INTRODUCTION

The era of low cost carrier (LCC) airline operations in Southeast Asia began when Tune Air Sdn Bhd purchased a financially troubled full service carrier (FSC), Air Asia, from the Malaysian government in 2001 (Air Asia 2015). Tune then transformed it into a LCC, while retaining the name Air Asia, and adopted the business model of Southwest Airlines which operated very successfully in the US market (Air Asia 2018).

Since then, many low cost airlines have begun operating in the region, especially after governments relaxed controls over the aviation sector. The Thai government in 2000 introduced air liberalisation measures. These allowed private companies to compete with the state-owned airlines in the Thai air transport market (Lonides 2000).

The LCC business model was extended to Thailand when Air Asia in Malaysia established Thai Air Asia with their Thai counterpart Asia Aviation in September 2003 (Asia Aviation 2014). In response to the new entrant to Thailand’s aviation market, airlines in Thailand reacted promptly by establishing their low cost subsidiaries. Two of these low cost operators were One-Two-Go Airlines and SkyAsia Airlines (later renamed Nok Air). Orient Thai Airlines launched One-Two-Go in December 2003 (Ludd and Ison 2013). In 2004 the national carrier, Thai Airways International, established SkyAsia (Nok Air 2017). The new airlines operate domestic flights in Thailand and international flights to destinations in the region.

With the success of the LCC operations in Thailand, the business model was adopted for the long haul market. Malaysia’s Air Asia X, along with groups of Thai investors, created Thai Air Asia X which targets Thailand’s medium to long haul, low cost (LHLC) market (Air Asia 2018). At the same time, Nok Air joined with a subsidiary of Singapore Airlines, Scoot, and formed Nokscoot (Kositchotethana 2013). By the end of 2017 Thai Lion Air had also begun low cost medium distance to long haul services, including the Thailand–China route (Liu 2017).

The growth in LCC operations has changed the air travel industry significantly. Inbound air travel demand has been driven by an increasing number of airline companies providing lower airfares (Hossan 2012). The increase in air travellers to Thailand has led to economic growth which has improved the living standards of Thai people, resulting in more Thai people travelling abroad until the global pandemic began in 2020.

This study aims to identify the impacts of LHLC airlines on tourism demand in Thailand. The findings will provide a reference for aviation stakeholders to develop strategies and to implement policies to promote the aviation and tourism industries. The framework of this research is divided into five sections. Section 1 introduces the background to the study. Section 2 contains the literature review and illustrates the relationship between LHLC airlines and tourism in Thailand. Section 3 identifies the methodology used in the study to examine the correlations between LHLC airlines, air travel demand and tourism flow. Section 4 presents the results of the study by analysing the trend of air travellers between 2012 and 2019. The final section discusses the findings, provides recommendations and identifies some limitations of the study.

1. BACKGROUND

Low cost carriers are also referred to as ‘no frill’ or ‘budget’ airlines. The pioneer LCC, Pacific Southwest Airlines, was established in 1947. The airline offers low fare services between San Diego and Oakland via Burbank. Pacific Southwest Airlines operated within California only and so it can keep fares low because the airline is not bound by Civil Aeronautics Board directions that regulate major airlines flying in the United States (Sheth et al. 2007). In 1967 Air Southwest (later renamed Southwest Airlines) was established in Texas, United States. Air Southwest modified the business model of Pacific Southwest Airlines and this has shaped today’s LCC industry (Guinto 2017).

LCCs offer inexpensive tickets by keeping their costs low. The typical cost saving practices of these airlines include: operating at secondary airports, flying a single type of plane, increasing plane utilisation, relying on direct sales, offering a single-class product, avoiding frequent flyer programs and keeping labour costs low (Haydon 2016). Moreover, to achieve plane utilisation, LCCs operate short haul flights (3 hours or less) with a point-to-point network (Budd and Ison 2017). According toGross and Schröder (2007), achieving a high frequency by flying short and medium distance flights (of 2.5–3 hours maximum) is most favourable to the LCC’s operations. Short haul operations require fewer amenities such as seat comfort and the need for food compared with long haul flights. Furthermore, crew members can return to their accommodation on the same day which avoids overnight stays at outposts and so allows the LCC to constrain costs (Francis et al. 2014). The amenities which can be purchased by travellers, including baggage check-in, meals, inflight entertainment and extended legroom seats, provide ancillary revenue for the LCC (Smith, O’Connell and Maleki 2017).

