differences and intra-individual dynamics which impose an advantage over cross-sectional or time-series data (Hsiao, 2005). The advantage is a more precise model parameters estimation. According toHsiao (1985) panel data reduce estimator bias, while simultaneously reducing problems of data multicollinearity. Due to the dynamic nature of economic relations, the following dynamic model is formed:

Where  , is the measure of the size of trade

credit use of an SME i at time t, with i=1,…,1225,

t=1,…,10; 𝜇 is the constant term,

, is the measure of the size of trade

credit use of an SME i at time t, with i=1,…,1225,

t=1,…,10; 𝜇 is the constant term,  is the one-period lagged size of trade credit use, 𝛾 is

the lagged dependent variable parameter, the vector of j explanatory variables accounts for the

firm’s specific financial system, macroeconomic and institutional variables,

is the one-period lagged size of trade credit use, 𝛾 is

the lagged dependent variable parameter, the vector of j explanatory variables accounts for the

firm’s specific financial system, macroeconomic and institutional variables,  is the disturbance,

which summarizes unobserved firm-specific effect and idiosyncratic error.

is the disturbance,

which summarizes unobserved firm-specific effect and idiosyncratic error.

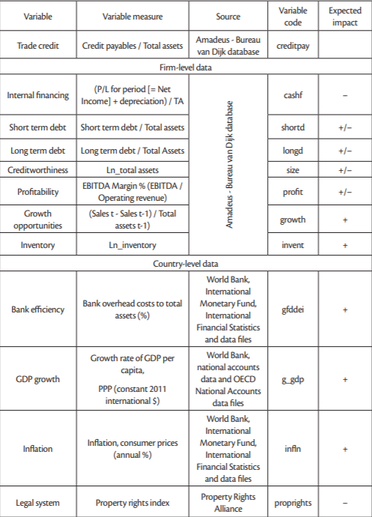

In order to estimate the impact of various factors that may have an important role in explaining trade credit financing, the authors created two groups of determinants; the first relates to firm-level determinants and the other to country-level determinants. A detailed insight into determinants, their measures and their expected effect on trade credit use is presented inTable 1.

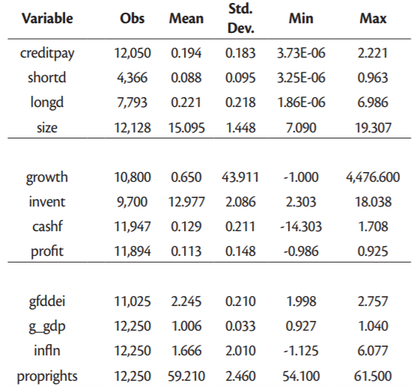

Table 2 provides an insight into descriptive statistics of the analysed variables. The average share of trade credit financing in the total assets for SMEs in Croatia in the observed 2008-2017 period amounted to 19.4%. Interesting to note, some SMEs in the sample used trade credits to an extent twice the recorded total assets.

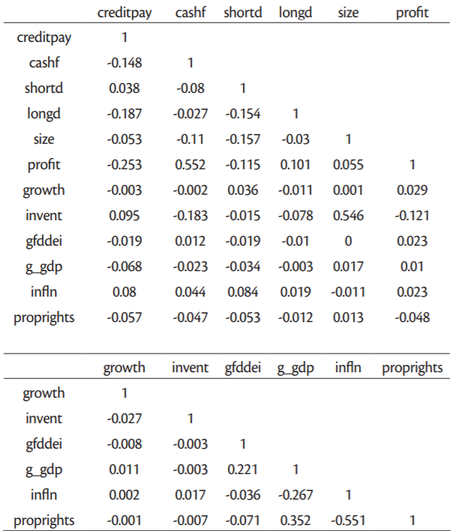

According toBaltagi (2008), panel analysis does not presuppose the multicollinearity test, hence the possible multicollinearity problem is analysed.Table 3 summarizes the pair-wise correlation coefficient for all the variables that have been included in the model. There is no pronounced correlation between the explanatory variables, which indicates that there is no problem of multicollinearity.

