INTRODUCTION

The new digital age brings with it several innovations and new products that have become an indispensable part of todayʼs business. Digital transformation of business, implementation, and use of new digital technologies are nowadays an indispensable part of the business if companies want to follow market trends and if they want to be competitive. Due to that, financial markets are creating financial innovations known as FinTech. Blockchain technology and cryptocurrencies are just some of FinTechʼs products that are changing business models and ways of doing business known so far. Cryptocurrencies in financial operations function without the mediation of banks, which ensures the userʼs complete anonymity and speed of data and money transfer. Cryptocurrencies are completely digital and carry a certain degree of risk because they are based on supply and demand for them, which represents a certain degree of uncertainty for the user. The task of the regulatory market is to ensure a transparent global network for transactions and data credibility, ie a regulatory body that will take care of and support the mentioned transaction mechanism. The area that requires the most attention when it comes to cryptocurrencies is their accounting and tax treatment and their regulation in the financial market. As cryptocurrencies become more popular, so do taxes on cryptocurrencies that vary from country to country. Cryptocurrencies are associated with risks such as money laundering, terrorist financing, and tax evasion, which require the establishment of a regulatory body and the implementation and application of regulations in the function of the transparent business with cryptocurrencies. This article aims to explore the concept and main features of cryptocurrency, its advantages and disadvantages, and its effect on the financial industry and specially accounting profession. The main goal is to investigate the regulation of cryptocurrencies in the financial market, i.e. in the field of accounting and tax regulation. Innovations in the financial market are rapidly evolving daily and pose a great challenge in front of the financial industry, and cryptocurrencies as one of the FinTech products are emerging into various industries especially the financial sector thus creating new rules and ways of doing business. A systematic literature review was conducted to provide an overview of the relevant areas of cryptocurrencies and their accounting and tax regulation. To collect data following phrases were used and that is (cryptocurrency) and (accounting) and (tax). The collected papers were analyzed to review the existence of accounting and tax regulations for cryptocurrencies. This article is sectioned into three parts. The first part of the article is dedicated to understanding basic terms related to cryptocurrencies and blockchain technology. In this first part, knowledge about cryptocurrency accounting and tax regulation is presented. The second part of the article represents the research approach, used methodology, and a literature review. Lastly, the third part is a discussion about the conducted research, conclusion, and recommendations. The goal of the article is to present a systematic literature review of papers and the connection i.e. regulation of cryptocurrencies established so far from the accounting and tax aspect. In our research, we focus on papers in the fields of banking, finance and accounting, business and management, and ICT technology.

THEORETICAL BACKGROUND

THE CONCEPT OF CRYPTOCURRENCIES

Cryptocurrencies are digital records stored in digital databases and are a means of digital exchange. Cryptocurrencies are virtual money (the equivalent of electronic money) that can be traded digitally and that serves as (1) a medium of exchange, (2) units of measure, (3) used to store value, but not an official means of payment in any states1; pp.656. Cryptocurrencies exist only on the Internet, they are not issued by any bank or state, so they are not formally money. However, some authors see its ease of transmission over the Internet as an advantage2; pp.25. Also, cryptocurrencies create cheaper transactions, they are more accessible, more practical, but the security of data is questionable, which is one of the key areas of their further regulation. Cryptocurrencies are kept in the so-called “digital wallet” on one of the websites that provide this kind of service. Unlike credit/debit cards cryptocurrencies do not contain or require names, but only have a digital wallet code, the so-called key that ensures anonymity, which is enabled through a peer-to-peer system, as a decentralized system without a central authority. All mentioned transactions take place through the general or public ledger which monitors and records all performed transactions of cryptocurrencies and is called the blockchain. The basic and key features of blockchain technology are that the system is based on peer-to-peer partners where the system is decentralized and there is no central authority (financial institutions, etc.) and each record and each transaction are recorded in real-time between many nodes within peer-to-peer systems2. In 2008, under the pseudonym Satoshi Nakamoto, an article entitled “Bitcoin - A Peer to Peer Electronic Cash” was published, constructing todayʼs most famous virtual currency, “bitcoin”. “Bitcoin is the first real digital solution to the problem of sovereignty, stability, and marketability it is resistant to unexpected inflation, while at the same time being marketable in every area, in all sizes and at all times”3; pp.167. “Bitcoin has no intrinsic value and its value mostly depends on its speculative value. The speculative value is based on spins on the technological mystery associated with cryptocurrency mining”2; pp.29. The main problem that arises around bitcoin is its regulation, i.e. the non-existence of a regulatory body and reaching an agreement on the nature of bitcoin (understanding bitcoin as money or as good), which is a possibility for various frauds. The importance of regulation and verification of transactions with cryptocurrencies is recognized by auditing and study who investigate audit procedures, i.e. risk assessment, i.e. significant misstatements in the financial statements related to cryptocurrency transactions and balances4. It is through “audit and audit monitoring of the adoption of blockchain technology that it can result in increased efficiency during the audit process because there will be a higher level of information revision”5; pp.36. Five important research gaps about bitcoin emerge was defined through study: “(1) research on the use of bitcoin and cryptocurrency in developing countries and across countries as well, (2) approach through a mixed-method (case study and user surveys) regarding the perception and understanding treatment of bitcoin and cryptocurrencies, (3) more research needed on legal regulations and the accounting framework of Bitcoin, (4) research on comparative analysis and mixed-method approach with respect to other cryptocurrencies and bitcoin, (5) need for studies focusing on a longer period of cryptocurrency analysis”6; pp.74.