The business model spread across the Atlantic Ocean to Europe when financially troubled Ryanair in Ireland restructured as an LCC in 1991 (Tungate 2017) and into the Asia-Pacific region when Tune from Malaysia purchased the financially troubled Air Asia from the Malaysian government in 2001 (Air Asia 2018). Air transport deregulation around the world has encouraged the demand for air travel. Governments have reduced their control over the aviation industry which has enabled many new airlines to enter the air transport industry. Many of the LCCs entering the market charge lower fares compared with the established companies, which has changed the nature of the air transport industry (Law, Zhang and Zhang 2018). Over the last two decades, the number of LCCs has significantly increased, especially in the Asia-Pacific region (Nyathi, Hooper and Hensher 2007). Until the end of 2018, 71 LCCs were operating in the Asia-Pacific region, overtaking Europe as the largest low cost market (Anna Aero 2018).

1.1. Long haul, low cost airlines

The definition of a long haul flight varies around the world. According toGrant (2019), flights under 1000 nautical miles are considered short haul operations, flights of 1001–2000 nautical miles are medium haul operations and long haul flights are classified as being more than 2001 nautical miles. According toMorrell (2008), a flight time of at least six hours constitutes a long haul flight. In Europe long haul operations were defined as flights of greater than 1890 nautical miles (CAA 2015). In Asia a flight time of more than 4 hours was classified by Air Asia as medium to long haul (CAPA 2007). In the 1960s Loftleidir Icelandic Airlines became the first LHLC operator (Loftleidir Icelandic 2018). The airline was able to offer low cost airfares across the Atlantic Ocean from its airport base near Reykjavik in Iceland. Loftleidir Icelandic offered short haul flights between Luxembourg and Reykjavik with travellers connecting to long haul services to and from the United States. The airline had decided not to participate in the International Air Transport Association (IATA) and therefore it was not bound by the IATA’s tariff regulations. This gave the airline flexibility in offering airfares lower than those of other transatlantic airlines (Icelandair 2018). Many LHLC airlines emerged in Europe after legislation for the deregulation of the airline industry was passed in 1977 (Truxal 2012). Laker Airway began operating LHLC flights on the London Gatwick–New York route. The airline’s LHLC flights lowered operating costs by eliminating mail and cargo transport. Passengers had to pay cash on a ‘first come, first served’ basis for flights and there were additional charges for food and drink (Sullivan 2006). The modern business model of LHLC airlines was introduced by Australia’s Jetstar in 2006 when the airline began operating with widebody aircraft on services on routes between Australia and Asia and North America (CAPA 2018a).

The modern business model of LHLC airlines is similar to that of the LCC except for crewing, security, airport facilities, turnaround times and aircraft types because of the requirements of long distance international air travel (Wensveen and Leick 2009). According toBinggeli and Weber (2013), the cost of LHLC airlines’ operations is much higher compared with that of the short haul operations of LCCs and therefore these airlines enjoy fewer cost advantages. The cockpit and cabin crew productivity on LHLC airlines is comparable to that of FSCs with the result that LCCs operating long haul flights do not benefit from the low cost business model (Morrell 2008). Based on a previous study of LHLC airlines’ profitability, achieving a load factor of 75% allows the airlines to obtain marginal profits on flights of 3500 nautical miles or more (Moreira, O’Connel and Williams 2011). As many LHLC airlines operate widebody aircraft, they have used the premium cabin section on their aircraft to offer additional comfort to premium passengers. This business model is known as the hybrid model (Morrell 2008). The hybrid business model allows the LHLC airlines to attract different types of passengers, including business and leisure travellers. These airlines offer connecting flights, loyalty programs and have a premium cabin section (Stoenescu and Gheorghe 2017). According toAlixPartners (2015), LHLC operations are more favourable in Asia compared with those in Western countries. The LHLC airlines in Asia enjoy lower operating costs due to the lower gross domestic product of the Asian countries. The airlines also benefit from lower labour costs, lower airport fees and minimal interference from trade unions, which enables them to achieve greater economies of scale (AlixPartners 2015).Table 1 shows the cost per available seat kilometre of five LHLC airlines: the cost of LHLC airlines in Asia is lower than operators in Europe and North America.