4. RESULTS AND DISCUSSION

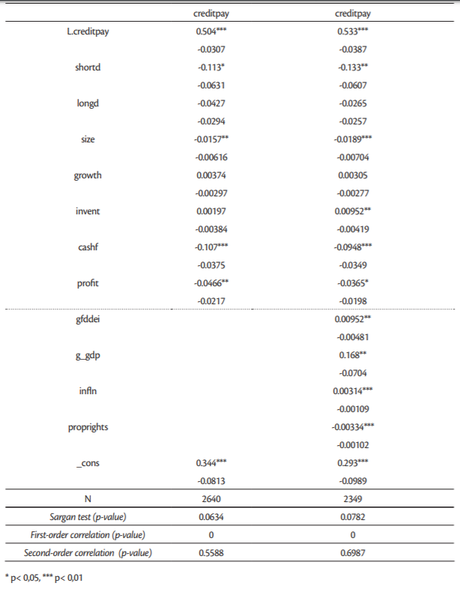

In this section, the empirical results and discussion are presented. Two models are estimated: the first underlying model contains firm-level variables while country-level variables are added in the second one. The models are estimated with the Blundell-Bond estimator. The estimation results are shown inTable 4. Based on the assumption of the relationship between the dependent and some of the explanatory variables in both directions, a part of the explanatory variables is assumed to be endogenous. They include: short-term debt, long-term debt, size, growth of sales, and inventories. The validity of each model is tested using the Sargan test. The performed Sargan test does not show the presence of endogenous problems. According toRoodman (2009), Sargan test is valid in the case when the number of instruments does not exceed the number of groups. This condition is also met. Another diagnostic test refers to the autocorrelation of residuals (first-order serial correlation and second-order serial correlation). The autocorrelation tests confirm the consistency of the estimator .

The impact of the analysed explanatory variables is in line with theoretical expectations. The results confirm that SMEs that generate more internal finance demand less trade credit. This negative relationship is confirmed in most previous studies conducted on SMEs (i.e.García-Teruel, Martínez Solano, 2010;Martinez-Sola et al., 2017;Canto-Cuevas et al. 2019). The negative coefficients with regard to short-term and long term-debt indicate a substitutive relation between trade credit and these alternative sources of financing. The availability of short-term debt reduces the need for trade credit which is more costly and thus less preferable. Although the same negative relationship holds for long-term debt as well, it is not statistically significant. Similar results are confirmed in other studies on SMEs, i.e.García-Teruel, Martínez Solano (2010),Yazdanfar and Öhman (2017) (substitution effect is evident only for the long-term debt) andCanto-Cuevas (2019). With respect to firm size, the results confirm that larger SMEs, which are observed as more creditworthy, tend to use less trade credit. With regard to firm profitability, it is concluded that profitable firms, due to their ability to generate internal funds, use less financing from suppliers. Firms with growth opportunities and larger inventories use trade credit more in order to finance their investments in working capital. The statistical significance of the latter is confirmed. Our results regarding the impact of firm profitability and sales growth correspond to the results of the aforementioned studies (i.e.García-Teruel, Martínez Solano, 2010;Yazdanfar and Öhman, 2017;Canto-Cuevas, 2019).

The coefficient of bank efficiency variable has a positive sign. Taking into consideration the measure of the bank efficiency variable, this implies that as banks are becoming less efficient, trade credits are increasing. In other words, the obtained results confirm the role of trade credit as a substitution for bank financing and are in line with the results of the following country-level studies:Nilsen (2002),McGuinness and Hogan (2014) andCarbó-Valverde et al. (2016).

Considering macro-economic conditions, there is a significant positive sign of the coefficient of the GDP growth variable, as it was hypothesized. Inflation positively affects the use of trade credit. This is consistent with a research on determinants of trade credit byDemirgüç-Kunt and Maksimovic (2001) as well as with a part of the research byHill et al. (2017).

