1. Introduction

Institutional investors account for the largest share of investment activity worldwide (Erhemjamts and Huang, 2019), with institutional pension funds standing out in particular, with assets under management of more than USD 55.7 billion in 2023 (Thinking Ahead Institute’s, 2024). The unique role and position of pension funds arise from their function as financial intermediaries, as they channel savings into investments via the capital market and directly influence the growth of individual and national savings, thus contributing to economic growth (Demirgüç-Kunt and Levine, 1995). The importance of pension funds for society and the well-being of citizens stems from individual responsibility and the burden on public budgets to ensure a stable and predictable future income in retirement. The nature of national pensions is of great interest not only for public policy in times of decreasing fiscal flexibility and aging populations but also for the design of private pension plans by companies for their employees. Moreover, pension assets are a large and important part of the national financial systems (Aggarwal and Goodell, 2013).

Pension funds are currently dealing with many challenges such as: an aging population, an increasing number of retirees and changes in the labour market and many others. The sustainability and adequacy of pension systems are therefore becoming increasingly important when it comes to capitalized pension savings and efforts to improve the performance of pension funds. This pressure is made even worse by the ongoing challenges and geopolitical and financial uncertainties around the world. Pension fund performance is the backbone of adequate retirement savings and reduces the risk of income shortfalls in retirement due to portfolio allocation inefficiencies (Hinz et al., 2010). Recently, low investment returns, low interest rates and a lack of economic growth have further worsened the financial situation of pension systems worldwide. For this reason, the study of pension fund performance and the factors that determine returns has received much research attention in recent years.

Conducting a systematic literature review (SLR) on the factors that influence pension fund performance is crucial for various stakeholders. For fund managers, it could provide important insights to make informed investment decisions, optimise asset allocation and implement effective risk management strategies. Policymakers could benefit from the insights they need to formulate policies that ensure the stability and sustainability of pension systems and protect the interests of pensioners. For pension fund members and contributors, such reviews could improve financial literacy by clarifying how their investments are managed and what factors influence performance, ultimately increasing their confidence in the management of their retirement savings. Building upon prior research, this study aims to identify the key factors deemed critical to pension fund performance. To accomplish this objective, the following research questions (RQs) were analysed through the application of the systematic literature review (SLR) method:

RQ1: What factors influence pension fund performance?

RQ2: How do these factors affect the performance of pension funds?

In addition to these research questions, the study analysed current trends in the literature dealing with pension fund performance factors. Furthermore, the bibliometric analysis includes an examination of the relationship between the quality of a country’s pension system and the origin of the relevant research papers. On this basis, two further research questions were investigated:

RQ3: What are the current trends in the study of pension fund’ research performance in terms of authors, journals, participating countries and institutions?

RQ4: Do most research papers come from countries with highly rated pension systems according to the Mercer CFA Institute Global Pension Index 2023?

These research questions will close the gap by identifying key factors impacting pension fund performance while enhancing understanding of their interplay within financial and regulatory frameworks. The findings aim to support sustainable pension systems, inform policies, and optimize investment strategies for long-term economic stability.

The remainder of the review paper is organized according to the IMRAD structure. The first part of the research introduces the topic, the second chapter explains the data and methodology. The third chapter deals with the research findings, including the systematic literature review (SLR) and the bibliometric analysis. The final part of the paper summarizes the discussion and presents the conclusions.

2. Data and methodology

This article uses a systematic literature review (SLR) and a bibliometric analysis (BA) to identify the articles that make the most important contributions to the topic of pension fund performance.

2.1. Systematic literature review

The SLR encourages researchers to search for studies outside their field and networks by introducing extensive search methods, predefined search terms, and standardized inclusion and exclusion criteria (Robinson and Lowe, 2015), while the BA provides a broader view of the topic.

The search was carried out on October 23, 2023, using the Web of Science databases due to their academic reputation. In this database, the articles in the Social Science Citation Index (SSCI), Emerging Sources Citation Index (ESCI), Science Citation Index Expanded (SCI Expanded) and the Conference Proceedings Citation Index (CPCI-S and CPCI-SSH) were accepted. Boolean operators such as OR and AND were used to refine the search process. The AND operator was used to narrow the search results, while the OR operator was used to broaden the search results. Besides the mentioned operators, we used $ as a truncation symbol, which helped us to find the root of certain words, and brackets () to control the order of operations in the search. The final search term we used was:

(implications OR influence OR impact) AND (financial success OR performance) AND (pension fund$ OR retirement fund$ OR pension system$)

This SLR review relied on the PRISMA framework of Page et al. (2021) to answer questions RQ1 and RQ2. PRISMA is an appropriate protocol for conducting SLRs as it encourages reviewers to carefully document their review plans to avoid arbitrary decisions (Shamseer et al., 2015). According to Petrović and Karanović (2024: 414) “PRISMA is structured methodology which enhances the review’s transparency and replicability, ensuring a rigorous and high-quality analysis”.

In the first phase of the keyword search, 513 potential articles were identified. However, since only English-language articles were accepted, 19 articles were excluded. The next exclusion criterion was to search for research articles, excluding proceedings papers, review articles, early access, book chapters, and editorial material. We also included articles from the Web of Science categories of Business Finance, Economics, Business and Public Administration. The extracted articles were published between 1997 and 2024. This SLR was conducted by authors who undertook various tasks, including writing the manuscript, developing selection criteria and bias assessment strategies, extracting data, developing the search strategy, analysing statistics, providing feedback, and approving the final manuscript.