1.2. The development of the LHLC airline industry in Thailand

Thailand’s aviation industry has been strictly regulated by the Thai government for many years. In 2000 the government introduced liberalisation measures to the aviation industry. The government relaxed some of the restrictions which had applied to the industry, and allowed new airlines to enter the domestic air market (Lonides 2000;Law 2017). Since then, many airlines have emerged in Thailand with the most significant change to the industry being the introduction of LCCs. In December 2003 Orient Thai Airlines established its LCC, One-Two-Go Airlines, to service Thailand’s domestic market (Kositchotethana 2013). This preceded the arrival of Air Asia in Thailand (Air Asia 2018). Other LCCs, including Nok Air, also commenced operations in 2004 (Nok Air 2017). In 2013 a joint venture between Indonesia Lion Air and a Thai local partner established Thai Lion Air (Thai Lion Air 2018) and VietJet with funding from Vietnamese and Thai shareholders began operating Thai Vietjet in 2015 (Thai Vietjet 2018).

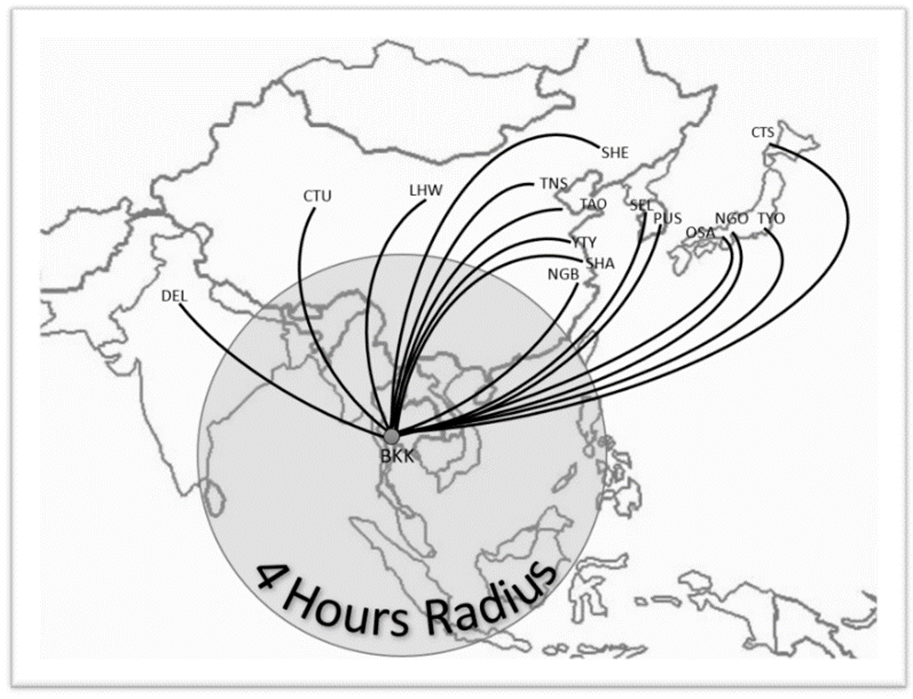

With the initial success of these short–medium distance LCCs in the Thai market, more airlines started operations in Thailand. Also, newly established airlines focused on the international long-haul market to which they applied the low cost business model. In 2009 a Korean Air subsidiary, Jin Air, became the first LHLC airline to service the Bangkok–Seoul route (Routes Online 2009). Other South Korean carriers, including Jeju Air and Eastar Air, followed (CAPA 2012). The development of Thailand’s own LHLC airlines began in 2013 when Thai Air Asia X was formed by Thai Air Asia and Air Asia X from Malaysia (Prakash 2013). A joint venture between Nok Air and Scoot, a LHLC airline from Singapore, formed Nokscoot in 2015 (Phang 2014). Thai Lion Air also started operating long haul flights in 2018 (Kositchotethana 2017). Like the South Korean carriers, the LHLC carriers in Thailand first started operating charter flights between Thailand and cities in Japan, South Korea and China which were later replaced by scheduled services (Kositchotethana 2014). Scoot also accessed the fifth freedom to operate flights between Singapore and Tokyo and Osaka via Bangkok. The fifth freedom is a set of commercial aviation rights granting a country’s airlines the privilege to carry revenue traffic between foreign countries as a part of services connecting the airline's own country (Law et al. 2018).Table 2 details the LHLC airlines operating in Thailand in 2019. Several of the airlines operated with a hybrid business model offering both premium class and economy class using widebody aircraft.Figure 1 shows the LHLC operations between Bangkok and cities more than 4 flying hours distant.

Remarks: Approximate average flying time India 4+ hours, North China 5+ hours, Japan 6+ hours, South Korea 5+ hours. * ceased operation in 2020 Source:CAPA (2020)

