INTRODUCTION

Online group buying for daily deals is a new e-commerce business model that acts as an intermediary between the end customers and merchants. The business model was introduced by the Chicago based company Groupon (Groupon.com) in 2008 and very soon it became the fastest growing online company ever, reaching $1 billion in revenue faster than any other online company in history1. The model was so successful, enjoyed massive growth in 2010, and continued growing rapidly in emerging economies2. As an online promotion form, the group-buying model has low barriers to entry therefore it can be quickly launched, but evidence shows that it can be as quickly closed due to fierce competition3. It caught the attention of many e-commerce experts and authors because of the innovative element it introduced – a solid connection between the local brick-and-mortar retailers and online customers. Before the advent of Groupon, services like dining, spa treatments and other experiences were not involved in online retailing and were not considered suitable for online selling. The main category of the deal industry, in the beginning, was the services but soon the goods became very popular as well as the travel deals, imposing the categorization of the deals into 3 main categories: services, goods, and travel. Group buying platforms untapped a new segment and influenced the e-commerce industry as a whole. As a result of this phenomenon, an increased number of group buying websites emerged while the size of the group buying population and the dollar amount spent has significantly risen4. Hundreds of local merchants from the service industry rushed to make deal promotions reach new customers and exploit the benefits offered by this new promotional tool. It offers various deals on deep discounts that enable end customers to make substantial savings and try new things at low risk, such as newly opened restaurants, spas, and beauty salons. The four types of motivations for online group-buying for end customers are profit, value, emotion, and achievement5. Consumers’ reactions towards online popularity information for online service deals do differ across cultures6. The deals are negotiated with the merchants and group buying site gets a commission fee for each coupon sold. Wu et al.7 investigate the coordination of traditional and online group-buying channels considering website promotion and found that the total profit of the whole system could be hurt when the agreed price or revenue-sharing contracts were adopted by the firms. From a marketing standpoint, the model offers measurable promotion that has not been offered by any online promotional channel so far – paying only per customer brought, instead of paying per impression (CPI – Cost per Impression) or clicks (CPC – Cost per Click). Despite the success of the model, a contrarian view of the success of daily deal sites for merchants has emerged8. The criticism lies in the skepticism of the value and returns on investments (ROI) from the deals offered by merchants. Discussions emerged between experts and scientists if the deals are effective for merchants, putting in danger the sustainability of the model of group buying due to the assumption that the deals are not profitable for merchants and they will stop using the promotional tool eventually9-12. Kumar and Rajan13 undertake a broader research of coupons as marketing strategy and measure profitability of three different businesses (restaurant, car wash service and beauty and spa) that completed deal promotions and construct a model for projecting when and how the merchant will recover the shortfall in profits from the coupon launch. Some studies,8,14 found that restaurants have a negative ROI rate for running deal promotions, and 42 % of the restaurants reported unprofitable Groupon promotions. The literature that investigated the deal effectiveness and profitability for merchants is scarce and most of the studies focus on the long-term ROI of the promotion. However, merchants are often more interested in the direct cost of the promotion and if they will break even, spend money or make a profit from running a deal. To our knowledge there is no study investigating the merchants’ one-time profitability of a daily deal and the ROI rate of one deal promotion. For that reason, this study focuses on the evaluation of the key factor – one-time profit earned from the deal promoted by restaurants or ROI on short-term. The research was conducted on the case of Grouper (Grouper.mk), the Macedonian pioneer and leading online group buying site. Restaurants particularly were chosen because they are a representative category to measure short-term profitability. In addition, they were running promotions since the appearance of the deal sites, they represent the most sold category8,14,15, and they are more likely to make upsell during the first customer visit. However according to the findings of8 not only that restaurants don’t break-even but they represent the third category with negative ROI rate, after perishables and apparel. Dholakia14 also found that 42 % of the restaurants reported unprofitable Groupon promotions.Accordingly, the research questions of this study is ‘Do restaurants make a profit from a group buying deal, break even or make a significant investment?’ and ‘Which factors affect deal profitability?’. A model for evaluating the short-term profitability of a restaurant’s deal promotion was developed to measure its ROI rate per restaurant category. Then, upon calculating the short-term ROI rate, different variables related to the deal promotion, the restaurant and its employees, as well the previous experience with deal promotion is investigated, to find out the once contributing to increased deal profitability for restaurants. Informed by the results of our empirical study recommendations for more profitable deals for restaurants are provided. In addressing this challenge, this study has a significant contribution from an academic and practice point of view. It is innovative research that will enrich the literature about the group-buying short-term profitability for the providers, in this case restaurants and fill the existing gap in this important issue. Developing the model for calculating the short-term profitability of restaurant deal promotions and identifying the factors affecting deal profitability will help merchants better understand the profitability of these promotions and restaurants’ owners and managers to make more profitable deals. The findings are expected to add value to group buying sites and help sales representatives to advise the restaurants for better deals in order to have a repeat and satisfied clients. The remainder of the article is organized as follows. Section 2 describes the model of online group buying for daily deals model and evolution. Section 3 discusses the literature on the profitability and effectiveness of deal promotion.. Section 4 describes dataset and the methodology. Section 5 presents the empirical findings and Section 6 evaluates whether the results warrant any change in the to hitherto conventional conclusion and provides managerial implications and recommendations.

