1 INTRODUCTION

1. 1 MOTIVATION AND GOALS

At the start of 2017 Bulgaria entered a tough political debate on a range of problematic issues raised during the parliamentary election campaigns. The main political parties put forward their proposals for the adjustment of taxation and income policies, in response to public expectations. Indeed, these expectations have a long history – about 15 years of neoliberal economic policy that introduced a 10% flat rate for personal income tax, brought about a substantial shift in the burden of social insurance from employers to employees, and focused income support on a narrow share of the population. Combined with the effects of the economic downturn of the 2008-2009 crisis, this policy inevitably induced persistent poverty, emigration, and negative demographic trends (Beleva and Dimitrov, 2014;Tosheva et al., 2016).

The paper suggests some preliminary results from a sequence of microsimulation exercises that produce estimates of the budgetary effects of a selection of initiatives for income policy adjustments discussed during the 2017 election campaigns. Most of these initiatives are targeted to reforming income support policies, taking two main types of approach – assistance- or taxation-based. For example, a proposal has been made to ease the task of bringing up children by working parents through the introduction of a child tax credit, replacing the tax base exemption for dependent children, which is deemed ineffective. An overall proposition for family taxation and joint filing is currently under debate, although it was already frequently considered in a series of political disputes during the market transition period. Furthermore, a minimum pension proposal has been hotly discussed, with mutual accusations of misleading populism. Along the same lines is a suggestion for a substantial expansion of the eligibility for targeted social assistance for heating and energy.

An overall impression is that none of the ideas for policy reforms or adjustments of policy parameters seem to be supported by a sound empirical analysis of the possible distributional effects. Besides, no estimates of the aggregate financial effects of such proposals have been announced – the tentative “bill” of each reform is not “submitted” to the taxpayer, nor it is clear to the public how the expanded deficit of the social budget could be compensated for.

The paper provides an empirical assessment of the possible non-neutral budgetary effects of selected proposals for policy adjustments – basically, the necessary shifts in the social spending budget – if implemented in the year 2017. The calculations are performed by EUROMOD – the tax-benefit microsimulation model for EU countries (Sutherland and Figari, 2013;De Agostini et al., 2014). Its Bulgarian section utilizes large sample data for Bulgarian households provided by several waves of the EU-SILC survey.

1. 2 A SHORT OVERVIEW OF INCOME TRENDS

Bulgaria at the time of the electoral debate is characterized by the consequences of the global crisis of 2008-2009 on the economic situation and the search for effective ways of regaining the pre-crisis levels of investment (especially FDI), employment, and exports. Another important issue is also in the focus of the debate: the steady establishment of the substantial dependence of the country on EU funding for all major structural reforms and overall economic revitalization. In the light of this, public interest during the election campaigns has become sensitive to all issues related to living standards, income policies and social support for the vulnerable, e.g. the old, unemployed, disabled and so on. In spite of the overall positive trend in the dynamics of the income level during the post-crisis period – coinciding largely with the first decade of Bulgarian full EU membership– the “status quo” of the “poorest EU country” has been emphasized and utilized by the argumentation throughout the campaign.