1.3. The relationship of LHLC airlines to the tourism industry in Thailand, Japan and South Korea.

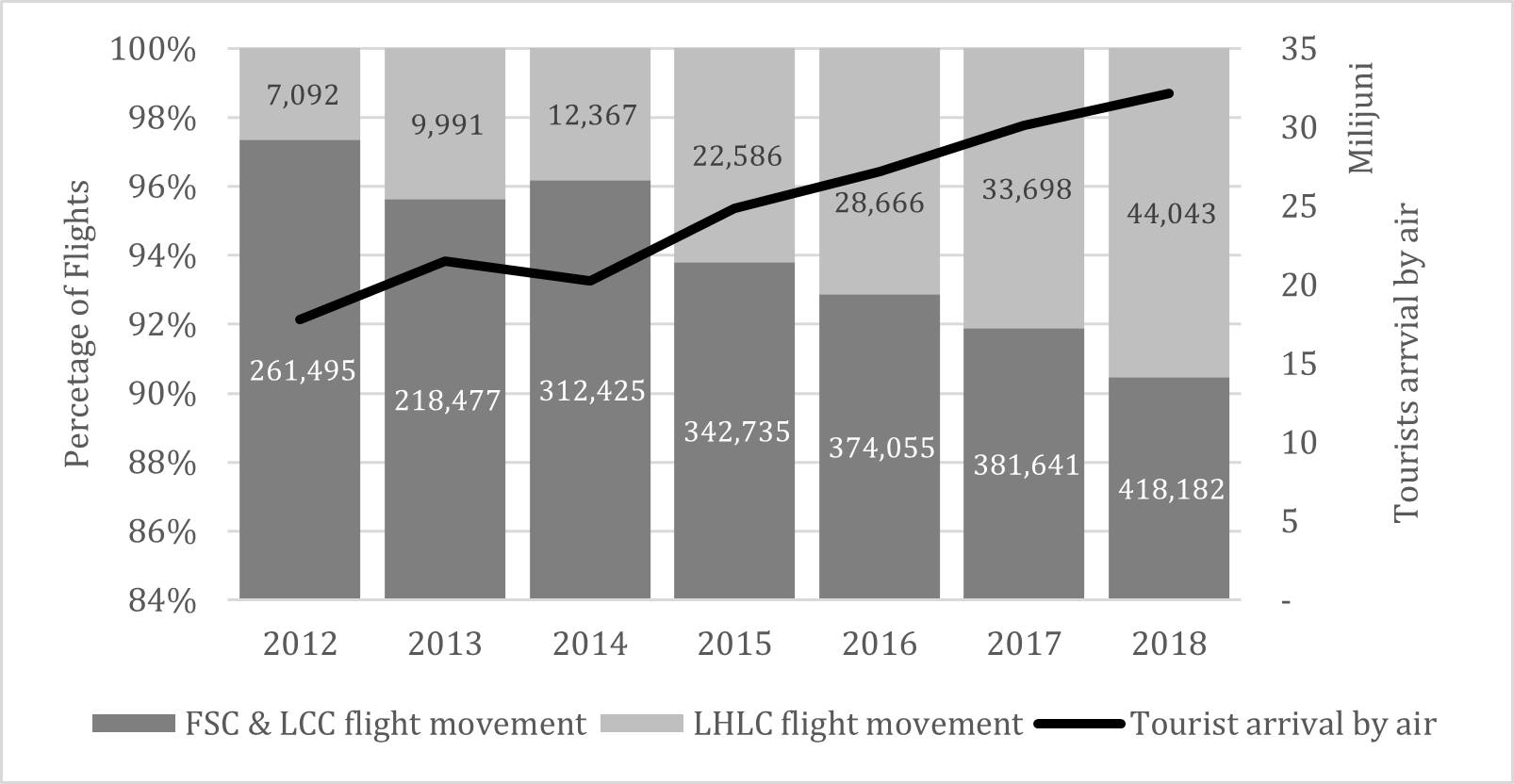

Thailand’s tourism industry has benefited from the deregulation of the aviation industry since 2000. New airlines were encouraged to enter the industry when the Thai government removed most of the restrictions (Schlumberger and Weisskopf 2014). The changes to the policies have increased the capacity of international flights and driven down airfares. These have motivated tourism for both inbound and outbound travel. Inbound tourism is one of the most important factors driving Thailand’s economy. According to tourism reports fromKasikorn Bank (2019) andBangkok Bank (2019), in 2018 Thailand received approximately THB2.01 trillion revenue from 38.12 million arrival travellers which accounted for 12.3% of its gross domestic product. The majority of these arrivals – more than 32.13 million travellers – arrived by air transport (TAT Intelligence Center 2020). The largest group of international arrivals were from China (10.6 million) followed by Malaysia (4.1 million), Korea (1.8 million), Laos (1.8 million), Japan (1.7 million) and India (1.5 million) (TAT Intelligence Center 2020). Flights connecting Thailand with China, South Korea and Japan were operated by both FSCs and LHLC airlines. The number of LHLC flights operating to and from Thailand increased significantly between 2012 and 2018 with an average annual growth rate of 37%. The rapid growth of LHLC movements was observed after Thai-based Thai Air Asia X and NokScoot began operations in 2014: this accounted for 5.8% of the overall international flight movements in Thailand in 2014 and the percentage