To ensure the relevance of the analysis, the authors first reviewed the abstracts and selected the most relevant to the core themes of the study. In the final phase, a data synthesis was performed based on the results of a quantitative analysis to assess the quality of the articles. This systematic approach ensures that the selected literature contributes directly to the research objectives and that the conclusions are based on high quality evidence. This process excluded 468 articles with justification, leaving 45 articles for quality assessment. Figure 1 shows the inclusion and exclusion of literature at each stage (PRISMA 2020 flow diagram).

Figure 1: Prisma flow diagram

Source: Author’s calculations

2.2. Bibliometric analysis

Bibliometric Analysis (BA) is a quantitative technique for analysing large amounts of scientific bibliography and bibliometric data in a specific field. Nowadays, it is used as a form of analysis to uncover emerging research trends in articles and journal performance (Donthu et al., 2021). The primary advantage of BA is to understand global research trends in a particular field (Alsharif et al., 2022). In our view, BA serves as a comprehensive method for statistically analysing productivity indicators at different levels, including years, authors, countries, and institutions. In addition, this approach facilitates the identification of correlations, such as co-authorships, citations, and other forms of collaboration, thus providing valuable insights to the reader. In this study, a BA is used to answer research questions aimed at better understanding the impact of the topic on the performance of pension funds. A bibliometric analysis was conducted using Biblioshiny software (Aria and Cuccurullo, 2017), following the methodology of several previous studies (Uskoković et al., 2024; Rani and Goyal, 2024; Sethi and Mahadik, 2024). The initial step of this analysis was to present the general data of the sample used in the BA in Table 1.

Table 1: Main information about data

Source: Author’s calculations

The timeframe for academic papers on the topic of Influence on the performance of pension funds spans from 2002 to 2022. The analysis of annual production shows a recognizable upward trend in the number of published papers.

3. Results

This chapter presents the findings of the systematic literature review and the bibliometric analysis. The review identifies five main categories of factors that influence the performance of pension funds, while the bibliometric analysis highlights current research trends. The results are organised according to the defined research questions in order to provide a comprehensive and structured insight into the topic.

3.1. Factors influencing the pension fund performance – SLR

Based on the reviewed literature, to address RQ1, “What factors influence the performance of pension funds?”, the findings can be categorized into five main groups, as illustrated in Figure 2.

Figure 2: Main Indicators Affecting Pension Fund Performance According to Published Literature

Source: Author’s calculations

Each of these factors is elaborated in separate chapters to address RQ2: How do these factors affect the performance of pension funds?

3.1.1. Capital market movements

Movements on the capital markets can have a significant impact on the performance of institutional investors, especially pension funds, as pension funds spread their investments across various capital market instruments. This diversification can make pension funds susceptible to fluctuations on the equity and bond markets, as they are sensitive to market changes. Pension funds must therefore manage their portfolios carefully to minimise the risks associated with market fluctuations.

According to Chovancova et al. (2019), pension funds are more dependent on the performance of the bond market than the equity market. They emphasise the importance of improving the management of pension savings, especially in the context of low interest rates, whereby the interests of savers should be prioritised by both regulators and managers. Bikker et al. (2010) found that the equity market has a significant impact on pension fund investments, as positive equity performance increase higher equity investments in both the short and long term. Pension funds are also more sensitive to negative news from the stock market than positive news. In addition, larger pension funds tend to invest more in equities, which makes them more sensitive to fluctuations in equity performance.

Overall, movements on the capital markets have an important role in the investment strategies and results of pension funds. This emphasises the need for careful risk management and strategic asset allocation to protect against market fluctuations.

3.1.2. Fund and investment characteristics

Size effect

Economies of scale in the active money management industry contribute significantly to lower expense ratios, which has a direct impact on the performance of pension funds. Several studies have examined how factors such as fund size, governance and market conditions affect cost savings and returns. Larger funds benefit most from diversification and lower administration costs, leading to better overall performance. Cummings (2016) examined the impact of fund size on Australian pension funds by analysing a sample of 284 funds. His study showed that larger funds benefit from advantages such as greater diversification, economies of scale and cost reductions for investors. Similarly, Bikker and De Dreu (2009) analysed the impact of size, governance, pension plan design and outsourcing decisions on Dutch pension funds using a data set of 10,000 observations. They found that larger funds achieve significant savings in both administrative and investment costs, which has a positive impact on their overall performance. Bikker and Meringa (2022) analyse the different effects of consolidation on pension funds of different sizes. They find that smaller funds are less affected by consolidation than larger funds. This suggests that the impact of consolidation on the returns of larger pension funds may be more pronounced. Adami et al. (2014) examined the performance of UK pension funds using three models focusing on fund size, market returns and momentum. Their analysis found that while these factors contribute to returns, they only partially explain them, particularly for smaller funds, with the momentum factor having a minimal effect. In summary, the size effect shows that larger pension funds use economies of scale to achieve lower expense ratios, greater diversification and significant cost savings, contributing to better performance overall.

