INTRODUCTION

Entrepreneurial orientation (EO) as an academic concept and its association with firm performance has been intensely researched over the last decades2 -7. Many researchers follow the conceptual framework laid down by8 and9 stating that EO covarying dimensions are critical for EO to exist, thus one strain of the literature is focused on observing EO as a unidimensional concept and examining various inter-relations with firm performance10-1210-12. On the other hand, the other strain of academics13-18 follow4 conceptual framework who relaxed the assumption of covariance among EO dimensions and investigated entrepreneurially oriented firm as a context-dependent. Therefore, these academics viewed EO as a more complex concept and examined the relationships between EO dimensions and firm performance in various contextual settings19-26. Although the relationship between EO and performance has been widely studied all across the globe, researchers cannot still state with certainty that the relationship mentioned above is completely understood. Many authors found that the relationship has positive connotations5,6,27; however, many authors have not found the relationship positive28-30. Moreover, many authors even looked in more nuanced aspects of the relationship and determined that the EO – performance relationship is more complex and even non-linear10,18,31-36,43. As stated earlier, EO as a concept has been looked upon as either a unidimensional or a multidimensional concept. Studies that adopted the multidimensional concept of EO explored the effects of certain EO dimensions4,5,38, independent effects of each EO dimension34,39, unique effects in certain industries16,40,41, and non-linear relations with performance33,34,42,43. Moreover, many studies have highlighted that EO (including EO dimensions) – performance relationship is context-specific and that the relationship needs to be observed in interaction with various contextual factors23,31,42,44-46. However, not many studies have explored how EO dimensions interact while related to firm performance. As far as authors‘ knowledge, only1 have performed such an investigation where they determined on the sample of 1020 Estonian, Latvian and Lithuanian small and medium-sized enterprises (SMEs) that “all three components positively contribute to performance, but in different ways. Risk-taking has a direct positive relationship with performance, the relationship between risk-taking and performance is conditional on the level of innovativeness, and that proactiveness contributes to performance through its positive effect on the level of risk-taking”1; p.713. Therefore, this study aims to replicate the model developed by (1) within a small developed economy context, such as Croatia, and thus provide further validation to their findings. This research aims to investigate the inter-relations between each EO dimension and determine their effect on small firm performance. To be more precise, the research effort will be focused on identifying which EO dimensions are direct drivers of small firm performance and which EO dimensions have a moderating or mediating relationship with small firm performance. The research approach follows1; p.712a configurational approach that looks for “a configurational model internally within the dimensions of EO rather than between EO and external factors.” This study starts with the literature review related to the concept of EO, its dimensions, and their relationship with small firm performance, where four hypotheses were developed based on examining their direct, mediating, and moderating effect. Afterward, the research method was discussed, followed by hypotheses testing and discussion of the results based on the data obtained from small and medium-sized enterprises in Croatia. The article concludes with the theoretical implications, implications for management, limitations, and implications for future research.