BLOCKCHAIN TECHNOLOGY

Cryptocurrencies use a Peer-to-Peer system (a system consisting of interconnected nodes) that works through a cryptographic mechanism through which all transactions are created and recorded through the so-called private and public address keys (digital record, a file containing the number of cryptocurrency units transferred). The entire blockchain system consists of computers connected to a network that confirm/verify certain transactions. Blockchain is associated with the term mining, which implies the process of confirming and adding new transactions in the blockchain. Although they do not physically exist, around 1700 virtual currencies are an increasingly common means of payment in the world, but bitcoin convincingly retains its leading position. The main feature and the biggest advantage of cryptocurrencies, i.e. bitcoin, and blockchain technology, is a simple way of transferring money that takes place without intermediaries (over the Internet) where a third party cannot influence the transaction, while the total cryptocurrency market today is worth more than 1,4 billion USD. With regard to the growing popularity of cryptocurrencies, especially among Generation Z, ensuring customer satisfaction has a positive effect on creating the intention to use cryptocurrencies7. Blockchain technology has great potential because it speeds up and automates business processes, which can lead to reduced costs and safer and faster returns on investment. Blockchain technology is associated with the emergence of the concept of “smart contract” concluded between two parties (automatic implementation by the platform and within it) without the need for human intervention 8. The concept of a smart contract is supported today by the four most popular blockchain platforms bitcoin, Ethereum, HyperLedger Fabric, and Corda8. “Blockchain technology can support a new generation of transactional applications and streamlined business processes by establishing trust among parties, accountability, and transparency that are essential to modern commerce”9. The growing interest in cryptocurrencies is also shown by the research which “proves that price increases encourage people to keep their money in long-term deposits, including in cryptocurrencies”10. We can claim that blockchain is “the main game-changer” in the fourth industrial revolution11. Recognizing the importance of blockchain technology as well as its further progress, some authors explore and define alternative mechanisms that can replace the existing Blockchain algorithm and thus make it more efficient12. The importance of blockchain technology is also visible in the creation of new innovative networks and new infrastructure with the aim of replacing old and non-integrated systems13. It has been proven that blockchain technology in combination with IoT elements contributes to the optimization of business processes, traceability, and transparency of the supply chain with significant financial savings within logistics processes, which speaks of a wider and significant application of blockchain technology14.