The legal system is confirmed as a significant determinant of trade credit for Croatian SMEs. As it was expected, the coefficient has a negative sign. This implies that improvements in the legal system result in the reduction of trade credit. The findings are in line with previous research byDemirgüç-Kunt and Maksimovic (2001),Hill et al. (2017) andPalacín-Sánchez et al. (2018).

The results obtained from the dynamic panel analysis confirm our hypothesis that firm-specific (internal) factors as well as institutional and macroeconomic (external) factors affect the use of trade credit as a financing source of SMEs.

5. CONCLUSION

The paper examines the determinants of trade credit as a financing source among SMEs in Croatia. This topic is of importance for SME performance, especially considering difficulties they face in obtaining financing through financial intermediaries. However, similar empirical analyses are relatively rarely performed in the context of South-East European countries that face different conditions and have different institutional characteristics than the usually investigated countries.

Thus, the aim of the paper was to reveal the influential factors – both firm-specific and countryspecific, that affect the use of trade credit, and to detect whether they differ in comparison to the factors observed in developed countries. Additionally, we were also interested in analysing whether trade credit substitute or complement other financing sources. The research sample included 1,225 SMEs operating in the 2008-2017 period and a dynamic panel methodology was applied.

The impact of analysed explanatory variables is in line with theoretical expectations. The results confirm that more profitable SMEs and those that generate more internal finance demand less trade credit. This confirms the hierarchy of preferences in financing (“pecking order”) due to which costly trade credit financing is a less desirable source. Firms with larger inventories and growth opportunities use trade credit more to finance their investments in working capital. However, the coefficient for the latter, although positive, is not statistically significant. With regard to firm size, it can be concluded that larger and thus more creditworthy firms, that have better access to other financing sources, use less trade credit. Smaller firms, on the other hand, tend to rely more on trade credit due to their higher degree of information asymmetry and their inability to satisfy restrictive criteria requested from the financial institutions.

Distinguishing between short-term and long-term debt, the analysis aims at disclosing the relationship between trade credit and the availability of other financing sources. The negative coefficients with regard to short-term and long term-debt indicate a substitutive relation between trade credit and financing alternatives. The availability of short-term debt may reduce the need for trade credit, which is more costly and thus less preferable. This means that alternative external financing options affect the use of trade credit. The explanation is also valid for the long-term debt. However, this relationship is not statistically significant. Thus, this issue needs to be further examined.

As this substitution relation may be affected by the external conditions in the country, the analysis was extended to include country-level factors that control these external conditions and capture the changes in bank loans supply side. Among country-level factors, the efficiency of the banking sector, GDP growth, inflation and legal system determine the trade credit of Croatian SMEs. Higher efficiency of the banking system reduces the cost of borrowing from banks, resulting in a reduction of trade credit. Economic growth encourages firms to use trade credits. In a situation of a shortterm monetary instability in comparison to the long-term one, the sources of financing are more available, implying an increase of trade credit financing. As suppliers are more able to cope with problems in repaying loans from their customers in comparison to banks in a situation of a less efficient legal system, the importance of trade credit increases.

It can be concluded that trade credit use among SMEs in Croatia is determined by both firmspecific and country-specific factors. The observed results are similar to those confirmed in other comparable studies conducted in other European countries. The research results should contribute to a better understanding of the relevance that trade credit use has as a financing tool, especially considering the obstacles SMEs face with regard to the availability of alternative financing sources evident in the specific Croatian environment.

For future research, it would be interesting to investigate more deeply the relationship between trade credit and alternative financing, especially long-term debt, as well as the rationale behind the decision to offer trade credit to customers. The research sample should be extended to include other South-East European countries in order to investigate and compare the influential trade credit factors in different institutional contexts. The effect of trade credit financing on the value of the company as well as on the probability of its survival could also be researched in the future.