LITERATURE REVIEW AND HYPOTHESES

Entrepreneurial orientation (EO) has been a focus in academic research for decades, and the literature on investigating EO is growing rapidly. Many researchers and studies covered EO and its implications on various aspects of performance6,47-51 and within various contexts24,52,53. However, despite such a growing number of publications related to exploring the EO phenomenon, there are still academics1,54,55 who believe that research around EO should return to a more conceptual discussion to understand the concept itself and its implications better. Therefore, even though the EO has been widely covered in the forms of thorough reviews of the EO literature7,18,55-58, examining the effects of various moderators and mediators59-65, investigating effects of different contingencies12,66-68, and even observing different contextual circumstances69-72 that govern the relationship between EO and firm performance, however, literature is very limited on studies related to investigating the interactions between the EO dimensions1,38,73. Therefore, this study aims to fill in this gap in the literature by replicating the1 approach of examining interrelations between the EO dimensions and investigating if and how each of EO dimensions could have a mediating or moderating effect on the relationship between another dimension and firm performance. To be more precise, as per1 proposition), risk-taking affects the firm performance directly and positively, innovativeness has a moderating influence on the relationship between risk-taking and firm performance, while proactiveness has an indirect (mediating) positive effect on firm performance. Risk-taking is one of the central themes in the literature on entrepreneurship74-76, especially when trying to explain entrepreneurial strategies and entrepreneurial mindset77. In the context of EO and following79; p.923 definition, risk-taking refers to “the degree to which managers are willing to make large and risky resource commitments – i.e., those which have a reasonable chance of costly failures”. Moreover, risk-taking can be explained by78; p.152 definition, stating that “risk-taking refers to a firm‘s willingness to seize a venture opportunity even though it does not know whether the venture will be successful and to act boldly without knowing the consequences”. Following1 hypothesis development approach, the relationship between risk-taking and firm performance can be explained through the tradeoff between risk and return, which is a fundamental principle in the financial economics theory. The basic assumption is that for entrepreneurs to take on more risk, i.e. more risky/uncertain actions/strategies/ventures, would require higher compensation (better performance) than for those actions/strategies/ventures that are viewed as being less risky/uncertain. Therefore, the following hypothesis is proposed: H1: Risk-taking has a direct positive relationship with firm performance. Similar to the previously provided explanation for the development of hypothesis H1,1 consider that comparable mechanism is adequate for explaining the development of the second hypothesis H2, where the relationship between venture-level strategy and firm performance should also be viewed through its association with risk/uncertainty. More precisely, since risk-taking should have a direct and positive effect on firm performance, the other two components of EO (firm strategy), innovativeness and proactiveness, should not have a direct, but rather an indirect effect on firm performance, i.e., they should affect firm performance via their association with risk-taking. However, such clarification is contingent on two assumptions: (a) the firm can self-determine the level of their EO, and (b) there is market competition among entrepreneurs. Thus, the following hypothesis is proposed: H2: Proactiveness and innovativeness that have a relationship with firm performance obtain this relationship through their association with risk-taking. Proactiveness, as a dimension of EO, can be viewed as a first-mover advantage originating from anticipating and pursuing new opportunities and by participating in emerging markets4 as shaping the environment opposite to reacting to the environment by introducing new products, technologies, or administrative processes79, or as firms desire to be pioneers in their respective industries6. Therefore, following the provided definition, intuitively, proactive behavior involves certain levels of risk-taking. Stated differently, proactive leaders act on more or less complete or accurate information, meaning they are willing to act on certain calculated risk levels incorporated in their decision-making and strategy formulating process. Therefore, a certain level of risk will be required for a firm to develop new market opportunities proactively. Such proactive actions/strategies will increase firm performance; thus, proactiveness affects firm performance via risk-taking. In their research, several authors34,78,80,81 argue that firms first proactively identify new opportunities, followed by innovative and risk-taking behaviors to seize these opportunities. Therefore, the following hypothesis is proposed: H3: Proactiveness has an indirect, positive relationship with firm performance via risk-taking as a mediator. Lumpkin and Dess4,78 view innovativeness as the firm‘s tendency to embrace new technologies or practices which could lead to new and creative ideas, novelty, and experimentation to bring new opportunities, novel solutions, new technologies, and products or services.79 reflect that innovativeness can come in different forms, such as technological innovation manifested in R&D and engineering, product-market innovativeness manifested in new market niches, product design, advertising, and promotion. Therefore, since innovativeness represents a ‘process‘ of creating something new, it entails a certain amount of risk-taking, which should bring value to the firm in increased performance. Many authors have found empirical evidence that innovativeness positively affects firm performance82-85. Authors in1 argue that the resource-based view (RBV) of the firm provides theoretical reasoning why innovativeness could be a moderator to the risk-taking – firm performance relationship. Due to the limited resources, the firm could be pressured to engage in innovative risk-taking actions/strategies to satisfy demands of both innovative initiatives and risky endeavors, since as per RBV, “risk-taking is a highly resource-absorbing orientation because it involves committing large volumes of resources to endeavors with uncertain outcomes”1; p.719. Therefore, the following hypothesis is proposed: H4: The positive relationship between risk-taking and firm performance is strengthened by innovativeness.