ACCOUNTING TREATMENT OF CRYPTOCURRENCIES

Digitalization and digital transformation of business has an impact on all companies, but also on its business functions, including accounting itself. A wide range of tools is available to accountants in data processing and analysis, but the digital age provides and markets new and modern technologies daily. Data processing, recording, analysis, and interpretation of data as part of the work within accounting is affected by new technology, where it is important to understand the importance and significance of new digital technologies to improve business and further development of accounting in the context of new technologies. “Blockchain technology is the most discussed technology option and tool in the accounting, finance, and legal professions in recent decades”6; pp.74. Cryptocurrencies, as already mentioned, are becoming a means of payment, so the way of regulating, recording, and monitoring these types of transactions for accountants is an increasingly demanding and complex task. In addition to cryptocurrencies, it is necessary to distinguish them between crypto-assets. Cryptoassets are totality assets and information necessary and available for storage and processing through a blockchain platform which, unlike cryptocurrencies, does not necessarily have to be anonymous15. “Blockchain and crypto-assets are transforming how business is conducted”16. “The new blockchain technology provides a triple-entry bookkeeping system where all transactions are immutable and time-certified, recorded in real-time, and encrypted”17. The transition to blockchain technology for accounting practice involves changing and adapting the accounting information system to electronic sophisticated programs and applications that are technologically advanced18. “Tracking accounting transactions and their continuous recording through blockchain can generate a complete route and history of items for such transactions”5; pp.36. The discussion about the contribution and importance of blockchain technology to accounting is visibly clear in terms of new technologies that bring a number of benefits, in this case, blockchain for the accounting profession. With the advent of new technologies and especially blockchain technologies, the American Institute of Certified Public Accountants (AICPA) monitors current legislative programs and their impact on the accounting profession19. That is why the work of accountants and the accounting profession results in new concepts of accounting for the profession to adapt and learn following the requirements of new modern technologies. Based on the above, the accounting profession is not yet fully adapted to the cryptocurrency business. Currently, there are no accounting standards in the accounting profession that follow cryptocurrencies and their accounting treatment, i.e. monitoring and recording, accountants currently refer to existing accounting standards. Due to that, we can talk about the lack of guidance for the measurement and presentation of holding and trading cryptocurrencies. Accounting treatment of cryptocurrencies under the Financial Accounting Standards Board (FASB) and International Financial Reporting Standards (IFRS) is unclear. “Although the International Financial Standards Board (IFSB) produced a draft document for guidance in the reporting of cryptocurrency, they have only provided a broad overview of these issues and the actual guidance for accounting for cryptocurrency is lacking”20; pp.171. Non-harmonized accounting can jeopardize the ability of users to properly assess the financial position and performance of entities involved in cryptocurrency transactions21; pp.184. “The regulation of cryptocurrencies, i.e. their treatment within the financial statements should maintain the economic circumstances arising from the psychology of cryptocurrency users”22. Regulation of accounting operations through IFRS hardly fits cryptocurrencies within the structure of IFRS23. The issue of valuing cryptocurrencies within accounting relates to its recognition and recording of transactions. In this context, the valuation and recording of cryptocurrency transactions through International Accounting Standard 38 (IAS) as intangible assets or in certain circumstances as Inventories through IAS 2 is considered acceptable23. However, there are different interpretations of cryptocurrencies, so there is a valuation outside the mentioned standards (Table 1). As already mentioned, cryptocurrencies are a form of digital money, but unlike real money that is controlled by the state or the central bank, cryptocurrency is not. In this accounting context, cryptocurrencies do not meet the definition of money according to IAS 7, according to which money includes cash on hand and demand deposits23; p.58. Furthermore, the valuation of cryptocurrencies as a financial instrument is also unacceptable because cryptocurrencies also do not meet the requirements of IFRS-9 (IFRS-9 defines the recognition of assets as a financial instrument if there is a relationship that will create a financial asset and a financial liability). Valuation through IAS 40, investment in assets, is unacceptable, cryptocurrencies are not a physical form of assets as they are by definition, e.g. land or buildings. Accordingly, from an accounting point of view, cryptocurrency cannot be valued as money, a financial instrument, and an investment in real estate. Intangible assets do not have physical characteristics and future economic benefits can be expected from them. According to IAS 38, intangible assets are separate assets (may be sold