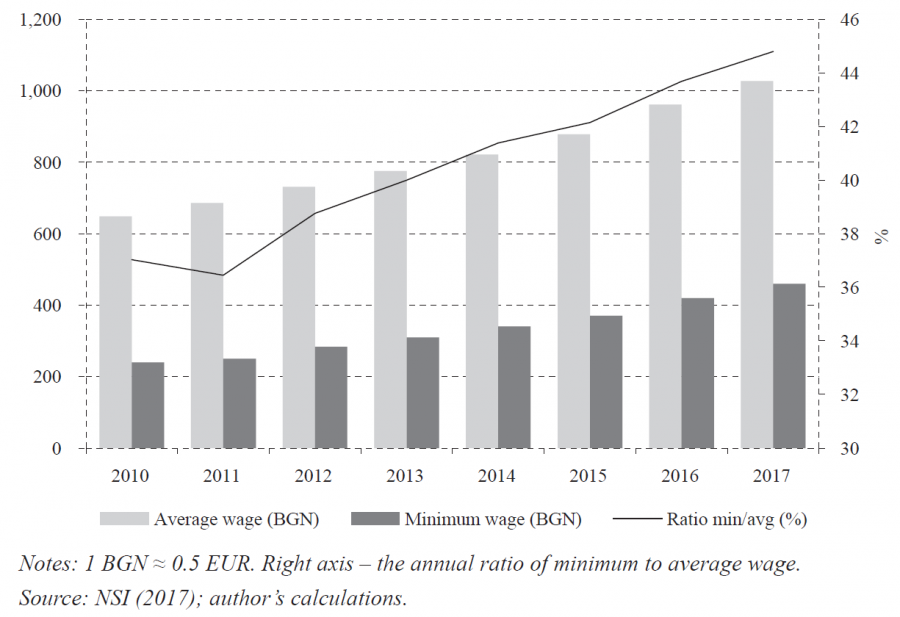

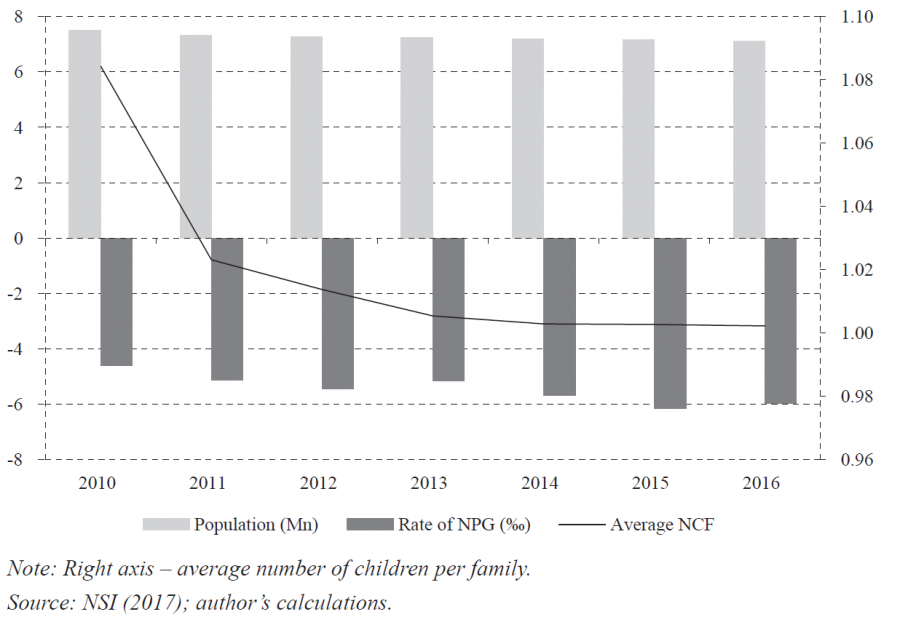

Nevertheless, the dynamics of the main income indicators showed recent trends somehow opposite to the adverse demographic shifts. A stable negative rate of natural population growth amounting to about -5 per 1,000 residents and continual emigration led to a severe decline in total population size (from 7.5 to 7.1 million in the period 2010-2016). In the first half of the 2010s, the average number of children per family has persistently stabilized at about one child (figure 1).