Impact of SRI on performance

In recent decades, the impact of socially responsible investing (SRI) on investment performance has been a focus of academic research. The main objective of these studies has been to investigate whether the consideration of ‘sustainable, responsible and ethical’ aspects in investment strategies influences investment outcomes. The general conclusion of the research to date is that SRI has a mixed, but generally neutral, impact on pension fund performance.

Marlowe (2014) examined the performance of publicly funded pension portfolios containing SRI compared to portfolios without such components. The study found that both portfolios performed similarly, suggesting that the concept of social responsibility does not significantly affect performance in this context. Moss and Farrelly (2015) examined the impact of a mix of global listed and UK unlisted real estate investments on the performance of UK defined contribution (DC) pension funds. The research shows that the inclusion of listed and unlisted real estate can lead to efficient risk-return outcomes for UK DC pension fund investors seeking better performance and liquidity. Alda (2018) investigated whether socially responsible pension funds have different performance characteristics to conventional funds. The analysis found that both types of funds use similar investment strategies, with socially responsible funds exhibiting better timing in some strategies while adhering to certain social responsibility criteria. Nonetheless, the study found no significant differences in performance, investment style or timing between socially responsible and conventional funds, suggesting that investors who prioritise social values can achieve comparable financial results. A later study by Alda (2020) examined the impact of SRI on traditional investment management. The results suggest that the environmental, social and governance (ESG) scores of both conventional and SRI funds are influenced by common characteristics such as fund age, turnover and costs, which are consistent with SRI characteristics. In addition, a higher intensity of ESG screening has been associated with higher returns and greater fund inflows. Alda (2022) examined the impact of corporate social responsibility (CSR) controversies on UK pension and investment funds. The study found that different types of CSR controversies affect fund performance in different ways. While ethical issues often improve performance, controversies about customers and employees tend to have a negative impact on performance. Fund managers tend to maintain their portfolios in response to CSR controversies, particularly in the case of socially responsible funds, while conventional fund managers tend to avoid controversial companies. Effective CSR engagement strategies can mitigate negative investor reactions, although concerns about symbolic CSR practices persist, highlighting the need for transparent communication between fund managers and investors. Hoepner and Schopohl (2018) found that the performance of Swedish and Norwegian state pension funds was not affected by the exclusion of companies involved in unethical practises. Apostolakis et al. (2018) examined retirees’ intentions to adopt SRI within pension plans, highlighting the role of attitudes, social norms, perceived efficacy and trust in influencing investment behaviour. Understanding these behavioural factors is critical to advancing socially responsible investment practices, particularly in discussions about incorporating individual choices into pension schemes.

While research has consistently shown that socially responsible investing (SRI) generally has a neutral impact on pension fund performance, several studies suggest that SRI and related practices such as ESG screening and CSR engagement can influence investment outcomes and fund management strategies. Despite the mixed results, understanding the behavioural and financial implications of SRI is critical for both investors and fund managers and highlights the importance of effective communication and strategic management to align social values with financial goals.

Asset allocation

Effective capital allocation has a crucial role in the performance of pension funds. Research shows that the inclusion of real estate in pension fund portfolios improves diversification and risk-adjusted returns, as studies of investments in Nigeria, Germany and the UK have shown. In addition, regional differences in asset allocation and investment strategies highlight the importance of strategic real estate investments and the selection of appropriate benchmarks to improve pension fund performance.

Umeh and Okonu (2018) found that the integration of real estate into the portfolios of Nigerian pension funds improves diversification and performance and increases risk-adjusted returns. Their results showed a weak positive correlation with federal and government bonds, but a strong positive correlation with money market securities and corporate bonds. Newell and Marzuki (2016) found that UK real estate investment trusts (REITs) generated lower risk-adjusted returns compared to UK equities, despite robust performance following the global financial crisis. Despite the high correlation with the equity market, UK REITs are crucial for small pension funds and defined contribution funds due to their liquidity, underlining their importance in diversified real estate portfolios. A later study by Newell and Marzuki (2018a) on German REITs found that although these REITs initially had lower risk-adjusted returns, they outperformed German equities and real estate companies after the financial crisis from 2007 to 2015. This finding underscores their value in mixed investment portfolios, particularly for pension funds and institutional investors seeking liquid exposure to German real estate. Overall, these studies highlight the differential impact of real estate and equity investments on portfolio performance across different regions and investment types. Newell and Marzuki (2018b) have also shown that student residences generate high returns and contribute to diversification in real estate portfolios. This underlines their importance as a key asset class for pension funds and sovereign wealth funds. Broeders and De Haan (2020) conducted an analysis of 455 Dutch pension funds covering the period from 2007 to 2016. Their results suggest that asset allocation is responsible for 39% of the variation in returns over time. In contrast, benchmark selection, timing and security selection contributed to 11%, 9% and 16% of the variation in returns, respectively. Among these factors, benchmark selection proved to be the most influential factor, explaining 33% of the variation in fund returns. Lopez and Walker (2021) examined the investment performance of Chilean pension funds using an extended return-based style analysis that also takes into account regulatory constraints and currency hedging. Their results show that Chilean pension fund returns closely tracked their style benchmarks from 2003 to 2017, suggesting that tactical asset allocation strategies did not provide significant benefits. This suggests that the strategies employed by fund managers and their security selection effectively covered the associated costs. Even and Macpherson (2008) found that investment in shares of the sponsoring company can influence the performance of pension funds. The study discusses the factors that influence these investment decisions, such as the cost of non-diversification and its impact on risk-adjusted returns. Large investments in employer stock can have a negative impact on performance, while smaller holdings generally have minimal impact. Since 2001, public pension plans have increasingly relied on alternative investments. Peng and Wang (2024) found that alternative investments, particularly private equity, have a generally positive but small and unsustainable effect on investment performance. An et al. (2016) discovered a significant negative correlation between pension fund ownership and REIT crash risk, in contrast to bank ownership. This correlation is due to the ownership of pension funds, which provide patient capital and effective governance due to their long investment horizon, stronger incentives and better monitoring capabilities.