separately, transferred, exchanged, etc.) and are the result of contractual or legal rights. Based on the aforementioned, cryptocurrencies meet the definitions of intangible assets because they are exchangeable, it is possible to identify them in total assets as separate assets and they are expected to have future economic benefits23. According to table 1, cryptocurrencies are defined as intangible assets within the provision of IAS 38 (alternatively through IAS 2), while the initial idea of the creator of cryptocurrencies was valuation, i.e. a substitute for money and cash equivalents or an investment that is logically similar to an investment into financial assets23. The regulation of cryptocurrencies within existing accounting standards due to the lack of standards for monitoring cryptocurrencies poses a major challenge for the accounting profession and is the result of several studies addressing these issues. Research conducted by some authors considers that based on the main characteristics of bitcoin, it belongs to the classification of foreign currency, whereby they believe that virtual currencies do not have all the characteristics of a classic currency but have important common features: medium of exchange, a common measure of value and standardized exchange value24. Given that IFRS does not contain specific guidelines for accounting monitoring of cryptocurrencies, Procházka proposes several models for monitoring cryptocurrencies based on existing accounting procedures21. These models serve to present user-relevant information that represents the economic reality of cryptocurrencies21. Based on all the above, it is necessary to find a consensus and define an international accounting standard that will monitor and record cryptocurrencies.

TAX TREATMENT OF CRYPTOCURRENCIES

Due to the increased need for cryptocurrencies, the need to change the laws in the countries to regulate the performance of cryptocurrency transactions is also encouraged. Tax authorities and regulators around the world are trying to understand the concept of cryptocurrency and blockchain and place them within the legal framework. Moreover, their virtual transactions are considered legal in many regulations. Therefore, the possession of cryptocurrencies is even prohibited by law in some countries (Bangladesh, Bolivia, Ecuador, Kyrgyzstan, Vietnam, Russia, and China are on the verge of being banned). “Due to the lack of legal regulation of cryptocurrencies, most countries do not regulate transactions and exchanges with cryptocurrencies, which leads to the growth of illegal transactions”25. Given that cryptocurrencies (bitcoin) are often associated with different types of legal and illegal activities, some studies explore ethical considerations related to the “use of cryptocurrencies and their impact on cryptocurrency price estimates”26. The results on ethical considerations indicate that the “frequency of unethical discussion about Bitcoin negatively correlates with its price, while the frequency of ethical discussion positively correlates with the price of the cryptocurrency”26. Their misunderstanding and lack of regulation underscores the need for cryptocurrencies (bitcoin) to be regulated by the state to avoid tax evasion, possible links to the illegal market, and protect consumer rights24. Different countries value cryptocurrencies differently, so the taxation and tax treatment of cryptocurrencies are different within different countries. Trading with cryptocurrencies generates earnings or receipts that are considered capital receipts, so income tax is paid on the income earned based on trading them based on capital gains. But there are also so-called. “Crypto-friendly” countries that have introduced more lenient laws to promote better adoption and innovation in the crypto-industry and allow investors to buy, sell or hold digital assets without tax. As of January 1, 2020, companies engaged in virtual currency trading and/or providing a wallet custodial service to store private cryptographic keys (e.g., cryptocurrency exchange offices and businesses that rely on crypto transactions) have become subject to the Prevention Act money laundering and terrorist financing (part of the implementation of the 5th European Union (EU) Directive on the prevention of the use of the financial system for money laundering and terrorist financing).