RESEARCH METHOD

SAMPLE

Database of the Croatian Financial Agency (Fina) has been used to obtain the list of the observed companies. According to the European Union definition of small and medium-sized enterprises, a random sample of companies has been pulled out of Fina‘s database. The data sample consisted of 2 000 randomly selected small and medium-sized enterprises contacted in December 2019 and January 2020, From the data sample, 202 firms correctly replied to the email questionnaire, constituting a response rate of 10,1 %. The questionnaire was sent to firm owners or firm‘s top management email addresses, where 73 % of the respondents were either firm owners or directors, while 27 % were managers. Moreover, almost 80 % had more than 7 years of working experience with the firm. Of 202 firms that replied to the email questionnaire, 145 were small (71,78 %), while 57 were medium-sized firms (28,22 %). Considering the industry, 66 firms operate in the manufacturing sector (32,67 %), while 136 firms operate in the service sector (67,32 %).

VARIABLES, MEASURES, AND ANALYSIS

Performance as a multidimensional concept has been measured via a modified instrument developed by [86] based on a 7-point Likert-type scale questions concerning indicators related to sales growth rate, operating profit, profit to sales ratio, market share, market development, and new product development. The performance score has a mean of 3,74, a standard deviation of 1,42, a range of 6,86, and Cronbach‘s α value of ,86. EO was measured using 7-point Liker-type scale questions assessing innovativeness, proactiveness, and risk-taking9. The entrepreneurial orientation score has a mean of 4,33, a standard deviation of 1,21, a range of 5,78, and a Cronbach‘s α value of 0,77. Innovativeness score has a mean of 4,59, a standard deviation of 1,51, and a Cronbach‘s α value of 0,83, proactiveness score has a mean of 4,64, a standard deviation of 1,41, and a Cronbach‘s α value of 0,79., while the risk-taking score has a mean of 3,78, a standard deviation of 1,46, and a Cronbach‘s α value of 0,84. Firm size and industry (sector) were used as controls to provide further robustness to our results. Firm size was measured according to the European Union definition of small and medium-sized enterprises, where micro firms are classified as the ones with less than 10 employees, small firms with 10-49 employees, and medium-sized firms with 50-250 employees. Regarding the industry or sector in which the firm operates, classification has been done whether the firm‘s main line of business was manufacturing or service. The sequence of regression analysis that iteratively arrived at the model that best fit the data was used to test the interrelations between dimensions of entrepreneurial orientation and determine their direct and indirect effects on performance. All variables have been mean-centered to improve the interpretability of results, where Durbin-Watson statistic, maximum Cook‘s distance, and variance inflation factors (VIF) were well below critical values. A non-response analysis and common method bias analysis have been performed, and it can be confirmed that it is unlikely to be a severe concern in this study.

RESULTS

As shown in Table 1, the correlation between entrepreneurial orientation and performance is 0,357, while each of the dimensions of entrepreneurial orientation has a positive correlation with performance. The correlation coefficient between innovativeness and performance is 0,407, risk-taking and performance are 0,171, while proactiveness and performance are 0,408,1 in their article refer to the work of11 based on a meta-analysis on 51 studies showed that overall correlation between entrepreneurial orientation and performance is 0,24. On the other hand, all three dimensions of entrepreneurial orientation are positively correlated, where their correlations ranged from 0,48 to 0,65. Moreover, all three dimensions were positively correlated with an entrepreneurial orientation where their correlations range from 0,75 to 0,82.