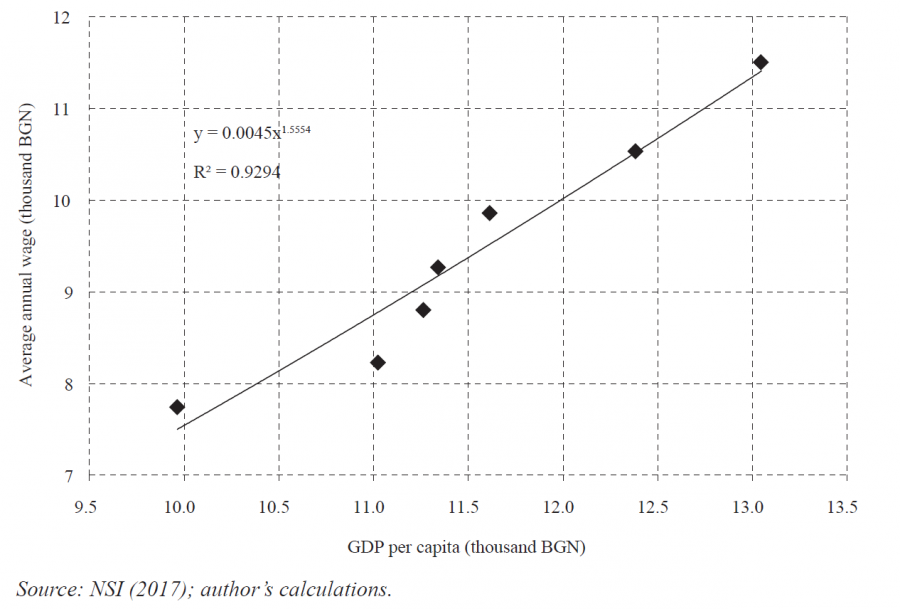

In the same period, the average monthly wage has constantly grown from about BGN 650 to over BGN 1,000 (50% for the period) followed by even faster growth of the minimum wage. As a result, the ratio of the minimum to average wage increased from 37% to 45% in the early 2017 (figure 2). As officially announced, the governments in charge during the post-crisis period have controlled the growth of remuneration levels by linking them to the growth of GDP per capita as a measure of aggregate productivity. The GDP elasticity of the average annual gross wage is estimated to 1.56% for the period 2010-2016 (figure 3).

In summary, according toEurostat (2017), in all the 10 years of EU full membership, Bulgarian society was obsessed with the country’s occupying the lowest position among EC member states regarding, for example, the minimum wage (EUR 184 for 2015, as compared to EUR 218 in Romania, EUR 300 in Lithuania, etc.) and GDP per capita in PPS (relative level of 46 for 2016 with 100 for EU28, 59 for Romania and Croatia, 65 for Latvia, etc.). This naturally provided many options for the political opponents to search for electoral support utilizing the existing apprehension and expectations of Bulgarians regarding the short-run income policies.

1. 3 BRIEF LITERATURE REVIEW

The specialised literature provides empirical evidence regarding Bulgarian taxbenefit policies and their effects, mainly regarding research into income distribution, inequality, and poverty (e.g.,Cerami and Stanescu, 2009;Tsanov and Bogdanov, 2012;Tsanov et al., 2014;Tosheva et al., 2016;Mihaylova and Bratoeva-Manoleva, 2017). Specific issues concerning targeted social assistance in Bulgaria, specifically “energy poverty” and the related social support instruments, are analysed by Shopov (2013;2016). Major sources of income inequality in Bulgaria for 2007 were analysed using decomposition methods and quantile regression byMintchev, Boshnakov and Naydenov (2010). Empirical studies of the contribution of income sources to the level of income inequality in Bulgaria have been recently updated byMihaylova and Bratoeva-Manoleva (2017) following the previous works ofKotzeva (1999) andNikolova (2009).

Bogdanov and Zahariev (2009) provide an overview of the policies related to minimum income support in Bulgaria implemented in the 2000s. The most up-to-date presentation of social protection instruments can be found inTosheva et al. (2017), provided for the maintenance of the Bulgarian section of EUROMOD where the regimes of both simulated and non-simulated social benefits are explained in the overall framework of the Bulgarian tax-benefit system for the period 2014-2017. Apart from the cross-country distributional analyses of the changes in tax-benefit systems on income inequality and poverty levels in Europe (e.g.EUROMOD, 2017), several studies utilize the capabilities of EUROMOD to assist specific analyses for Bulgaria.Boshnakov, Tosheva and Draganov (2013) provide evidence for the expected gains in poverty reduction through simulation of scenarios for updating the social assistance benefit based on the guaranteed minimum income (GMI) policy parameter. A detailed study of income assistance schemes byTasseva (2016) finds that – although a substantial share of the beneficiaries of assistance through GMI and heating allowances is located at the left tail of the income distribution – this policy’s impact on poverty is minor since these benefits reach a small fraction of the poor: only about 12% through GMI and 25% through targeted benefit for heating.Tosheva et al. (2016) provide empirical results that assess the effects from changes in tax-transfer policies (enacted in the period 2011-2015) on income distribution, inequality and poverty in Bulgarian households. Their results show that the changes in the policies induced positive income shifts mainly for the households in the lowest income groups. Furthermore, the poverty rate has decreased by 1.3-2.9 percentage points (depending on the level of poverty threshold chosen).