RESEARCH APPROACH

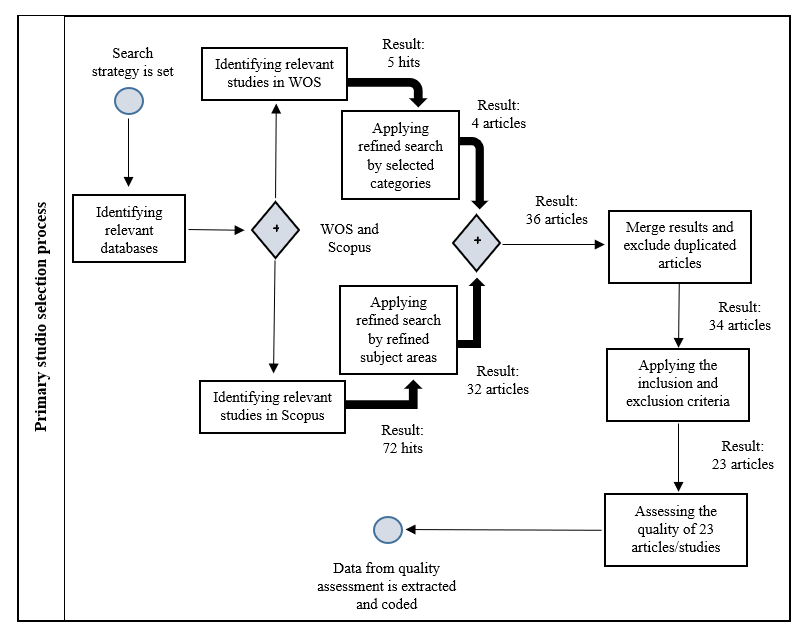

In our research, we have used the literature review, as a means to summarize past findings in a research field, in our case findings of accounting and tax regulation of cryptocurrencies. Our selection process of the papers for the literature review is presented in Figure 1. First, we identified relevant databases for our research, and we have decided to focus on the peer-review journals that are cited in Scopus and WoS (SSCI and SCI papers). Tables 2 and 3 present our search strategies in WoS (SSCI and SCI) and Scopus, with the period 2015 2021. We conducted a search using the scientific databases Web of Science (WoS) and Scopus in January 2022. Through the first part of the search, we checked WoS and Scopus using keywords: “cryptocurrency” AND “accounting” AND “tax”. The search was focused on peer-reviewed papers in journals in the English language. This approach resulted in 77 hits (72 in Scopus and 5 in WoS). In the next step, the search strategy was refined. Since cryptocurrency is applied in different avenues of scientific research, we decided to limit our research to papers in the fields of banking and finance, business and management, accounting, and ICT technology. This criterion was related to Scopus subject areas and WoS categories (Table 2 and 3). This approach resulted in 36 hits (32 hits in Scopus and 4 hits in WoS).

In our analysis, we have included 36 papers (4 from WOS and 32 from Scopus). However, after merging all papers, we excluded 2 papers that were found in both databases. Therefore, 34 papers remained for the analysis. After reviewing the abstracts and keywords of all 34 papers, we eliminated 11 papers that did not report the description of cryptocurrency and its accounting and tax treatment. We used the following criterion that the paper was considered relevant if it specifically covers cryptocurrency and its accounting and tax treatment.

Finally, after applying this exclusion criterion 23 publications remained, and they represent the basis for our further analysis.RESULTS OF RESEARCH