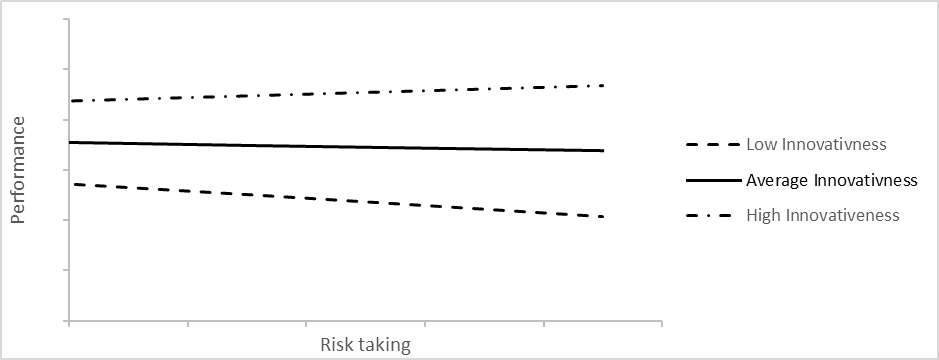

Tables 2 and 3 present the relationships between firm performance and EO dimensions. Model 1 shows a statistically significant positive direct effect of entrepreneurial orientation on performance (β = 0,385, p < 0,01), controlling for firm size and industry. Model 2 provides the separate effect of each EO‘s dimensions on performance while controlling for the other dimensions of entrepreneurial orientation, where innovativeness (β = 0,203, p < 0,01) and proactiveness (β = 0,218, p < 0,01) have a statistically significant positive direct effect on performance, while risk-taking does not. However, when we remove innovativeness and proactiveness from the model and only observe the relationship between risk-taking and performance as in model 6, results reveal a statistically significant positive direct effect of risk-taking (β = 0,132, p < 0,05) on performance. Therefore, we can state there is enough evidence to support hypothesis H1. Same as in model 6, when not controlling for risk-taking, both innovativeness (β = 0,30, p < 0,01) and proactiveness (β = 0,325, p < 0,01) have a statistically significant positive and unconditional effect on performance, as observed in models 5 and 7. Furthermore, model 2 showed that relationships between innovativeness and proactiveness with performance are significant when controlling for risk-taking; we can conclude there is not enough evidence to support hypothesis H2. Mediating relationship between proactiveness, as a dimension of entrepreneurial orientation, and performance was tested by the same approach used by1 and advocated by87. In the first step, model 7 provides us with the value of the total effect (coefficient c), which is 0,325. In the second step, model 9 gives us the value of coefficient a, 0,499. In the third step, the value of the coefficient b is calculated, which is -0,025. Based on the obtained coefficients, we can determine the proportion of indirect effect or mediation channel (a×b = -0,012) in the total effect (c = 0,325), where the mediation channel accounts for 3,8 % of the total effect of proactiveness on performance ((a×b)/c) and is statistically non-significant. Calculated both as per the bootstrap method (0 is included in the interval between LLCI and ULCI) and as per the Sobel test (t-statistic of -0,44, standard error of 0,02, and p-value of 0,6598). Therefore, we can conclude there is not enough evidence to support hypothesis H3, meaning that proactiveness does not have an indirect, positive relationship with performance via risk-taking as a mediator. Moderating relationships between dimensions of entrepreneurial orientation were tested via moderated linear regression analysis, an approach used by6, where model 3 and model 4 build on model 2 by adding two-way and three-way interactions of innovativeness and proactiveness with risk-taking. Model 3 explains for additional 4,2 % of the variation in performance (p < 0,01), while model 4 explains for another 0,02 % of the variation (p < 0,01). The results show statistically significant positive effect of the interaction between innovativeness and risk-taking with performance in both model 3 (β = 0,157, p < 0,01), and in Model 4 (β = 0,196, p < 0,01). There is no evidence of moderating the relationship between proactiveness and risk-taking with performance, nor the three-way interaction effect between innovativeness, proactiveness, and risk-taking on performance. Therefore, the conclusion is there is enough evidence to support hypothesis H4, To further explore the moderating effect of innovativeness on the relationship between risk-taking and performance, figure 1 plots the relationship between risk-taking and performance for three levels of innovativeness – low, average, and high, where low level is defined as one standard deviation below the mean, average as the mean, while the high level is defined as one standard deviation above the mean level of innovativeness. Slopes in Figure 1 provide additional support for accepting hypothesis H4, showing that higher levels of risk-taking and innovativeness are rewarded with higher performance.