reached 8.6% by 2018.Figure 2 shows the number of international traveller arrivals and flight movements between 2012 and 2018. The number of LHLC airlines operating flights in Thailand increased significantly from 2.6% in 2012 to 9.5% in 2018. During the same period, the number of traveller arrivals increased from 17 million to more than 32 million.

The introduction of LHLC airlines offering low fare direct flights connecting Thailand with cities in North Asia has fostered travel movements. Japan and South Korea have become attractive destinations for Thai travellers. According to data from Thailand’s National Statistical Office, the number of Thai travellers to South Korea and Japan increased by 300% between 2010 and 2018, which outpaced all other destinations in the Asia-Pacific region (NSO 2020). This growth was due mainly to the increased connectivity between Thailand and Japan and South Korea which motivated travel intentions (Muqbil 2018). Part of this growth was due to the introduction of LHLC airlines in Thailand, which gave the travellers more airline choices between Thailand and the North Asian region (CAPA 2018b). To avoid direct competition with FSCs, many LHLC airlines operate direct flights connecting the primary and secondary cities of Tokyo, Osaka, Nagoya and Sapporo in Japan and Seoul and Pusan in South Korea with Bangkok, Phuket and Chiangmai in Thailand. According to an Official Airline Guide (OAG) article byGrant (2019), LHLC airlines had little impact on the legacy airlines in the transatlantic market. With the entrance of LHLC airlines to the market, the FSCs responded rapidly to the LCCs by offering competitive pricing to secure their market share (Hazledine 2011).