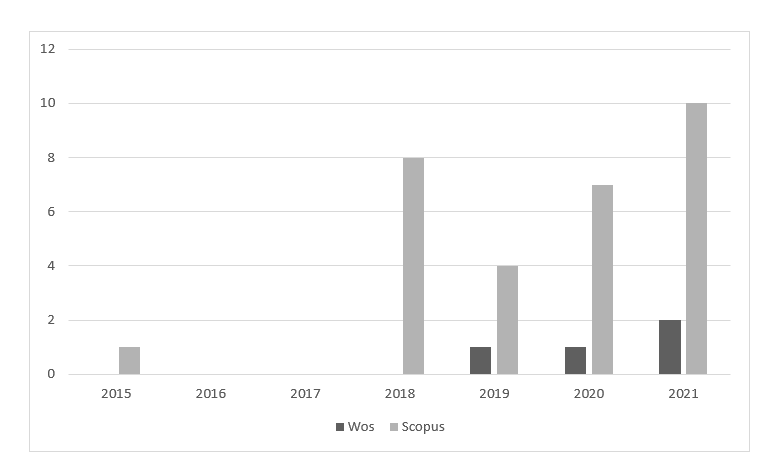

The objective of this work was (1) to study and explore the importance of cryptocurrencies in the financial industry and their involvement in the business process of today organizations (2) to analyze and explore the accounting and tax treatment of cryptocurrencies (3) to ensure a systematic literature review of the research literature in these fields. To achieve the set goals, numerous world literature was analyzed, which explores the field of cryptocurrencies and their accounting and tax treatment. By researching the world literature, it is obvious that too few scientists are dealing with the research field. Today cryptocurrencies are the subject of numerous researches and topics of numerous authors through various fields but only a few studies and even insufficient is in the field of cryptocurrencies regulation and its accounting and tax treatment. Numerous studies dealing with the topic of cryptocurrencies have shown their impact and benefits in todayʼs global business operations. However, as mentioned there is still a lack of research that investigates and deals with cryptocurrencies regulation and its accounting and tax treatment which is evident from the review of the researched literature. Figure 2 depicts the annual number of publications from 2015-2021. A growing trend of published papers is revealed. A growing trend in this area is from 2020 until 2021 (in 2016 and 2017 no paper has been published) where 20 articles were published regarding cryptocurrencies regulation and its accounting and tax treatment. As shown a very small number of articles deal with cryptocurrencies regulation and its accounting and tax treatment.

Common to all researched papers is that they emphasize the importance of cryptocurrency and blockchain technology in todayʼs business process. As shown, there is insufficient research that connects cryptocurrencies with their regulation and their accounting and tax treatment which represents the basis for further research in this area. Still, papers that deal with cryptocurrencies and link them to accounting and tax treatment claim prove a lack of regulation and insufficient research in this area.

CONNECTION BETWEEN CRYPTOCURRENCY, ACCOUNTING, AND TAX

Our research of relevant data basis on the correlation between cryptocurrency, accounting, and tax found 18 papers connecting cryptocurrency and accounting, and 14 papers connecting cryptocurrency and tax (Table 5). As can be seen, almost an equal number of papers are engaged in research in the field of cryptocurrency accounting and in the field of cryptocurrency taxation.

| Cryptocurrency regulation | Paper ID | #of papers |

| Accounting | 1, 3 ,4, 6, 7, 9, 10, 11, 12, 13, 14, 15, 17, 18, 20, 21, 22, 23 | 18 |

| Tax | 2, 4, 5, 7, 8, 9, 11, 16, 17, 19, 20, 21, 22, 23 | 14 |

Today, the application of blockchain technology is visible in almost all areas and various business functions, and this includes the field of banking and capital markets, corporate governance, international trade, accounting regulators, and taxation27. We can claim that blockchain and cryptocurrencies are changing the power of the global economy. Blockchain technology, which is related to the use of cryptocurrencies, as a promised technology to ensure higher levels of data encryption and security. The European Banking Authority (EBA) report for 2019 shows that the supply, trading, and use of cryptocurrencies for payment is on the rise. But the problem that arises when trading cryptocurrencies is the lack of an effective system of legal regulation of cryptocurrencies. Exploring and linking the economic recession with cryptocurrencies, some authors believe that “blockchain technology can promote the money supply that responds to changes in the demand for holding money”28. “It is the policy of one government that supports the development of innovations in blockchain technology and cryptocurrencies that can be seen as an opportunity for profitable implementation of rules that promote macroeconomic stability of the state”28. However, some authors believe that the government opposes the adoption of cryptocurrencies as a currency because these instruments could indirectly affect the fluctuation of domestic currency prices, which would affect the money supply29. This is obvious today in the market where users of cryptocurrencies are constantly flooding the foreign exchange market with domestic currencies29. Despite the large application of new technologies such as blockchain and cryptocurrencies today, there is still some uncertainty for its users about their use. Some authors investigate the “acceptance and use of blockchain technology, taking into account several factors: certification, regulatory support, social influence, design, and experience”18. Research shows that users at a certain level of experience feel secure in using blockchain-based applications while a high level of security results if Blockchain-based applications are regulated and provided by the local government. Some author finds that the “cryptocurrency Bitcoin represents a distinct alternative investment and asset class”30. Although blockchain technology and cryptocurrencies are widely applicable, they create disruptions and changes within the financial industry and especially in accounting practice. The authors explore and try to approximate and explain the challenges and changes that blockchain technology and cryptocurrencies reflect on the accounting profession15. Today, growing problems arise in the accounting profession and corporate responsibility due to the growing trade in cryptocurrencies and due to the currently vague accounting regulations31. Since there is no clear and specific definition of what cryptocurrencies are from an accounting point of view, their regulation makes it difficult for regulators to determine which aspects require regulation and how to control and monitor cryptocurrency activities32. Cryptocurrencies are becoming and are a complex and challenging area for standard setters, financial report creators, and users themselves. Due to different models and their impact on business, they are treated differently within accounting, which requires specific regulation within the standard33. Although blockchain technology is increasingly accepted by companies, for the accounting profession it is certainly a strategic and technological tool that will encourage innovation within the accounting profession7. The lack of specific accounting standards that cover the area of cryptocurrencies, but also due to their variable value, creates a great impact on the audit and accounting profession because of the lack of a basis for assessing the audit risks of cryptocurrency holders34. The importance of regulating cryptocurrencies within accounting and tax regulations is evident in a study which explores how the IASB deals with the emerging issue of accounting regulation for cryptocurrencies31. Just mentioned research shows how disruptive technology, among which are cryptocurrencies, impacts the area of accounting regulation and gives concrete insight into the existing limitations within the regulatory process of the IASB, emphasizing the relationship between the rapid pace of technological innovation and the length of IFRS. The issue of cryptocurrency taxation is also an area that is not sufficiently researched but also regulated. One study provides and gives an overview of the initial mechanism for the development of tax treatments for transactions that are not covered by existing legislation but also gives normative recommendations on the taxation of Bitcoin35. This research highlights the view of applicable tax laws, the manner of acquisition but not the reason (intention) to acquire, which is crucial in determining how Bitcoin will be taxed35. Research on cryptocurrency regulation, research field covers various areas (but only a few research) such as money laundering, terrorism, crime, classification of cryptocurrencies within accounting standards, and tax evasion. Also, only a small number of researchers at the national level study the accounting and tax treatment of cryptocurrencies (Table 6).