ONLINE GROUP BUYING FOR DAILY DEALS MODEL AND EVOLUTION

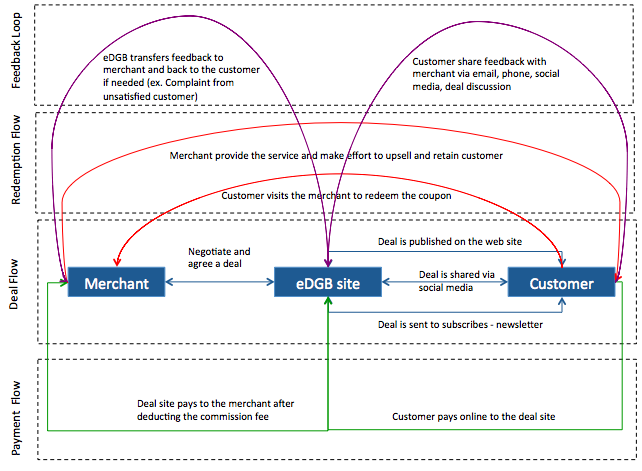

The base of the business of group buying via daily deals itself was not new, for instance in the core of the model are the well-known coupons that date from the 19th century. Asa Candler, one of the partners of Coca-Cola, was the first to introduce and practice this revolutionary promotional tool in 1887 when he decided to dispense coupons that entitled customers to one free glass of his drink16. Coupons represent a promotional tool in marketing theory and have been heavily used for years in almost every industry. However, the coupon evolved over time and the new technologies brought online coupons that replaced the coupon clipping in newspapers and other printed forms. The innovation of Groupon’s business model consists of the ideal combination of promotional coupons for discounts and the power of the group using advances in technology. Group buying also traces back to the 19th century when it was practiced in different forms. Buying clubs represent the oldest form of group buying when people groups in order to get discounts17. The Internet-based group-buying was first introduced in the late 90s18 and is being widely used for both business-to-business (B2B) and business-to-consumer (B2C) transactions. Groupon’s business model is the brokerage between the merchants and the end customers. It offers various benefits for both sellers and buyers. Benefits for the consumer include low prices and very high discounts that allow remarkable savings. The benefits for the merchants include an effective promotion, advertising and selling of the agreed product or service. The online group buying (OGB) site receives a commission from the merchant for each coupon sold i.e. for each customer brought to the merchant. The OGB site promotes the deal in front of thousands of potential customers; interested customers buy the online coupons and redeem them at the merchant to get the pre-paid service or product. OGB site receives the payment from the consumers and then transfers it to the business, deducting a certain fee, which is agreed upon in the contract with the merchant. The merchant’s fee charged from each coupon sold represents the OGB company’s revenue. So, the model offers win-win-win outcome. Figure 1 depicts the business model and process flows that occur between the three parties involved.

However, the new business model of so-called group buying via daily deals evolved over the past few years. Firstly, the name ‘deal of the day’ and ‘daily deal’ was used because the deals lasted for 24 hours in the beginning creating a feeling of urgency and stimulating impulse buying, but this changed over the years and now every site publishes lots of new deals each day that last for a longer period, from few days up to one month, depending on the category and nature of the deal. Secondly, the name ‘group buying’ was used to emphasize that each deal had to reach a certain minimum predefined number of buyers in order to get ‘tipped’ i.e. to be successful. This was used to guarantee the merchants a certain number of buyers in order to get group discounts while it incentivized the buyers to share the deal with their friends in order to get the discount, which included a social momentum of sharing. The deal sites became very popular and each deal had lots of coupons sold that often passed the maximal capacity of the merchant to serve so many customers, so this moment of the minimum threshold to be reached for each deal disappeared over time and nowadays many daily deal sites removed this graphical element of their sites and don’t require a predefined minimum number of buyers for each deal. And third, in the beginning, the daily deals were used and targeted at the service industry such as restaurants, beauty salons, spas etc. The main goal being the high promotion and attraction of new customers the deals were considered to be most suitable for the local businesses in the service industry, having in mind the high margins and the constant need for new buyers. After a certain time, the deal sites enriched their portfolio by adding travel deals and products. The merchants selling products could use the new tool either for promoting their brand or new products and bringing new customers but as well to sell piled-up inventories. Having in mind the evolution and changes of the business model we propose a new short name – ‘eDeal group buying’ instead of ‘online group buying for daily deals’. The letter ‘e’ that stands for ‘electronic’ is widely used in any field to emphasize the electronic and online momentum. On the other hand, the ‘daily’ part can be removed because the deals last more than one day. The part ‘group buying’ is left because of the recognition of the model so far and still brings a group of people to one place and because of possible misinterpretation of the term ‘eDeals’ if it stands alone because there are eDeal services that offer Software as a Service (SaaS) possibilities and Customer Relation Management (CRM) eDeals for companies. Further in this study the term eDeal group buying will be used and the abbreviation eDGB.LITERATURE REVIEW