2. LITERATURE REVIEW

Air transport has an important role in tourism growth (Zajac 2016).Dwyer and Forsyth (1993) concluded that LCCs were motivating travel. Previous studies have confirmed that tourism generates positive economic benefits for a country. For example, government revenue is increased significantly by the contribution of inbound tourism through taxation as the study byForsyth (2006) indicated. Forsyth showed that the increasing number of traveller arrivals in European countries via LCCs has generated economic benefits through increased tax receipts and rents, reduced unemployment and economic growth.Álvarez-Díaz et al. (2019) further concluded that LCCs has a positive influence on the number of inbound travellers’ night spent at the destination which has benefited a country by monetary injecting into the economy. These economic benefits have justified government expenditure on infrastructure developments. Other studies have also concluded that LCCs have positively generated tourism demand in many countries, including South Korea (Chung and Whang 2011), Saudi Arabia (Alsumairi and Tsui 2017) and the Iberian Peninsula (Álvarez-Díaz et al. 2019). Based on a previous study on the impact of LCCs on tourism in Thailand byLai et al. (2019), the results have shown that LCCs are playing an important role in the tourism industry in Thailand and have accelerated tourism demand for Thailand.

Besides leisure travels,Álvarez-Díaz et al. (2019) andGonzález-Gómez and Otero Giraldez (2021) have also defined that outgoing visitors in the Visiting Friends and Family (VFR) segment, mainly diaspora have attracted the interest of low-cost airlines to connect the destinations. According to theMinistry of Foreign Affairs of Japan (2019) data, Japan has the largest Thai population residing compared with other Southeast Asian countries (approximately 54,000) and Thailand has the fourth biggest Japanese population outside of Japan (approximately 75,000). There is also a sizeable Thai national population residing in Korea (approximately 53,000) and Korean expatriates and immigrants living in Thailand (approximately 44,000) (Statistic Korea 2019). The statistic has demonstrated that there is potential demand from inbound travellers and outbound tourism associated with the VFR segment.

Some previous studies examining LHLC airlines have covered the context of the business model, cost and profitability, and service quality. Studies on the business model have included that byAlbers et al. (2020) which determined that the LHLC business model strategy is advantageous to an airline in defending its competitive position in the long-haul market.Wensveen and Leick (2009) found that LHLC airlines can transform the business model into three specialties – network, product and price – which generate competitive advantages for the airlines. Researchers on the context of cost and profitability of LHLC airlines have determined that the airlines have lower operating costs compared with those of the FSCs (Morrell 2008;Moreira, O’Connel and Williams 2011;Francis et al. 2014;Poret, O’Connell and Warnock 2015;Soyk, Ringbeck and Spinler 2017). Previous studies of the service quality of LHLC airlines includeO’Connell and Williams (2005),Jiang (2013), andIsmail Jiang (2019). However, no previous study has covered the relationship between LHLC airlines and tourism demand to examine whether these airlines generate tourism growth in a country.Binggeli (2013) argued that it is difficult for the LCC business model to be replicated on long haul routes. Higher operating costs and lower productivity compared with those for short-haul operations mean LHLC airlines have fewer benefits over FSCs. Besides, long-haul passengers demand a higher comfort level and the inclusion of inflight amenities (meals and entertainment), both of which incur an additional charge when travelling on LHLC airlines. Thus, LHLC airlines may not be the customers’ first choice when they are planning a long distance journey. A similar view was expressed by Ryanair’s chief operating officer, Peter Bellew, who explained that passengers may find that there is not a big difference in their fare after adding ancillary costs to the ticket price and so the LHLC airlines are not attractive to customers (Brook 2019).