Although research shows a number of benefits and involvement of cryptocurrencies in the financial sector and business in general today, few researchers express concern about the use of cryptocurrencies to facilitate large-scale terrorist financing and money laundering schemes26,29,36. “In order for cryptocurrency trading to be legally legal, it is necessary to determine the legal nature of cryptocurrency within which there will be a regulatory framework within which cryptocurrency trading may or may not occur, in order to ultimately avoid illegal transactions”26,29. Considering the ethical implications of cryptocurrencies, some research explore “cryptocurrencies as money; cryptocurrencies as a means of tax evasion, and cryptocurrencies as a relief for consumption”35,37. Comparing fiat central bank money and cryptocurrencies there is an obvious difference where cryptocurrencies are not subject to money supply manipulation. Likewise, “cryptocurrencies allow users to undertake equitable financial transactions without the need for intermediaries such as banks”3. “Tax evasion is generally considered an unethical practice, ie cryptocurrencies due to their intrinsic nature qualify to become tax havens, facilitating tax evasion”35,37. It is precise “because of a number of negative implications related to cryptocurrencies due to illegal and insufficient regulation that governments need to improve and strengthen mechanisms, enact and implement new regulations to reduce tax evasion and criminal acts related to cryptocurrencies”37. Governments do not recognize cryptocurrencies (alternative currencies) as currency (money) i.e. fiat currency, because in this way the right to implement monetary and fiscal policy is waived. Because cryptocurrencies are online it bypasses traditional remittances through commercial banks thus technically allowing illegal trade as they are transmitted through an unknown source29. “Manipulation with cryptocurrencies is also in the area of taxation where users store their net cryptocurrency value in an online database allowing them to report fake earnings that donʼt actually represent their value”29. Manipulations at the corporate level of companies related to cryptocurrency trading are reflected in the creation of assets or earnings in offshore locations through cryptocurrencies thus trying to avoid taxes38. Study on ethical and non-ethical behaviour results and shows the use and transactions with cryptocurrencies26. “Due to its anonymous and the lack of minimal surveillance transaction with cryptocurrencies can lead to money laundering, the establishment of illegal exchange offices and platforms, the use of underground black markets dealing in the illegal sale of drugs and illegal firearms”28. Very few authors research the legal status of cryptocurrencies at the country level. At a country level, the issue and debate about the legal status of cryptocurrencies, ways of trading and acquiring cryptocurrencies (possible corruption risks), forecasting the mining taxation system was researched at the level of Ukraine39. At the level of the state of Ukraine, investigation about tax control was conducted40. Authors believe that the lack and insufficient regulation leads to money laundering, terrorist financing, and tax evasion. For this reason, they present factors that they believe are important for understanding tax control (structural, functional, systematic, and institutional approach) and consider to be the basis for identifying the characteristics of cryptocurrency transactions as objects of tax control40. Some authors investigate the legal position of cryptocurrencies in Russian legislation and state that they have not yet found their consistent consolidation and legislation41. The attitude of professional accountants towards cryptocurrency legislation is researched in Nigeria42. On a sample of 250 respondents (tax practitioners, financial analysts, state auditors, bankers, accountants, lawyers, lecturers, and other accounting professionals) they found that professional accountants in Nigeria are willing to work in a cryptocurrency environment provided the Government legally assigns their use42. Interesting research was conducted and represents conceptual scenarios of digital taxation of income and taxation objects in the process of creating a cryptocurrency in the Russian Federation with critical reviews of the application of international standards for tax accounting of digital assets43. Traceability, legal, accounting, and tax regulation are key to detecting cryptocurrency misconduct so that cryptocurrency-related crimes mainly revolve around fraud, such as tax evasion through false reporting of income, drug and/or arms smuggling, and money laundering could be minimized29.