2 MAJOR POLITICAL FORCES: POLITICAL DEBATE AND “MESSAGES”

The 2017 election campaigns were not substantially different to those conducted during the past 20 years, which was a period of relative stabilization after the hyperinflation crisis and banking system collapse of 1995-1996, followed by the introduction of the Currency Board Arrangement in 1997 and stabilization of the macroeconomic indicators. In most cases, the debate has been between the major left- and right-centred political forces, with the participation of minor liberal, centrist, and (less significantly) ultra-left or nationalistic wings.The leading role during the 2017 election campaigns was played by CEDB (Citizens for European Development of Bulgaria) – the political party that just came out of central government offices with the role of a “proponent” of the established current economic and social policies. Its election platform was publicly announced on the party’s website1as well as through participation of CEDB representatives in media and other communication events. The major “messages” of the leading party did not deviate much from the “low taxes/low deficits” postulates implemented by Bulgarian governments since 2001. In this line, the underpinnings of its campaign were basically:

the undisputable status quo of the 10% flat PIT rate and the relatively low burden of compulsory social insurance (with the current employer/employee split2;

main sources for increasing the public revenues identified as: tightened administrative operations, with a better focus on counteracting corruption (including pressures on the grey economy, underreporting, customs misconduct facilitating smuggling/trafficking, etc.);

strict control over the expenditures, assuming the argument “redistribute only what you collect” – as a result, social spending focused only on those who objectively cannot manage in the labour market (the old, disabled, families in extreme poverty and so on);

family support provided mainly through improved community services (kindergartens), financial support to children if at school and such like.

The program rarely announces quantitative targets and other policy parameters, which shows its great caution regarding any “promises” the keeping of which will be able to be verified in due time. Just few numerical parameters were modestly defined, e.g.:

increment of all pensions by 2.4% since July 2017 (which was planned during the budgetary process of 2016);

support to the so called “3-child family model”, although not accompanied by any specific policy instruments except a general vow concerning targeted financial support to a third child, with a reduction of this support to subsequent children;

few targets that are, however, spread over the whole 4-year mandate: macroeconomic expectations for at least 2% GDP annual real growth rate; average and minimum monthly wages to reach 1,500 and BGN 650 respectively, at the end of the mandate (i.e. about 50% growth in both wages, or 12% annually).

A similar general platform was announced by the prospective governmental partner of CEDB – which actually became so after the election – the United Patriots coalition3. It generally lacks any quantitative policy parameters, emphasizing massive political and administrative enforcement of a range of measures, e.g. revision of concessions and contracts; “strike against monopolistic and oligopolistic structures”; reorganization of the customs service, from which a gain of BGN 2 billion (about 2% of GDP) is expected from anti-smuggling measures; empowerment of the State Bank to credit SMEs; and enforcement of a state employment programme “providing a job for every Bulgarian”. An important suggestion raised in the autumn of 2016 (during the presidential elections) has been kept – the introduction of a minimum floor of BGN 300 for the contributory old-age pension. The related necessary budget was not clearly evaluated; however, a general idea for its provision has been outlined concerning a rigorous revision of the regime and practices for disability categorization and determination of disability pensions and benefits.

The main opposition forces were represented by the Bulgarian Socialist Party (BSP) – a political organization integrating the social-democratic wings of the former totalitarian party-ruler of the country up to 1989. Although its political platform4was announced as an “ultimate and only reasonable” alternative to the liberal and right-centre platforms, it raises a range of modest proposals aligned to the traditional values of the Party of European Socialists (following the general idea of “leaving no one behind” policies). Conforming to the general framework of low deficit policies (specifically emphasizing compliance with the Maastricht deficit criterion), several policy parameters were targeted in respect to income policies. The main ones were:

an upgrade to the monthly benefit for raising a child aged between 1 and 2 – up to the minimum wage level, i.e. by 35% – from BGN 340 (not uprated since year 2014) to BGN 460;

double expansion of the coverage of the targeted benefit for heating – a special tool expected to provide a vast support from low-income voters;

a targeted reform of the flat PIT: the introduction of a twice higher marginal tax rate (20%) for incomes above BGN 120,000 annually, which is equal to about 10 average wages for 2017 (another “tool” for mobilizing ultra-left voters with the idea of “taxing the top incomes higher”);

a substantial revision of the PIT policy for treatment of the children – namely, introduction of a child tax-credit and abolishment of the regime for tax base exemption for raising children. The proposal is however generally formulated “to support the parents who work – and have taxable earnings – for raising their children”. According to the proposal, they must receive an annual refund of the tax bill: BGN 600 for 1 child (BGN 50 monthly) and BGN 1,000 for 2 or more children.