Despite the popularity of the model, which can be a fruitful field for investigation and research, the literature is still scarce. Lui and Sutanto19 investigated the group-buying literature including journal articles and articles published in conference proceedings and emphasized that online-group buying studies require further development due to the limited number of existing studies and inadequate topics explored. They found that modeling analysis was used in more than half of the studies, thus lacking empirical evidence considering them theoretical in nature. Bralić et al.20 investigate online group buying websites in Croatia that changed marketing strategies to identify critical factors that affect the intention to purchase from the group-buying sites. Luo et al.21 develop a framework predicting that (1) deal popularity increases consumers’ purchase likelihood and decreases redemption time, conditional on purchase, and (2) the social influence–related factors of referral intensity and group consumption amplify these effects.In line with this, Kao et al.6 found that deal popularity does influence purchase intention. Group-buying platforms may promise substantial savings for consumers and create opportunities for businesses to gain exposure to new customers and in addition to offering consumers discounts, such platforms also serve to inform consumers about the existence and nature of businesses22. Wan et al.23, design a GB coupon with two factors: the degree of consumer perceived ease of use and the discount price rate with a detailed analysis, they recommend the optimal group-buying mechanism and provide the corresponding conditions by comparing the profitability of single-time and double-time mechanisms. Only a few studies investigated the deal effectiveness and profitability for merchants. These studies focus on the long-term return-on-investment (ROI) of the promotion including determinants that are not always easy to quantify and measure with empirical studies. Dholakia14 investigated the performance of daily deal promotions for merchants and identified 3 main factors: new customer acquisition efficacy (1), spending beyond the coupon value, often called ‘upselling’; (2) and repeat full-price purchase (3)24. Surprisingly, he found out that the spending beyond Groupon’s value is not a significant predictor of the deal profitability, while the other two (1 and 3) positively affect the profitability of the promotion. To understand the real potential associated with daily deal promotions Dholakia and Tsabar25 conduct an in-depth descriptive analysis of the experience of Gourmet Prep running a Groupon promotion. The results provide evidence of significant exposure value, defined as the increase in sales because of exposure received by the business to the Groupon customer base. Dholakia and Tsabar25, concluded that deal promotions are beneficial to merchants in multiple ways, and daily deal promotions can be an effective marketitoolsool for retail startup businesses in local markets for achieving exposure and stimulation sales. Gupta et al.8 measure long-term profitability and return on investment including similar key determinants and adding new determinant called cannibalization, which occurs when a customer opportunistically uses a voucher for purchases that would otherwise have paid full price. Their model for measuring profitability takes in consideration: voucher purchase and redemption (1), cannibalization from prior customers (2) and future profit from new customers (3). They found out that in the short-term merchants suffer losses, which are offset in the long run by upside revenue from newly acquired customers. Eventhogh Gupta et al.8 conclude that daily deals can be cautionary tale for merchants: a substantial percentage are unlikely to benefit, and might well lose money, they suggested that a careful analysis of the right data provides clear indicators of both: what types of merchants are likeliest to benefit, and which factors that influence profits should receive the most management attention. He concludes that for merchants that meet the criteria for promising outcomes, define a clear objective for their promotion, and manage it around the particular factors critical to its success, daily deals can be a very effective marketing tool. Shivendu and Zhang26 develop a two-period game-theoretic model to analyze the strategic interaction between heterogeneous merchants and consumers and found that merchants that are new in the market place or less wellknown gain more from offering a deal on the daily deal website. Farahat et al.27 observed the relationship between business survival and daily deal adoption for restaurants and spas and found that restaurants that are more likely to offer a daily deal are on the edge of business survival, whereas the correlation is weaker for spas. As Edelman et al.28 point out, discount coupons are likely to be profitable if they predominantly attract new consumers who regularly return with full-price payment on future visits; however, coupons could also sharply reduce profit for firms when offered to a large number of long-time consumers. Hence, when designing discount coupons, firms