Effective capital allocation is central to improving pension fund performance, with the integration of real estate proving to be an important factor in improving diversification and risk-adjusted returns. Studies in various regions, including Nigeria, Germany and the UK, have shown that real estate investment and strategic asset allocation contribute significantly to fund performance. The results also highlight the differential impact of real estate and equity investments, with regional differences underlining the importance of appropriate benchmark selection and liquidity considerations. In addition, factors such as risk appetite following poor performance, benchmark selection and the influence of employer equity investments highlight the complexity of pension fund management. Taken together, these findings highlight the need for well-informed investment strategies and effective management practises to optimise pension fund outcomes.

3.1.3. Pension fund corporate governance

Corporate Governance and Management

Recent research emphasises the critical role of governance and strategic practices in the performance of pension funds. Effective governance, characterised by transparency, accountability and active oversight, combined with advanced investment strategies, leads to significantly better returns and fewer inefficiencies. These strategies often include diversified portfolios and data-driven decision-making. Conversely, poor governance and outdated investment approaches negatively impact performance and lead to lower returns and higher inefficiencies. Therefore, strong governance and innovative strategies are key to optimising pension fund outcomes.

Liu and Ooi (2019) examined the impact of related-party outsourcing and interlocking trustees and directors on the performance of Australian pension funds. Their study found that these practices are associated with suboptimal investment outcomes for fund members, primarily due to conflicts of interest and operational inefficiencies. The researchers also identified problems with the current definitions and roles of independent directors and found that these problems could affect the equitable distribution of funds among members. Their findings are particularly relevant in light of the ongoing reviews by the Pension Productivity Commission, which is looking at these governance issues and aims to improve the effectiveness of pension fund management. Akomea-Frimpong et al. (2022) examined the impact of sound corporate governance practises on pension fund performance. Their study showed that a transparent financial structure, fair treatment of shareholders, strong internal controls and effective monitoring by audit committees are associated with better performance outcomes for pension funds. In addition, their analysis found that factors such as board composition, board member experience, frequency of board meetings and gender diversity contribute significantly to the effectiveness of governance practises and therefore pension fund performance. Abinzano et al. (2017) examined the impact of governance structures on the fees and performance of pension plans in Spain. Their analysis found that effective governance mechanisms that facilitate the alignment of interests and strengthen management oversight led to significantly lower fees and better performance for employer-sponsored pension plans than for individual plans administered by companies that manage both types of pension plans. The study underscores the importance of decision-makers’ bargaining power in lowering fees and optimising performance outcomes. Black (2006) concludes that there is a significant correlation between the performance of a company’s pension fund and its financial health. If the pension funds perform well, the company can reduce future contributions, which has a positive effect on cash flow and the share price. Conversely, poor performance leads to increased financial obligations for the company, negatively affecting earnings and cash flow. The volatility of pension fund investments is reflected in the volatility of the company’s financial ratios. Consequently, pension fund management has a crucial role in the company’s strategy, influencing its risk profile and financial stability.

In summary, recent research highlights the central role of governance and strategic practices in improving pension fund performance. Effective governance, marked by transparency, accountability, and sound oversight, combined with advanced investment strategies, leads to better returns and fewer inefficiencies. Together, these studies confirm that strong governance and strategic innovation are essential to optimising pension fund outcomes.

Board Diversity

According to several authors, the performance of pension funds is closely linked to governance structures and board diversity. Empirical studies show that factors such as fractionalization and the overall composition of the board can influence investment returns. However, the results make it clear that effective governance practices and ethical management are key to optimising performance and mitigating risk. While board diversity and structure are important, efficient governance and ethical oversight have a critical role in improving pension fund outcomes.