DISCUSSION

The relationship between EO and firm performance has been widely researched; however, a gap in the literature has been identified concerning how the inter-relatedness of EO dimensions drives firm performance. Since this study aimed to investigate different configurations within the EO dimensions, this study tried to replicate the research of1 who used financial economics theory to explore the direct relationship between risk-taking and performance, where they used innovativeness as a moderator and proactiveness as a mediator of the relationship mentioned above. Using the data obtained from 202 Croatian small and medium-sized firms, results reveal that EO, viewed as a unidimensional concept, and its all three dimensions, have a positive direct effect on small firm performance. Relationships between innovativeness and proactiveness with small firm performance are significant when controlling for risk-taking; therefore, they do not obtain this relationship through their association with risk-taking. Moreover, the three-way interaction effect between innovativeness, proactiveness, and risk-taking on firm performance is not supported. Proactiveness does not have an indirect, positive relationship with small firm performance via risk-taking as a mediator. The positive relationship between risk-taking and firm performance is strengthened by innovativeness as a moderator. Therefore, it can be concluded that the empirical results obtained in the context of Croatia do not fully confirm the results obtained by1. To be more precise, although the direct effect of risk-taking on performance and moderating role of innovativeness on the risk-taking – firm performance relationship has been supported, however, mediating role of proactiveness and that innovativeness and proactiveness obtain a relationship with firm performance through risk-taking have not. Therefore, this research has not proved that each EO dimension positively affects firm performance but for different reasons, as stipulated by1 which suggests that further validations of their model are required.

RESEARCH IMPLICATIONS

This study further validated EO as a construct since EO was viewed both as a unidimensional and multidimensional construct. All three dimensions of EO demonstrated a positive and direct relationship with firm performance. Moreover, this study confirmed that risk-taking is rewarded since higher levels of risk-taking initiatives/strategies increase the firm‘s performance. Furthermore, this study also confirmed that those risk-taking initiatives/strategies associated with higher levels of innovativeness yield higher performance than those risk-taking initiatives/strategies associated with lower levels of innovativeness. Apart from observing the relationships above, it would be useful in future research to explore relationships between inter-relatedness of EO dimensions with other elements of strategy and determine how these relationships affect firm performance. Is the nature of these relationships characterized by direct, moderating, or mediating effects. Since the relationships between proactiveness and innovativeness and firm performance were conceptualized that they obtain such a relationship through their association with risk-taking, and were based on the assumptions that the firm possesses the ability to self-determine the level of its EO and that there is a market competition among entrepreneurs, future research should focus on exploring various contextual factors which could influence these relationships. Moreover, future research could investigate other factors that could potentially moderate and mediate the risk-taking – firm performance relationship. Although most of the academic research is focused on investigating various effects EO has on firm performance; however EO could also be related to other outcomes, not just performance; therefore, future research could examine the underlying notions between EO and other variables, which could provide further clarification of EO‘s role within the entrepreneurship process. Also, since many studies have confirmed the non-linear relationship between EO and firm performance, future studies could look into the non-linear effects between EO and firm performance dimensions. This research study has certain limitations. Like any other academic article, this section will provide a brief overview of the main limitations that the reader needs to bear in mind while reading this article. Since this study focused only on Croatian SMEs, a sample of 202 small and medium-sized firms could be considered a relatively small sample size, especially when considering the response rate of 10 %. Moreover, since the research context was grounded in a small, developed economy such as Croatia, future research should be done in the wider regional context investigating the effects in other countries of Southeast Europe so that multicounty analysis could increase the validity of the currently obtained results and further test if context-specific aspects influence the observed relationships. Another limitation is concerned with the information gathering process since the unit of analysis was a single firm. The online questionnaire was filled out by only one firm representative making the results highly susceptive to the subjectivity of the respondents. Thus, future research should try to gather information from other sources within a firm and preferably use objective secondary data, such as financial and management reports, to triangulate the data. Furthermore, this study used9 scale for determining EO within the firm. Future research could use other scales to measure EO to validate the results further and maybe offer some additional interesting insights.

CONCLUSIONS

This research has been conducted on 2 000 Croatian SMEs and analyzed 202 small and medium-sized firms. Results revealed a positive relationship between EO, observed both as a uni-dimensional and multidimensional concept, and firm performance. More specifically, innovativeness, proactiveness, and risk-taking positively affect firm performance. Results also reveal that relationships between innovativeness and proactiveness with performance are significant when controlling for risk-taking. Therefore, it can be concluded that proactiveness and innovativeness do not relate to firm performance through their association with risk-taking. Furthermore, it has been determined that proactiveness does not have an indirect, positive relationship with performance via risk-taking as a mediator or moderator. There is no three-way interaction effect between innovativeness, proactiveness, and risk-taking on performance. However, results confirm the positive moderating effect of innovativeness on the risk-taking – firm performance relationship. Stated differently, the positive relationship between risk-taking and performance is strengthened by innovativeness.