would like to pick up the targeted consumers and discourage the untargeted consumers from using the discount coupons. Cheung et al.29, point that retailers need to recognize the role of group buying and whether this strategy is beneficial or detrimental. Using survey data they revealed that group buying agent is beneficial to retailers. They supported the hypotheses that group buying is an effective promotion tool for retailers in expanding their customer base. Their research also showed that customer satisfaction positively influences repeated purchases through group buying agents and future purchases with retailers at regular price. Wan et al.23, design a GB coupon with two factors: the degree of consumer perceived ease of use and the discount price rate and with the detailed analysis, they recommend the optimal group buying mechanism and provide the corresponding conditions by comparing the profitability of single-time and double-time mechanisms. Reiner and Skiera30 found that all merchants achieved a positive profit. However, this finding is driven mainly by long-term profits; short-term profits were only slightly positive. Daily deals were found to add value to the businesses of affiliated merchants and facilitate revenue management31. Online reputation is positively associated with the sales of vouchers32. For instance, deal sites act as a reminder for the existing customers of their favorite places, so they are reminded and incentivized to visit the place, which otherwise they might have chosen differently. Heo22 investigated the impact of different deal features on the generation of business and revenue on group-buying platforms and found that discounted price has no impact on business generation and revenue on the group-buying platform. In contrast, the minimum number of buyers was the most significant factor contributing to the number of successful restaurant deals and the second most important influence on total revenue. Recently Angelovska et.al.3 via empirical study found that merchants' intention to repeat offers depends on profitability of the deals output, spending beyond the coupon, new customers brought by the deal, and there is diverse across different categories of businesses. It is important to note that profitability varies across industries and should be approached in different manner for different industries. For example, restaurants are representative group to measure short-term profitability of a deal because they have the highest opportunity to upsell as coupon users come for a meal and are likely to buy drinks and deserts; they can also bring friends with them who have not purchased coupons. On the other hand, services like a monthly subscriptions for sports do not have the opportunity to upsell, so more adequate measurement for those industries will be needed to measure the return rate and recommendation rate to friends and family. Events (ex. concerts, shows, etc.) or certain activities (ex. horse riding, paragliding, etc.) represent another category that deserves a different model for measurement. These types of industries do not have the opportunity to upsell, and thus don’t have extra amount spent by customers beyond the coupon. Additionally, it is not likely that the same coupon user will return to the same activity or event. One person who did paragliding is not likely to do that in near future again so we should take in consideration neither the upsell amount nor the repetition rate. The benefits for these companies are often filling the capacities (ex. event venues), attracting new customers, and building awareness. These companies often use promotions to make a profit that otherwise would not occur. For example, a paragliding club has the capacity to make 20 flights a day but he makes on average 5 in a certain period. It can be assumed that his goal is to use the capacities while making a profit with the lower margin than the regular one. Based on the literature review determinants that affect the deal success can be divided in two groups based on the timing when they appear. The first one being direct benefits from the deal include: New customers acquired – the primary purpose of a promotion is to attract new customers; Increased awareness – the deal is promoted to various channels that the site uses to advertise: newsletter campaigns, social media channels and affiliate partnerships with other sites thus enabling high deal visibility; Possibility for price discrimination – merchants can offer coupon promotion via the eDGB channel not affecting their regular prices and customers and Profit earned from the deal – the short-term profit that the merchant makes from running a particular deal. The second group of determinants that arise after the deal, and which depend solely on the merchant itself and how he served the customers with coupons during the deal, include: Increased number of repeat customers – satisfied customers are likely to come back to the merchant and become repeat ones; Increased profit – the increase in repeat customers means increased profit for the merchant in long run; and Increased awareness and WOM – awareness reached due to Word-of-Mouth of satisfied customers.