Veltrop et al. (2015) argue that board diversity influences performance through the representation of different interest groups and the formation of factions within the board. Their research indicates that such factionalisation can undermine board effectiveness and adversely affect financial returns. However, the study emphasises that the reflexivity of the board, its ability to self-assess and adapt, can mitigate these negative effects. Pennacchi and Rastad (2011) found that pension funds with greater participant representation on their boards are more likely to opt for riskier investment portfolios, indicating a preference for potentially higher returns. Jackowicz and Kowalewski (2012) found that the composition of the supervisory board and the knowledge and motivation of its members are crucial for improving the performance of pension funds in Poland. Their study highlights the need for robust internal governance mechanisms, as existing remuneration systems are often insufficient to enforce manager discipline. The study concludes that while the presence of older and less educated board members can have a negative impact on profitability, increasing the number of external board members generally leads to an improvement in fund returns. The study also identifies weaknesses in external and internal governance structures and highlights the role of fund activism and behaviour in performance. It argues for a more proactive role for governments and regulators in the selection of board members and calls for further research to fully understand the impact of various governance factors on pension fund performance. Benson et al. (2011) emphasise the critical role of corporate boards in ensuring ethical practices and effective risk management. They argue that broader organisational responsibilities and systemic issues are overlooked when financial failures are attributed solely to individual directors. In their study, which concludes that adherence to recommended practices is associated with better financial outcomes, they examine governance practices in pension plans and their impact on financial performance. Key factors include the size of the board of directors, the frequency of conflict checks, and the function of the investment committee. The study highlights that effective governance is essential for making sound investment decisions and dealing with fluctuating returns, and calls for further research to improve pension plan governance practices.

In summary, the current evidence suggests that governance structures and board diversity have a significant impact on pension fund performance. There is also evidence that board size and composition can influence investment returns. Overall, these studies show that while board diversity and structure matter, efficient governance and ethical oversight are critical to improving pension fund performance. To improve pension fund performance, further research is needed to investigate and refine these governance practices.

Management Strategy

The implementation of effective management strategies and the introduction of new technologies are key factors in improving the performance of pension funds, according to a recent study. There is evidence that consolidation is particularly beneficial for larger funds and brings significant advantages. In addition, there are promising opportunities to improve both returns and stability through advances in active management practises and the introduction of collective defined contribution (CDC) schemes.

Garcia (2010) argues that organisations that exhibit suboptimal performance should implement enhanced strategies to improve their results. Factors such as problematic relationships, unequal access to information and poor strategic planning are often blamed for inefficiencies. The study makes a strong case for the integration of new technologies as a means of implementing best practise in pension fund management. This underscores the importance of technological advancement in optimising performance and eliminating inefficiencies. Gonzalez et al. (2020) show that the combination of a high level of activity and a longer holding period improves the performance of pension funds. Specifically, they find that a one-month increase in the duration of active management within one year can increase annual returns by around 3.3 %. Collective Defined Contribution (CDC) plans, a pension scheme proposed for the UK, were examined by Owadally et al. (2022). Their research shows that CDC plans offer benefits for both employers and employees as the risk is spread across different generations. This also stabilises pensions in the face of financial market volatility. Simulations comparing CDC plans to traditional pensions show that CDC plans generally provide retirees with higher average replacement rates and less income uncertainty.

The study highlights the importance of effective management strategies and technological advances in improving the performance of pension funds. Taken together, these findings underscore the importance of strategic innovation and effective management practises in optimising pension fund outcomes.

3.1.4. Behavioural and Political Influences

Behavioural and political biases

Political bias can lead to underperformance by tempting management to invest in companies that are politically favoured rather than those that offer the best returns. Such bias can lead to sub-optimal asset allocation, reduced diversification and potential conflicts of interest, ultimately impacting the overall financial performance of the fund. Bradley et al. (2016) claim that public pension funds sometimes prefer to invest in local companies that are politically active, e.g. through lobbying or donations to local politicians. This can lead to these funds investing too much in these companies, which may not be optimal for their overall investment returns.

Behavioural biases pension management to make sub-optimal investment decisions, which affects overall performance. Previous studies have shown that pension fund performance can fluctuate due to liquidity, behavioural biases, herding behaviour and the influence of past returns. Arbaa and Varon (2020) found that investors are risk-averse and overreact in bull and bear markets. They also consider liquidity as an important factor influencing the flow–performance curve. They found that high liquidity leads to a linear relationship between flows and returns, while increased risk turns the curve into a concave curve, challenging previous research. Verma and Verma (2018) investigated behavioural biases such as the disposition effect and the house money effect in the investment decisions of US-defined benefit pension funds. The study shows that past losses lead to investment more in riskier investments and less in safer investments, confirming loss aversion. In addition, pension-related variables also influence the trading behaviour of the funds. Overall, while the disposition effect is evident, there is no evidence of the house money effect in the portfolio decisions of these pension funds. Alda and Ferruz (2016) investigated whether the performance of Spanish pension funds decreases or increases when pension funds herd. They found that pension funds that do not herd or follow certain strategies do not show significant differences in performance compared to herd funds. Ferruz et al. (2007) examined the short-term performance persistence of Spanish equity pension plans from 1999 to 2006 and found a significant relationship between historical returns and investment flows, providing insight into how past performance influences investor behaviour in these portfolios. The correlation between investment flows (cash and investor flows) and past performance is statistically significant in almost all the annual periods studied.