All proposals originating from political fragments that strive to gain significant support are clearly justified by expectations of massive support from targeted social strata. In some cases – as will be shown below – these strata include a substantial number of potential voters. With the assumption of a 50% turnout, typical of parliamentary elections in Bulgaria (it reached actually 54% in 2017), the votes of even half of the potential “beneficiaries” from some of the proposals could provide significant positive shifts in the overall position of the respective party-proponent. However, what the budgetary effect of the introduction of any such proposal would be remains unclear, i.e. the question “how much is the bill and who will have to pay it” does not have any reasonable answer, and various speculations were floated during the election campaigns.

3 EVALUATION OF SELECTED REFORM PROPOSALS

3. 1 METHODOLOGICAL ISSUES

The quantitative evaluation of selected proposals for income policy reforms in Bulgaria is performed by the method of tax-benefit microsimulation implemented in EUROMOD. Such a simulation method has several important qualities one of which is particularly valuable for the present study, namely, “… the possibility of accurately evaluating the aggregate financial cost/benefit of a reform. The results obtained … at the individual level can be aggregated (using the weights contained in the datasets where necessary) at the macro level, allowing the analyst to examine the effect of the policy on government budget constraints” (Spadaro, 2007: 20). Such a type of reliable weighting is available in the EU-SILC survey, which provides large representative datasets for the implementation of procedures within the EUROMOD model. In particular, the calculations here are performed on the basis of the Eurostat UDB data containing the results from the Bulgarian SILC 2015 operation, which provides income data at year 2014. All relevant variables are appropriately uprated to their projected levels for the year 2017, using official statistics for a range of income policy parameters and aggregates evaluated for the years 2015 and 2016. Certainly, some tax-benefit instruments appear to be oversimulated while others are under-simulated, for one reason or another (seeTosheva et al., 2017) – these deviations are inherent to tax-benefit microsimulation analyses and the results must be interpreted with some degree of caution.

3. 2 EMPIRICAL RESULTS FROM POLICY SIMULATIONS

Proposal 1. Minimum contributory old-age pension

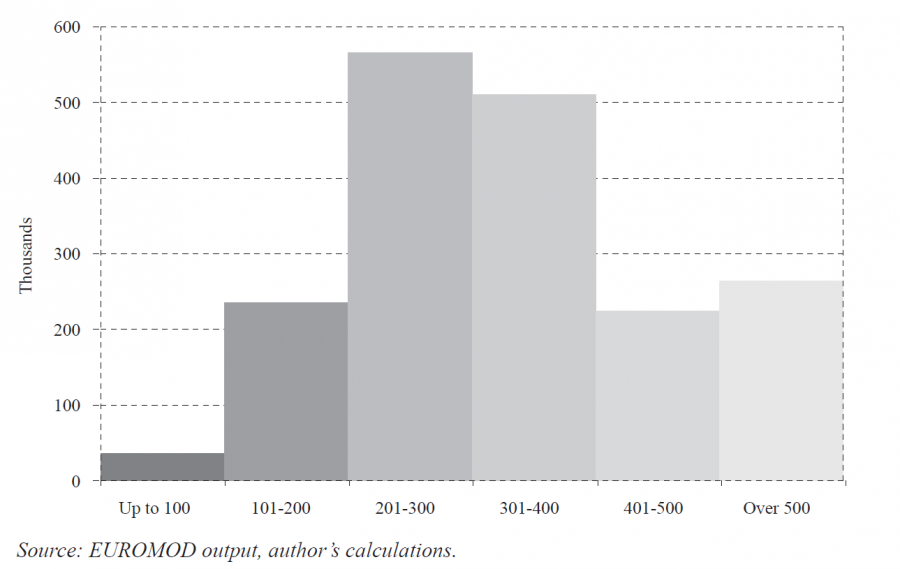

The “pension for insurance and old age” (PIOA) is provided to individuals who have reached the standard retirement age (about 61 for women and 64 for men) with a minimum length of contributory service of 35 (women) and 38 (men) years. Figure 4 presents the distribution of PIOA recipients by the main intervals of the monthly pension and shows that 45% of them are below the line of the announced proposal: an unconditional floor of BGN 300.

Source: EUROMOD output; author’s calculations.