RESEARCH MODEL AND HYPOTHESES DEVELOPMENT

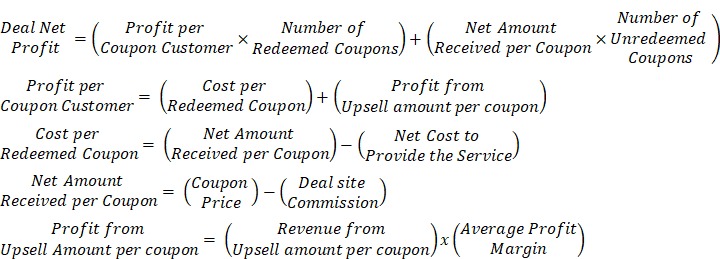

The research was conducted on the leading eDGB site in the Republic of Macedonia, Grouper. Macedonia is a small emerging market and Grouper was the first eDGB site on the market. It was launched in January 2011 when the e-commerce level of adoption was very low33 and shortly it revolutionized online buying in the country giving incentive to the population to buy online. Online group-buying quickly became a bright spot in the mainland of the e-commerce market. It nurtured a group of online shoppers and speeded up the development of the e-commerce market in Macedonia. Grouper is not just the first online group-buying site on the Macedonian market but is the leader in the e-commerce industry holding 40 % of the market share in the Republic of Macedonia in 2012 and 201315,34. By this time, a significant number of local businesses have tried running deal promotions with Grouper, and over 80 % have run multiple ones. It has featured over 10.000 deals in cooperation with over 1600 companies to more than 95.000 users15. The share of restaurants in the total number of Grouper merchants is 17 %. From the 272 restaurants in Grouper’s merchant’s ,portfolio 22 closed their business so the number of active restaurants is 25015. The restaurants portfolio of the eDGB according the years of operation consists of recently opened restaurants, restaurants with few years of operation and restaurants with tradition. According the style of the restaurant all types of restaurants are involved, from fast food restaurants, small local restaurants to big fine-dining restaurants. The period of investigation was set to 3 months from August to November 2014 and all restaurants that had scheduled deals or launched a deal between August 2014 and November 2015 were included in our analysis or a total number of 32 restaurants. The research was conducted in period of 12 months, from August 2014 to August 2015. The data collection and analysis can be divided in 7 phases: Phase 1: Providing selected restaurants a document to evidence the upsell amount from coupon customers Before the start of the deal each restaurant was given an excel spreadsheet with two columns, the first one consisting the coupon code and the second one empty column in which the restaurants were asked to fill in the amount that every coupon customer spent beyond the coupon while redeeming it. Phase 2: Mystery shopping to rate employees’ ability to upsell Mystery shopper visited each restaurant 3 times during the redemption period with purchased coupon to evaluate restaurant’s employees capability to upsell. The frequency of the visits was calculated in a meaningful way to include different shifts and hours. The mystery shopper rated the employee’s upsell inclanation with ‘Yes’ or ‘No’ and considering the 3 visits value of ‘Yes’ or ‘No’ was applied to this tested variable. Phase 3: Gathering information for upsell amount and collecting additional information during interviews Upon the redemption period of the deal, the sheet was collected from each restaurant and empirical observation was conducted followed with an interview with the general manager of the restaurant to collect additional data about variables that might affect the profitability of the deal: years of operation (1), type of restaurant (2) and number of employees (3). Additionally, data needed to calculate the profit was collected such as average profit margins of restaurant (4) and the cost to serve each coupon customer (5). Phase 4: Gathering information from the deals database of Grouper for the selected deals and restaurants Data for each deal analyzed was collected: face value (1), discount (2), deal price (3), is the deal package for 2 or more persons (4), does the deal include drinks (5), is takeout allowed (6), are there restrictions in the usage conditions (7), was additional discount offered with the coupon (8), number of coupons sold (9) and number of coupons redeemed (10). In addition, data was collected for the restaurant’s number of deals featured before the deal analyzed (11). Phase 5: Analysis of the deals profitability The following model was designed and used to calculate the deal profit for each deal (Fig. 2).

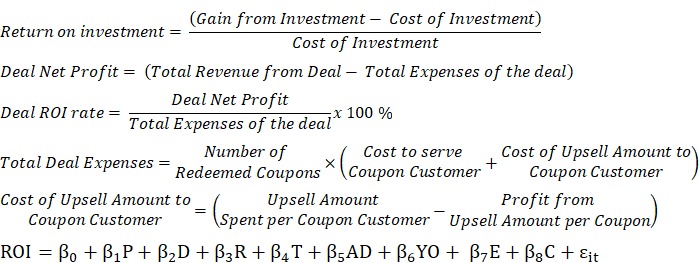

Because in our case Grouper pays the company for each coupon sold, regardless it was redeemed or not to calculate the total deal profit we multiply the profit per customer with the number of redeemed coupons and add the amount restaurant received for the unredeemed coupons. After calculating the net deal profit per deal in absolute amount we want to express it in relative amount in order to make comparison between restaurants. For that purpose, the ROI of each deal was calculated. The total deal profit with already extracted costs for the promotion is expressed, and the ROI rate is calculated by dividing the net deal profit with the cost of the investment i.e. total expenses of the deal (Fig. 3). To analyze the collected data quantitative research methods are applied. Descriptive statistics is used to describe and compare the data. To determine the impact of deals details and restorant's characteristics regression analysis is employed and to estimate the factors that will impact calculated ROI rate. As the goals in this research are focused answering two questions: ‘Do restaurants make profit from a group buying deal, break even or make significant investment?’and ‘How the short-term ROI rate, is affected by: the deal details (1), restaurant (2), restaurants’ employees (3), and restaurant’s previous experience with running deals (4)?’. The hypothesis for each group of factors are set. It is assumed that the deal details taken in consideration in the first five hypotheses will affect deal profitability. Restaurants run different deals aiming to attract different targets of consumers. The deal can offer main dish for one person or it can be a package for two or more persons. Deals can offer food and drinks or only food, so that restaurant is able to make upsell on drinks to the deal customers. Further, some restaurants pose time restrictions in usage to fill in empty tables during off-peak periods and not affect the regular hours when they are full with regular customers. One example is excluding weekends of the deal usage period or certain hours during the weekdays. Some restaurants give the option for takeout to the deal customers, while others prefer to keep that option out assuming that deal customers will make additional purchases while dining in the restaurant. Additional discount on certain products can be made to induce cross-selling of certain products that the restaurant wants to push, for example a coupon for main dish of choice may entitle users to extra 20 % off on a bottle of wine during the redemption of the coupon. Following the developed model for calculating short-term profitability and previous literature review, we adress the identified research gap and the hypothesis to be tested are:H1: Offering package deal for 2 or more persons negatively affects deal profitability.