3.1.5. Regulatory and Legislative Environment

Regulatory changes

The replacement of managers and policy decisions have a significant impact on the performance of pension fund performance and affect returns, risks and overall efficiency. Dopierala and Mosionek-Schweda (2020) found that regulatory changes, such as increased regulation and restrictions on investments such as government bonds, have a significant impact on the performance of pension fund performance. Witkowska et al. (2019) analyse the impact of political decisions on the Polish investment fund market, focusing on how changes in pension fund activity affect the efficiency of investment funds with stable growth strategies. They compare the performance of pension funds and mutual funds managed by the same companies under the new regulations and conclude that pension funds outperform mutual funds in terms of returns, but face higher portfolio risks and lower efficiency due to the regulatory changes. Alda (2016) used an event study to examine the impact of manager changes on the performance of pension funds. The study concluded that manager turnover is often triggered by poor excess returns and certain manager characteristics such as team leadership, gender diversity and experience. It also found that longer manager tenure can lead to higher gross returns, but does not necessarily improve excess returns. Similarly, Afolabi and Sy (2015) emphasize the challenge for pension funds to find a balance between short and long-term goals, while adhering to strict governance standards that are important for risk management and benefits for plan sponsors and beneficiaries.

Legislative Framework

According to previous findings, legislative interventions have had a particular impact on pension funds by lowering returns, changing strategic shifts between conservative and growth-oriented funds and influencing the level of risk without lowering it uniformly.

Papik and Papikova (2021) found that legislative interventions reduced the average daily return of pension funds by 0.01% to 0.03%. Mitkova and Mlynarovič (2020) analyzed the impact of regulatory changes on conservative and growth-oriented funds in the second and third pillars and found that regulation shifted the efficiency frontier for conservative funds towards higher returns without increasing risk, while it led to strategic changes for growth-oriented funds after 2009. Hoepner and Schopohl (2020) concluded that while regulatory changes had a significant impact on investment strategies, they did not necessarily lead to a reduction in risk. They found that the 2009 regulation led to a reduction in risk with no change in returns, while the relaxation of regulation in 2012 allowed growth funds to increase risk to achieve higher potential returns.

3.2. Current trends in analysis of pension fund performance – Bibliometric Analysis

Second part of analysis of the factors influencing the performance of pension fund analysed the current trends in terms of authors, journals, countries and institutions. A further aim was to investigate whether most research papers originate from countries with highly rated pension systems, suggesting a correlation between the quality of a country’s pension system and the origin of the corresponding research papers. On this basis, two further research questions were investigated using bibliometric analysis:

RQ3: What are the current trends in the study of pension fund’ research performance in terms of authors, journals, participating countries and institutions?

RQ4: Do most research papers come from countries with highly rated pension systems according to the Mercer CFA Institute Global Pension Index 2023?

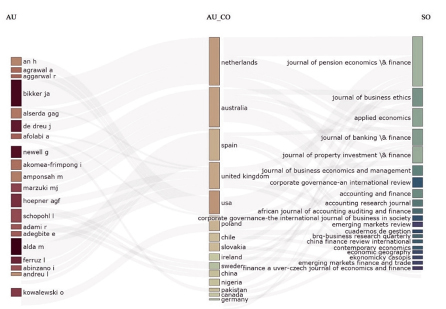

A three-field plot based on the Sankey diagram shows the interrelationship between affiliation, country and source (journals) in Figure 3. The three highlighted elements are emphasized by their height and different colour to underline their relevance; the higher the rectangle, the greater the strength or connection between them. The diagram also shows that authors from countries such as the Netherlands, Australia, Spain and the UK have made significant academic contributions to highly rated journals such as the Journal of Pension Economics and Finance, Journal of Business Ethics, Applied Economics and others.

Figure 3: Three-field plot: author, country and source

Source: Author’s construction

To identify the most important authors, the h-index was chosen as the main indicator and the results are shown in Table 2.

Table 2: Most relevant authors according to the H-indeks

| Element | h_index | g_index | m_index | TC | NP | PY_start |

| Alda, Mercedes | 3 | 5 | 0.333 | 43 | 5 | 2016 |

| Bikker, Jacob A. | 3 | 4 | 0.188 | 65 | 4 | 2009 |

| Newell, Graeme | 3 | 3 | 0.333 | 57 | 3 | 2016 |

| De Dreu, Jan | 2 | 2 | 0.125 | 56 | 2 | 2009 |

| Ferruz, Luis | 2 | 2 | 0.125 | 10 | 2 | 2009 |

Notes: h_index – Hirsch index, g-index measures a scholar’s overall scientific productivity, m-index measures the impact of a scholar’s work by combining the h-index and g-index, TC total citations, NP number of publications, PY publication year.

Source: Author’s calculations

The analysis has identified three authors who have had the greatest influence on research into the determinants of pension funds. The H-index (Hirsch, 2005) was used as the most important indicator to measure the scientific contribution an author, the second criterion was the g-index (Egghe, 2006). In addition to the authors listed in the following table, the five most important scientific journals in this field were identified based on the number of articles published and the H-index.

Table 3: Most relevant journals

Source: Author’s calculations

To examine whether the majority of studies come from countries with reputable pension systems, Mercer CFA Institute Global Pension Index 2023 (Mercer, 2023) has created an index composed of adequacy, sustainability, and integrity. Based on the scores awarded, the Table 4 displays the performance of pension systems in 2023.