The results from the simulation of this proposal (table 1) provide an estimate of BGN 826 million as a summary amount required for topping-up every pension below the BGN 300 threshold. The “bill” amounts to 0.85% of GDP – a serious potential deficit which requires harsh measures, cutting other budgetary items or lifting the taxation burden – otherwise, the achievement of the Maastricht limit for the central budget deficit could be substantially jeopardised. Nevertheless, during the political campaign such a “promise” can have (and it actually did have, although not to the expected extent) a decisive role in the final results of the nationalistic coalition.

Proposal 2. Expanding the scope of the targeted benefit for heatingThe targeted benefit for heating (TBH) is provided as a non-contributory allowance which, however, is income-tested – it is granted to individuals that live alone or to families with incomes that are below the “differentiated minimum income for TBH purposes” (DMI); the claimants should also meet additional eligibility criteria. DMI is calculated by a procedure similar to that applied for the universal social assistance benefit for low income – based on a set of ratios linked to some preliminarily defined categories of beneficiaries and attached to the Guaranteed Minimum Income parameter (GMI = BGN 65; seeTosheva et al., 2017). If eligible, the unit (individual or a family) is approved to receive a monthly benefit of BGN 72 for 5 months during the heating season, targeted to cover some defined heating expenditures.

In order to expand the scope of the eligible receivers of TBH the thresholds have been relaxed in order to ease access to the benefit for a selection of targeted individuals (single mothers, the elderly, and the disabled). For example, any person with reduced work capacity of 50% or more (50% disability) who also lives alone, gets an uprated threshold to guarantee eligibility if her/his income is below BGN 300 – the current ratio of 2.7268 is increased to 4.6154. Thus, if the test shows that the income of this individual is less than 4.6154*GMI = BGN 300, then her/his eligibility for TBH is approved. Further categories that get uprating of the threshold up to 4.6154 are:

persons aged over 65 and living alone;

persons older than 70;

persons with reduced working capacity of 50% or more living alone;

single parents with a child younger than 18 (or 20 and in education);

children aged below 18, with a permanent disability.

Table 2 presents the results from the simulated proposal 2. The baseline estimates show about 368 thousand expected receivers of TBH under the standard conditions along with BGN 133 million on aggregate for the simulated amount of the benefit.

Source: EUROMOD output; author’s calculations.

After the introduction of the reform – although targeted only to the categories presented above – the number of eligible recipients is expanded by over 333 thousand. This number can still be increased by including another targeted category of individuals in the scope of the simulation exercise. The budgetary effect is not substantial – this political goal can be achieved by a small additional deficit of 0.1% of GDP (which will not even emerge if GDP actually grows at least by half a percentage point more than the macroeconomic budgetary forecast).

Proposal 3. Introduction of a 20% marginal PIT rate for top incomesVarious proposals for discarding the flat PIT rate regime have been initiated with the expectation that a return to the progressive income taxation (abandoned since year 2008) will provide higher PIT revenues along with “restoration of social equity”. However, none of these succeeded in gathering enough political support among the governing coalitions led by CEDB after 2009. Paradoxically, the introduction of flat PIT rate was done while a coalition led by BSP (2005-2009) was in power, which was considered “abnormal” for a right-wing party – however, justified by the necessity to collaborate with their neoliberal coalition partners. Acting as opposition in the 2017 campaign, and expecting to mobilize a significant voting potential (i.e. supporters of the idea “to tax the rich higher”), the socialist platform raised a proposal for introducing a threshold (BGN 120,000) for the annual taxable income. All incomes above this threshold must be taxed at a rate twice as high than the standard rate (20%).Table 3 presents the aggregate results from the simulation exercise accomplishing this proposal assuming “all other things equal”.

These results however should be considered with caution due to problematic issues of the SILC survey related to underestimation of the “upper tail” of the income distribution due to under-coverage of such taxpayers (e.g. refusals to participate), under-reporting of earnings, etc. (Tosheva et al., 2017).

Source: EUROMOD output; author’s calculations.

The results show clearly that negligible budgetary effects can be expected from such a reform, even in the case of the static calculations performed by EUROMOD – about BGN 17 million (0.5% of the total PIT revenues and 0.02% of the expected GDP for 2017). The taxpayers that have official (reported) incomes above the policy threshold are just 0.1% of all PIT taxpayers – the narrow scope of this reform proposal identifies it as much more of a propaganda tool than a genuine income policy reform.