H2: Inclusion of drinks in the deal negatively affects deal profitability.

H3: Time restrictions in the deal usage conditions negatively affect deal profitability.

H4: Providing takeout in the deal negatively affects deal profitability.

H5: Offering additional discount with the deal positively affects deal profitability.

H6: Restaurant’s years of operation affects deal profitability.

The size of the restaurant, measured by the number of employees and the experience of the restaurant by the years of operation is investigated. Further restaurants were divided into 5 categories: fine dining, casual dining, fast casual, fast food and ethnic35. We examine if the restaurant category will affect profitability to find out if there is significant difference between ROI rates of different restaurant categories. The hypothesis to be tested are:

H7: Restaurant’s number of employees positively affects deal profitability.

H8: Restaurant’s category affects deal profitability. During redemption of coupons deal users can make additional purchases and orders, which represent the upsell amount per coupon user and directly affects the deal profitability. With this hypothesis, we want to test if restaurant’s employees’ effort to upsell will affect users to make more purchases thus affecting deal profitability. If a restaurant offered several deals, we assume that lessons learned will be applied to future deals to achieve better results. The hypothesis to be tested are:

H9: Restaurant’s employees’ effort to upsell positively affects deal profitability.

H10: Restaurant’s previous experience with running deal positively affects deal profitability.

Phase 6: Testing ROI rate dependency on selected variables After calculating each deal’s ROI rate, regression analysis is applied to test the dependency of the ten variables set in the hypothesis, in order to make significant conclusions. The baseline empirical model is the following:

ROI=β_0+β_1 P+β_2 D+β_3 R+β_4 T+β_5 AD+β_6 YO+ β_7 E+β_8 C+ε_it (1)

where: ROI is the return on investment calculated in Fase 5, P is the deal package for 2 or more?, D denotes does the deal include drinks?, R denotes restirctions in the deal conditions for usage?, T denotes was takeout allowed?, AD denotes was additional discount offered?, YO denotes years of operation, E denotes no of employees, C denotes restaurant category. Pearson’s correlation coefficient (r) is a measure of the strength of the association between the two variables. Pearson’s correlation to test the relationship between ROI rate is used and variables connected to the deal details, restaurant’s employees and restaurant’s previous experience in running deals. ANOVA (Analysis of variance) is used to analyze the differences among group means of more than two groups. The differences in ROI rates across five restaurant categories using ANOVA test is used. The restaurants in three categories according the years of existence and three groups according the number of employees are formed.

Phase 7: Creating a model for recommendations for more profitable deals for restaurants Finally the , inductive method and descriptive analysis is used to provide recommendations for the restaurants for more profitable deals.

EMPIRICAL ANALYSIS AND RESULTS CALCULATION OF THE NET PROFIT AND ROI RATE FOR EACH DEAL

The research was done on 32 restaurants running deals with Grouper, and 6 restaurants of them were in the category of fine dining, 4 in fast food, 6 in fast casual, 10 in Ethnic, and 6 In Casual dining. Only 15,6 % of the restaurants were employing below 5 employees, 43,8 % were employing from 5 to 10, and the rest above 10 employees. 50 % of the restaurants were operating less than a year, and this fact is confirmation that the group-buying model is used frequently as a promotion tool. The deal profitability using the values previously collected in Phase 3 and 4 using the equations from Phase 5 is examined. Table 1 shows the input variables used for calculation and each variable’ minimum, maximum and average value.

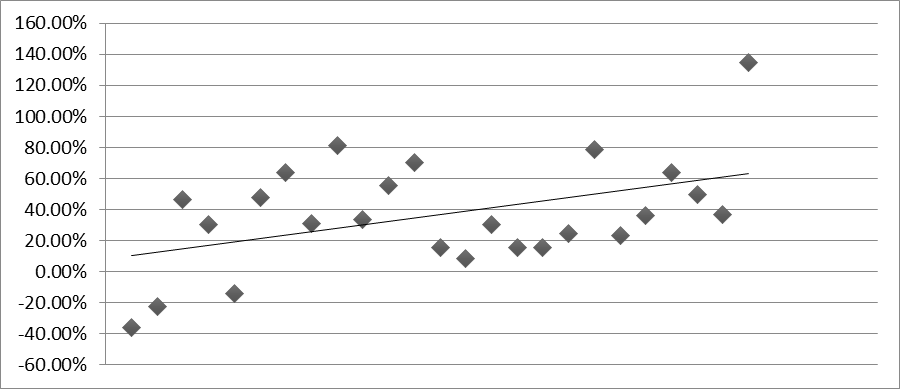

Having calculated the profit for each deal analyzed, the ROI rate is calculated to make comparisons using the modified equations for ROI calculation from Phase 6. The ROI rate varies across companies between -36 % and 120 % (Fig. 4).