Table 4: Pension system performance results in 2023

Source: Adapted from Mercer (2023)

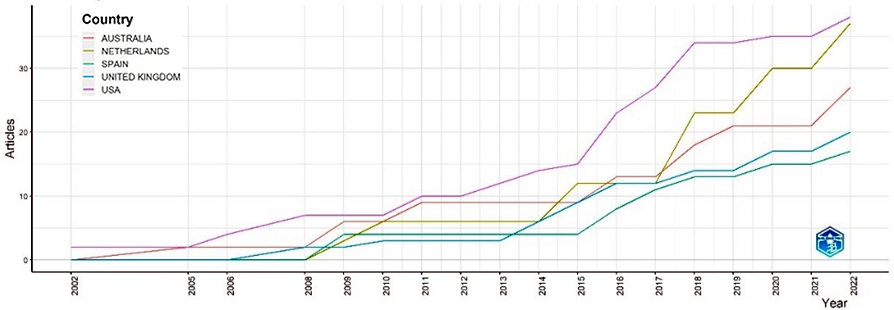

Country production over time as displayed in Figure 4, measures the frequency of authors’ appearances based on their country affiliation. The most prolific authors in this research area come from the USA, the Netherlands, Australia, the United Kingdom, and Spain. From this, it can be deduced that three of these five countries have strong pension systems.

Figure 4: Country production over time

Source: Author’s calculations

In addition to analysing country production, it was important to evaluate the citation frequency of the most frequently cited countries and to derive an overall index value. The results in Table 5 show that five countries received a B grade, three countries a C grade and one country an A grade.

Table 5: Most cited countries

| Country | Citation | Overall index grade |

| USA | 263 | C+ |

| Netherlands | 154 | A |

| Australia | 88 | B+ |

| Canada | 83 | B |

| UK | 76 | B |

| Spain | 57 | C+ |

| Poland | 28 | C |

| Portugal | 15 | B |

| Italy | 10 | C |

| Chile | 6 | B |

Source: Author’s calculations

Based on the results of the 2023 pension system on the one hand and the country production and prominence of the most frequently mentioned countries on the other, research question 2 can be answered in the affirmative. It can be observed that the research papers predominantly come from countries with highly rated pension systems. From the perspective of the most frequently mentioned countries, it can be deduced that they mostly belong to rating class B, which according to Mercer (2023: 9) represents “a system with a solid structure that has many commendable features, but also shows room for improvement, which distinguishes it from a class A system”.

4. Discussion

The research objectives were achieved by categorizing the determinants into five key areas: capital market movements, fund size and investment characteristics, pension fund corporate governance, behavioural and political influences, and regulatory and legislative environment. Each of these areas provides unique insights into the mechanisms driving pension fund performance, with implications for both academic research and practical fund management.

The movements in the capital markets influence the performance of pension funds primarily via the bond and equity markets (Chovancova et al., 2019). More specifically, pension funds are closely linked to the performance of the bond markets, which provide liquidity, particularly in a low-interest-rate environment. Positive equity market performance encourages higher equity investments, while negative news leads to sensitivity and lower performance (Bikker et al., 2010). Larger funds that are heavily invested in equities are more susceptible to market volatility. Effective management strategies must therefore balance these influences to protect and grow pension savings.

The size effect in pension funds shows that larger funds benefit from economies of scale, resulting in lower expense ratios, greater diversification and significant cost savings that improve overall performance. Studies by Cummings (2016), Bikker and De Dreu (2009) and Adami et al. (2014) show that fund size, governance and market conditions influence these benefits. Larger funds outperform due to these efficiency advantages, while smaller funds are more strongly affected by factors such as market returns and momentum.

Studies show that socially responsible investment (SRI) portfolios in pension funds perform similarly to conventional portfolios, suggesting that social responsibility does not compromise financial returns (Marlowe, 2014). Higher ESG scores, influenced by factors such as fund age and costs, are associated with better returns and inflows (Alda, 2020). CSR controversies affect performance in different ways, with ethical issues improving performance and customer or employee issues detracting from it (Alda, 2022). Attitudes, social norms, perceived efficacy and trust have an important role in the adoption of SRI in pension schemes by retirees (Apostolakis et al., 2018). Overall, SRI funds can achieve comparable financial results while meeting social responsibility criteria.

To summarize the impact of capital allocation, it is important to emphasize that the integration of real estate into pension fund portfolios improves diversification and performance (Umeh and Okonu, 2018). Risk appetite is influenced by past performance and governance, with underperforming funds and those with participant representation taking more risk. Ethical considerations, such as the exclusion of unethical companies, do not have a significant impact on performance, suggesting that socially responsible investing can achieve similar financial results (Hoepner and Schopohl, 2018). These results underscore the importance of real estate, strategic asset allocation and ethical investing in pension fund management.

Board diversity impacts pension fund performance, as stakeholder and internal faction representation can influence effectiveness and returns (Veltrop et al., 2015). However, a board’s ability to self-assess and adapt can mitigate this impact. Board composition, knowledge and motivation are critical to improving performance and underline the need for robust internal governance mechanisms. Older, less educated board members have a negative impact on profitability, while more external board members improve returns (Jackowicz and Kowalewski, 2012). As governance structures are often weak, governments and regulators need to have a proactive role in board selection.

When analysing governance, it is important to emphasize that effective governance is crucial to the performance of pension funds. Studies show that conflicts of interest and inefficiencies due to poor governance, as found in Australian pension funds, are detrimental to performance. In contrast, sound governance, including transparency and strong internal controls, improves outcomes (Liu and Ooi, 2019). Effective governance structures also reduce fees and improve performance, as can be seen in Spanish pension funds (Abinzano et al., 2017). Overall, sound governance practices are critical to optimising pension fund management and achieving better results.