Proposal 4. Introduction of PIT reform for child tax creditIn a similar manner, suggestions for joint filing and favourable tax treatment of the family have been discussed since the start of market transition in Bulgaria. Indeed, one special form of “family taxation” was introduced in 2005 and practiced for 3 years (removed in 2008 with the introduction of the flat PIT rate), namely, tax base deductions for raising 1, 2 or 3+ children. This practice was reintroduced in 2015 – one of the parents could reduce her/his annual tax base by BGN 200 for the first child, BGN 400 additionally for a second child, plus BGN 600 for all other children in the family. The tax exemption rule can be utilized by one of the parents (expectedly, the one with higher PIT base) without any joint filing. So annually, a family with 2 children can reduce the tax base by BGN 600 which provides a reduction of the annual PIT by BGN 60 (or BGN 12 per month, 4 plus 8 for child 1 and child 2).

During the election campaign the BSP suggested the introduction of a child tax credit – reduction of the annual PIT duty by BGN 600 (if there is 1 child) or BGN 1,000 (if 2 or more children are being raised in the family). This makes an “allowance” of BGN 50 monthly for child 1 and BGN 33.33 additionally for the second child, which, however, is non-refundable. The political “message” seems clear – all those working parents who have low incomes (with PIT duty up to these thresholds) that raise their children will be supported by the government not by social assistance, but by leaving all of their (already) earned income – except the compulsory social insurance – in the family to meet the ever growing needs related to childcare.

Table 4 presents the results from the simulation of a simple scenario for the introduction of such a version of unconditional child tax credit. The data from the SILC survey show a predominant presence of cases of the “first” (which is often the only child in the family) and the “second” child being the targets of the policy.

Source: EUROMOD output; author’s calculations.

The simulated child tax credit identified in these two cases amounts to BGN 665 million. In this static version of the simulation exercise no behavioural responses are assumed – the result shows what the expected change in the PIT revenue in 2017 would be if the parent (with the largest taxable income) were allowed to deduct the proposed amount of child tax credit from her/his tax liability. The question that concerns the budgetary planners – about how to compensate the deficit of 20% in the PIT revenue – requires additional calculations and initiation of parallel proposal(s) related to necessary alternations of the existing family support policies. At the stage of the electoral campaign, the sources of funds for the coverage of this “bill” were not clearly defined.

4 CONCLUSIONS

The empirical results about the effects of selected proposals for income policy adjustments evaluated in this article were obtained by the utilization of the capabilities of EUROMOD – European-wide microsimulation model that assists the analyses of tax-transfer interventions on personal and household incomes in the EU countries. The information basis of the empirical analysis here is derived from the annual large sample representative survey of household income components in the EU countries (EU-SILC) which ensures the required degree of reliability and validity of the achieved results. The capacities of EUROMOD for the evaluation of particular proposals about reforming tax-transfer policies are substantial but still underexploited, especially in the case of Bulgaria.

The paper suggests empirical results from simulation exercises conducted to obtain numerical estimates of the potential effects of proposals for policy reforms concerning income taxation, social assistance and child support. These proposals were suggested by some of the major participants in the Bulgarian 2017 parliamentary election campaigns. The results show that any introduction (or alteration) of policy instrument that has an impact on a large mass of potential beneficiaries will induce a substantial budgetary deficit, which, in some cases, can compromise the low-deficit policy of Bulgarian governments compliant with the Maastricht deficit criterion. In this respect, one example can be pinpointed, in respect to the proposal concerning the minimum threshold of BGN 300 for the old age pension – when they were part of the governmental coalition, the proposers compromised on a threshold of BGN 200 to be introduced from October 1st 2017 (which led to an agreement for parliamentary approval of the necessary adjustment of the central budget for year 2017.

The results presented above clearly show the need for further in-depth analysis of each of these proposals involving alterations of related policy instruments that could compensate fully or partially for the negative budgetary effect. Any such further analysis could include, in the first place, the design and simulation of an integrated scheme for child treatment through PIT, including joint filing and targeted coordination of family support policies – both contributory and assistancebased provision of child benefits. Another important and sensitive problem for Bulgarian society is pension system reform – it definitely requires the exploration of a refined simulation of minimum thresholds for contributory pensions coordinated with the provision of disability and inheritance pension components.