The autoregressive distributed lag (ARDL) approach is a cointegration method for time series analysis developed byPesaran et al. (2001). It is an ordinary least square (OLS) based model in analysing non-stationary data and mixed series time series of integrations (Shrestha and Bhatta 2018). The ARDL approach was widely used in tourism and aviation related studies as it could examine the short and long-run effects of independent variables of tourism and air transport demand. The study ofGonzález-Gómez, Álvarez-Díaz and Otero-Giráldez (2011) has adopted the ARDL modelling procedure to determine the influencing factors on the Galician domestic tourism demand.González-Gómez (2021) have adopted the model to examine the determinants of European travelling demand to Cape Verde. The author has concluded that increasing investment of tour operators and accommodation premises significantly and positively affected international tourism demand. The study ofChi and Baek (2013) has also employed the ARDL approach in their study to examine the relationship between economic growth and travel demand in the U.S airline industry. The authors have defined that air passenger and freight services increase with economic growth in the long run, while only air passengers are responsive to economic growth in the short-run. The study ofFildes (2011) has examined the air passenger traffic flows for a number of airline routes in North America and the European market using multiple approaches. The author has defined that the ADRL model consistently performs better in forecasting passenger traffic flow compared with the time-varying parameter (TVP) model and the vector autoregressive (VAR) model. The study in the ASEAN industry has also adopted the panel ADRL approach and has defined that there is no significant relationship between air transportation and economic growth in the short term but described that air transport passengers and the number of operating airlines have a significant effect on ASEAN nations’ economic growth in the long-run due to increasing tourism demand (Ananda et al. 2020).Law et al. (2022) found that there is bi-directional causality between air passenger traffic and economic growth in the long run in their study using ADRL to examine the relationship between air transport, economic growth and inbound tourism in Cambodia, Laos, Myanmar and Vietnam.

LHLC airlines are relatively new operations in the Asia-Pacific market. This study contributes to the knowledge of these airlines in the aviation industry by identifying whether they generate tourism demand in a country.

3. DATA AND METHODOLOGY

Based on the previous studies covered in the literature review, it is assumed that there is a relationship between LHLC airlines and the tourism demands of Thailand. The following hypothesis is created based on this assumption:

H1: Long haul low cost airlines have a positive impact on tourism demand to and from Thailand.

The current study includes the total number of air travellers (AIR) as the dependent variable and the explanatory variables are the total numbers of full service carrier movements (FSC), long haul, low cost airline flight movements (LHLC), inbound travellers from Japan and South Korea (ITOR) and outbound travellers from Thailand to Japan and South Korea (OTOR). These variables were chosen as they are important indicators to estimate the changes in air travel volume from FSC and/or LHLC airlines. According toIATA (2008), air travel demand is generated through inbound travel by overseas residents and outbound travel by domestic residents. By including these variables in the study, it helps to determine whether these travel volume changes were triggered by inbound travel, outbound travel or both.

To examine the long-run relationship between the variables, this study employed the pooled mean group (PMG) autoregressive distributed lag (ARDL) model. The ARDL approach has been successfully applied in different fields including tourism and aviation demand (Chi and Baek 2013;Ananda et al. 2020;González-Gómez, Álvarez-Díaz and Otero-Giráldez 2011;González-Gómez 2021;Law et al. 2022). It is an applied ordinary least squares (OLS) based model used in time series analysis. The model is suitable for applying to non-stationary time series with mixed order integrations, i.e., I(0) and I(1) (Pesaran and Pesaran 1997;Shrestha and Bhattab 2018). To verify the heterogeneity bias caused by the heterogeneous slopes in the dynamic panels, two estimators – mean group (MG) and pooled mean group (PMG) – were used (Pesaran and Smith 1995). The MG estimator estimated each group in the panel dataset separately and also the coefficient across the groups, and the PMG estimator allowed for the different short-term parameters between the groups and restricted the long-run coefficients to being equal (Pesaran, Shin and Smith 1999). The Hausman test was applied to identify the appropriate estimator to be used.

In addition, the ARDL model integrates the short-run with the long-run equilibrium through the error correction model (ECM). The ECM model provides consistent short-run dynamic adjustment and long-run equilibrium specification (Khumaloand, Olalekan and Okurut 2011). A negative and significant coefficient of the error correction term (ECT) indicates the presence of a long-run causal relationship between the explanatory variables and the dependent variable.

The following model, based onPesaran, Shin and Smith (1999), is developed:

(1)

where a, b, c, d and e denote the optimal lag length variable; D is the first difference operator; αi is the specific intercept, and µit-1 in the equation indicates the ECT. q is the speed of adjustment i. Included in the model are AIR, FSC movements, LHLC movements, ITOR and OTOR.