Three out of thirty-two merchants or 9 % reported negative rate of ROI, which indicates that they did not break-even with the deal promotion. The average ROI rate amounts 41 %. The restaurant with worst ROI rate is a fast food restaurant (Traditional food), newly opened with 6 employees offering a deal for takeout food of choice. The restaurant with the greatest ROI rate is a casual dining restaurant (Chinese food), newly opened with 6 employees that offered a main dish of choice for the deal users.QUANTITATIVE ANALYSIS OF THE FACTORS THAT AFFECT ROI RATE

Drawing on regression analysis the findings present impact of deals details and restaurants characteristics on ROI rate. The results of the regression analysis are presented in Table 2. Before the interpretation of empirical results, a brief discussion regarding diagnostic tests. According to the R2 (0,56) measure of the overall fit, and the Anova F (2,5) of significance of the parameters the model estimations perform well. The Durbin-Watson statistic is 1.93 indicating there is no autocorrelation detected in the sample. The results showed that offering a package for 2 or more persons in the deal (H1), deals including drinks (H2) and deals adding time restrictions in deal conditions (H3) are not statistically significant (at 5 % significance level) predictors of ROI rate. The deals offering take out and deals offering additional discount are found to statistically significant (at 5 % significance level) impact ROI rate. Deals that provide option for takeout (H4) impact negatively and are less profitable and deals that offer additional discount on other purchases during redemption (H5) impact positively and are more profitable for restaurants. The average upsell amount per deal user amounts 3,38 EUR for deals that offered additional discount, versus 1,46 EUR for deals that did not, which indicates that the additional discount encouraged more than double spending by deal customers that were entitled to additional discount on another product or service. Furthermore, the impact of years of operation (H6), number of employees (H7) are not statistically significant predictors of restaurants profitability. Restaurant category (H8) is found to be statistically significant impact on ROI rate of each deal.

Based on the results that restaurant category impact profitability ROI rate across categories are analyzed (Table 3). Fine dining and casual dining restaurants show highest rates of ROI, 62 % and 58 % respectively; consequently, they offered the most profitable deals. Fast casual and ethnic restaurants showed ROI rate between 35 % and 40 %, which indicates that they offered profitable deals as well. Fast food restaurants are the once with the lowest deal profitability - close to zero (0.50 %), indicating that deals are not profitable for this restaurant category. The lower profitability is expected taking in consideration that fast food restaurants are characterized with fast turnover of people, where people don’t go to enjoy dinner or launch but grab a quick meal or takeout.

Table 4 consists the average values of the variables used to calculate deal profitability: cost per coupon, upsell amount and average profit margin across restaurant categories. Fast food restaurants have the highest cost per coupon, the lowest upsell amount and the lowest profit margin, which indicates that lowest profitability can be logically expected. Fast casual restaurants had low upsell amount per coupon as well, but the lower cost per coupon and the higher profit margin compensated for the low upsell amount and enabled higher profitability. For casual dining restaurants the cost per coupon is close to zero as the amount received per redeemed coupon is almost the same as the cost to provide the service offered with the coupon. The upsell amount is included when calculating deal profitability and directly affects the deal profitability positively.

|

Restaurant Category | Cost per coupon (EUR) | Upsell amount per coupon (EUR) | Average profit margin % |

| Fine Dining | –0,49 | 3,41 | 68 |

| Fast food | –0,53 | 0,50 | 45 |

| Fast casual | –0,13 | 0,70 | 60 |

| Ethnic | –0,52 | 1,86 | 58 |

| Casual dining | 0,02 | 1,84 | 65 |

Whether or not the employees will affect the profitability depends if they will induce more sales from deal users during redemption. Employees directly affect customer’s experience and satisfaction from a certain restaurant. Mystery shopping showed that 56 % of the restaurant’s employees were not keen to upsell and did not make efforts to recommend something or induce additional purchases. Pearson’s correlation analysis showed statistically significant difference between ROI rates of deals where employee’s where keen to make upsells. Restaurants whose employees make effort to upsell enjoy higher profitability (H9). Half of the restaurants whose deals were analyzed had previously offered a deal and for half of them the analyzed deal was the first one they offered. Whether or not the analyzed deal was the first one offered by the restaurant, Pearson’s correlation coefficient did not show statistically significant difference (H10) (Table 5).