Management strategies should focus on several key principles. To improve suboptimal performance, organizations should implement better strategies that address issues such as poor relationships, unequal access to information and inadequate planning. Integrating new technologies is critical to optimizing pension fund administration and eliminating inefficiencies (Garcia, 2010). Consolidation has a greater impact on larger pension funds than smaller ones and affects their returns more. A high level of activity combined with a longer holding period improves the performance of pension funds, with a slight increase in active management significantly increasing annual returns (Gonzalez et al., 2020). Collective defined contribution (CDC) schemes offer higher average replacement rates and lower income uncertainties compared to traditional pensions by spreading risk across generations, even in the face of financial market volatility (Owadally et al., 2022).

One of the indicators addresses political and behavioural biases in pension fund management. Public pension funds sometimes prefer to invest in politically active local companies, which can harm overall returns (Bradley et al., 2016). Investors are generally risk averse and overreact in both bull and bear markets, with liquidity affecting the flow-performance curve. High liquidity leads to a linear relationship between inflows and returns, while increased risk leads to a concave curve (Arbaa and Varon, 2020). Behavioural biases, such as the disposition effect, influence investment decisions in US-defined benefit pension funds, with earlier losses leading to riskier investments. However, the house money effect is not observed (Verma and Verma, 2018). In Spanish pension funds, performance is not affected by herd behaviour and past performance significantly influences investment flows (Alda and Ferruz, 2016).

Regulatory and political changes have a significant impact on the performance of pension fund performance. Regulatory changes, such as the tightening of regulations and investment limits, have a significant impact on pension funds (Dopierala and Mosionek-Schweda, 2020). In Poland, policy decisions have impacted the efficiency of mutual funds, with pension funds outperforming mutual funds in terms of returns but facing higher risks and lower efficiency due to new regulations (Witkowska et al., 2019). The replacement of managers in pension funds is often triggered by poor returns and certain characteristics such as team management and experience, with longer tenures improving gross returns but not excess returns (Alda, 2016). It is a challenge for pension funds to find a balance between short-termism and long-term goals while maintaining strong governance (Afolabi and Sy, 2015).

Legislative intervention has slightly lowered daily returns, while regulatory changes have shifted conservative funds towards higher returns without increasing risk and led to strategic changes in growth funds. Regulatory changes have influenced investment strategies, with the 2009 regulation leading to a reduction in risk for stable returns and the relaxation of measures in 2012 allowing growth funds to increase risk for higher return opportunities (Hoepner and Schopohl, 2020).

5. Conclusion

Pension funds are one of the fundamental factors for an efficient financial system, but also for the sustainability and adequacy of national pension systems. By capitalizing savings, they help to increase citizens’ future pension income and reduce the social, economic and political pressure on pension systems. Therefore, a deep insight into the factors that influence their performance is of great interest to the professional and scientific public. The aim of this study was to summarise the available research on indicators that influence the performance of pension funds and the current trends in this area. Two methods were used in the study to answer the research questions: an SLR and a bibliometric analysis. When analysing the research papers using the PRISMA framework, studies that did not fall within the scope were excluded, resulting in a final sample of 45 papers (published between 2002 and 2022). Based on the results, the papers were categorized into five groups: capital market movements, fund size and investment characteristics, pension fund corporate governance, behavioural and political influences, and regulatory and legislative environment. The results underline that effective management, governance and strategic asset allocation are critical to enhancing pension fund performance, contributing to broader financial stability and sustainability. More precisely, to improve efficiency and long-term sustainability of pension funds, it is important that policy makers strengthen corporate governance, ensure a flexible but effective regulatory framework and promote sustainable long-term investment strategies, while fund managers should adopt a strategic approach to asset allocation, match investments to the size of the fund and apply international best practises in day-to-day management.

Based on the bibliometric analysis, the study highlights the authors, journals and countries that have contributed most to the topic. In addition, the fourth research question is partially confirmed, as three of the five countries with the most prolific authors in this research area — the Netherlands, Australia and the United Kingdom — are among the best-performing pension systems according to the Mercer CFA Institute Global Pension Index 2023. By offering actionable insights for optimizing fund performance, the study contributes to enhancing the competitiveness of pension systems within the global financial landscape.

Finally, some limitations should be noted: The reliance on a single database such as Web of Science may have meant that relevant literature accessible through other databases was omitted. Furthermore, by focusing the study on peer-reviewed journal articles, other potentially relevant sources such as book chapters and reports were excluded. The keyword-based method of article selection may also lead to subjective biases that may affect the accuracy of the results. In addition, bibliometric properties may not be consistent over time, and distributional patterns within the impact of different indicators on pension fund performance may still evolve. Further research should extend the analysis to databases such as Scopus and combine academic articles with industry reports to gain insights into the practical challenges faced by pension fund managers. In addition, future research should utilize qualitative methods such as interviews with industry experts to gain deeper insights into management strategies and challenges.

Acknowledgment

This paper was supported by the University of Rijeka, under the project line uniri-iskusni-drustv-23-07.