DISCUSSION AND RECOMMENDATIONS

Most of the papers analyzed gave a theoretical point of view on the analyzed problem. The results of the presented literature review indicate that new modern and digital technologies such as cryptocurrencies are an indispensable part of todayʼs business world while changing traditional ways of doing business. The research shows that most authors are engaged in researching the very concept and importance of cryptocurrencies in the financial market, while there is a small number of those who research the problem and importance of accounting and tax regulation of cryptocurrencies. However, there are few cases and studies that are engaged in research of accounting and tax regulation of cryptocurrencies, but they are rather the exception than the rule. The practice and conducted studies show that due to the lack of a clear definition and nature of cryptocurrencies from an accounting point of view, problems arise in the area of its regulation which makes it difficult for regulators to determine which aspects require regulation and how to control and monitor cryptocurrency activities. As benefits of this research, we can point out also some recommendations for further research. This research deals with and explores cryptocurrencies and the related concept of blockchain technology, while the focus of the research is on the accounting and tax regulation of cryptocurrencies. Research gives an overview of accounting and tax regulation of cryptocurrencies, showing that researched area is insufficiently explored through the scientific literature, but also insufficiently regulated in practice, which is a recommendation for further research in this area. The findings of our research indicate that the impact of correct and adequate accounting and tax regulations of cryptocurrencies is on the verge to disrupt the current accounting profession. Also, this is the research area that needs more empirical evidence, theoretical and quantitative evidence, and presents scope for many studies to be carried out in the future.

CONCLUSIONS

The main goal of the article was to provide a brief and clear overview of the accounting and tax regulation of cryptocurrencies using a systematic literature review. The article deals with the process of recording, monitoring, and valuing cryptocurrencies and their effect on the financial market and accounting profession. Although the concept of cryptocurrency is not a new phenomenon, its growth, and development change how companies operate, especially from the aspect of its regulation. Due to main goal of this article we can highlight the objectives of this article that were provided and proven: (1) importance of cryptocurrencies in the financial industry and their involvement in the business process of today organizations (2) review of accounting and tax treatment of cryptocurrencies (3) a systematic literature review of the research literature in these fields. To achieve the set goals, numerous world literature was analyzed, which explores the field of cryptocurrencies and their accounting and tax treatment. However, after providing data and given systematic literature review it is obvious that the area is insufficiently researched. Lack of research is evident in the context of insufficient regulation and inconsistencies in the implementation, monitoring, and evaluation of cryptocurrencies at the global level in the field of accounting and tax. It is extremely important to find a unique and acceptable way to regulate, monitor, and record cryptocurrencies shortly to minimize the level of uncertainty between holders and users of accounting information and thus minimize accounting and tax risks. Precisely due to insufficient regulation of cryptocurrencies, business operations involving cryptocurrencies are becoming areas of illegal activities, money laundering, and even terrorism. For further research in this area more efforts should be focused on the legal, accounting, and tax regulations of cryptocurrencies in order to minimize illegal activities and to ensure that operating with cryptocurrency is secure in the future.