The research shows that the deal promotion was profitable for 91 % of the restaurants. Fast food restaurants reported negative rates of ROI, indicating that the group buying deal is not profitable for them, but they can reach great awareness and acquire new customers. On the other hand, restaurants that offered takeout option have lower profitability, which can be also connected to the deal category because fast food restaurants are most likely to offer takeout. Restaurants that offered additional discount with the coupon had higher deal profitability and encouraged more than double spending by deal customers while coupon redemption. Finally, employee’s ability for upsell affected profitability positively.

CONCLUSION, PRACTICAL IMPLICATION, LIMITATION AND FUTURE RESEARCH

CONCLUSION

The findings of the researchers dealing with profitability of group buying deals are ambiguous. Gupta et al.8 found out that on short-term merchants suffer losses, which are offset in the long run by upside revenue from newly acquired customers. The other group of researchers found that deal promotions are beneficial to merchants in multiple ways, and daily deal promotions can be effective marketing tool for retail startup businesses in local markets for achieving exposure and stimulation sales, especially for new merchants25,28,29. This research is focused on one-time (short-term) profitability of deal promotions offered by 32 restaurants that ran and completed promotional deals between August 2014 and August 2015 in this study is examined. Internal data from Grouper’s deal database, mystery shopping and input from restaurant owners and managers is used. The results of this research are in line with second group of researchers and the deals are found to be profitable for 91 % of the restaurants, while 9 % did not break-even with the deal promotion. The average ROI rate amounts 41 %. The profitability highly varies across restaurant categories; fine-dining restaurants have the highest ROI rate (62 %), while fast-food restaurants have the lowest (0,5 %). Furthermore, factors that affect deal profitability connected to the deal promotion itself are takeout option (1) and additional discount provided (2). Deals that allow takeout are less profitable, and deals that offer additional discount on selected products during redemption are more profitable. Although, restaurant’s years of operation and number of employees don’t affect deal profitability, restaurants that employ friendly staff that are willing to make recommendations and are trained to upsell experience higher deal profitability. Spending beyond the coupon value, often called ‘upselling’24 is found as not significant predictor for the deal profitability in Dholakia14. Altogether, the results find deals profitable and effective promotional tool for restaurants.

MANAGERIAL IMPLICATIONS AND RECOMMENDATIONS

Our recommendations can be used by eDGB sites to improve restaurant’s satisfaction while maximizing profitability and by restaurants themselves to help them in the choice and decision-making process when composing a deal. Taking in consideration the results some specific recommendations can be drawn to help restaurant owners when running a deal with an eDGB site. There is no doubt that all restaurants benefit from the deal in terms of advertising, increasing awareness and acquiring new customers but when it comes to profitability restaurants have to carefully decide what they will offer in order to maximize their deal profitability. We address the concerns raised from the analysis and offer recommendations that can be used as a guide to help the decision making in choosing the best deal. Fast food restaurants concern - Fast food restaurants should minimize the cost per coupon by offering products that have highest margin in order to break-even with the deal. When composing a deal, they should assume that deal customers won’t make additional purchases and form a deal price which when deducted the deal site commission will cover their cost to serve the coupon customer. That way they will ensure not having additional costs for running the deal; meanwhile they will get promotion, increase awareness and attract new customers. On the other hand, if they have a pre-defined budget they are willing to spend on the deal they can limit the number of coupons sold. They can calculate the number of coupons they should offer by diving the total sum of the pre-defined deal budget with the cost to serve the coupon customer. Deal specific recommendations – The ideal deal for any restaurant category would be a deal that offers main dish per person excluding drinks; one that provides additional discount to selected products with higher margin that the restaurants prefer to cross sell; and require redemption in the restaurant, excluding take out. Additionally, restaurants can apply time restrictions to maximize capacities utilization during off-peak hours. However, they should be careful when applying time restrictions in order to maximize sales and deal profitability as well. Employees training for upsell – Restaurant employees should be well trained to encourage up-spend by making recommendations to coupon customers. Employees directly affect the customer’s satisfaction of the restaurant and should provide excellent service to coupon customers to make a good first impression to new acquired customers. Daily deals can be a very effective and profitable marketing tool for restaurants that have clear objective for their promotion and manage it around the particular recommendations critical to its success.

LIMITATION AND FUTURE RESEARCH

Several limitations of this study that may restrict the generalizability of the findings need to be emphasized. The findings of this research are based on sales data from only one group-buying platform, Grouper dealing in Macedonia. Future studies may expand this focus to include several other group buying websites in other countries.This may allow researchers to identify similarities and differences among them. Other such websites may include different deal features and it may be interesting to examine the effects of other deal features such as urgency, exclusivity, and social sharing functions. The survey is conducted within a small population which severely impairs the validity of the data. On the other hand, the characteristics of the restaurants fit the profile of the case company, which increases the reliability of the research. Also, the study is cross-sectional, further studies can be conducted to examine the impacts of these same factors over time. A longitudinal study with measures at different times will be helpful to answer these questions.