If there is a long-run causal relationship between the variables, the ARDL model can be transformed to ECM by grouping the variables in the levels in Equation (1):

(2)

where ECTi-1 is the error correction term. A negative and significant coefficient q (speed of adjustment) denotes how fast a deviation from the long-run equilibrium is eliminated following changes in each variable.

The panel consists of 96 monthly data between 2012 to 2019 (8 years) of air traffic and tourism data between Thailand and Japan, and Thailand and South Korea. The AIR data was obtained from the Airport of Thailand (AOT); the ITOR data was collected by the Ministry of Tourism and Sport, Thailand (MOTS); the OTOR data were obtained from JTB Tourism Research & Consulting Co. (JTB) and the Korea Tourism Organisation (KTO); the LHLC data and the FSC data were collected from OAG (Table 3).Table 4 provides information about the variables to be used in the study.

| Variables | Definitions | Sources |

| AIR | Number of air passengers (Total) | (AOT 2021) |

| FSC | Number of full service carrier airline flight movements (Total) | (OAG 2021) |

| LHLC | Number of long haul, low cost airline flight movements (Total) | (OAG 2021) |

| ITOR | Number of traveller arrivals from Japan and South Korea in Thailand (Total) | (MOTS 2021) |

| OTOR | Number of travellers from Thailand to Japan and South Korea (Total) | (JTB 2021;KTO 2021) |

4. RESULTS

The model is first tested for the existence of heteroskedasticity, multicollinearity and autocorrelation problems. Heteroskedasticity refers to the residuals/errors in OLS regression which could cause less precise estimates. Multicollinearity refers to the occurrence of high intercorrelations of two or more independent variables in a multiple regression model which could undermine the statistical significance of an independent variable. Autocorrelation refers to the degree of similarity between the values of the same variables across different observations in the data which could cause an underestimated result. The testing results indicated that all of the independent variables in this study have no signs of multicollinearity.

The Dickey Fuller test was used to test for stationarity (Dickey and Fuller, 1979). The result of the unit root test confirmed that the variables are non-stationary (Table 5). The test at the first difference in the individual intercept and at the individual intercept plus trend indicated that all series of the null hypothesis of the unit root test were rejected at the 5% level of significance. This shows strong evidence that all of the variables are integrated and are useful to the study.

Note: *** denotes significance at 1% level.

The results of the unit root test inTable 5 recommended that all the variables are stationary at the first level. To select the optimal lag length, the likelihood ratio (LR), Akaike information criterion (AIC) and Schwarz criterion (SC) tests suggest an ARDL (1 1 1 1 1) which was adopted in the model. Further, the Hausman test was performed to determine the appropriate estimator – MG or PMG – for this study (Hausman, 1978). The result of that test indicated a Chi-square value of (X2(4)) =57.01. The null hypothesis is rejected at 1%, thus implying that the PMG estimator is more reliable than the MG estimation. Thus, the PMG estimator is applied to this study.

*Note: p-values and any subsequent tests do not account for model selection.

The results inTable 6 shows that in the long term all variables have a significant effect on air passenger traffic demand at a significance level of 5%. The result indicates that a 1% increase in FSC airline movement is causing a decline of 0.4% in total air passenger traffic. A 1% increase in the LHLC airline movement is generating a 0.13% increase in air passenger traffic. A 1% increase in inbound travellers is generating a 0.48% increase in air passenger traffic and a 1% increase in outbound travellers is generating an increase of 0.18% in air passenger traffic. This has demonstrated that the increase of LHLC airlines is positively generating inbound and outbound traveller traffic for Thailand. The negative effects and significance of the ECTs indicate that there are significant long-run relationships between FSC airline flight movements, LHLC airline flight movements, inbound traveller demand and outbound traveller demand. The convergence speed value is -0.53, which demonstrates that a deviation from the long-run equilibrium can be restored with an adjustment period of about 1.8 months.

In the short-run effects, other than the LHLC airline flight movements, all other variables are not statistically significant to air transport demand. In the short run, a 1% increase in the LHLC airline flight movements is causing a 0.16% increase in air passenger traffic. The result indicates that the LHLC airlines are generating air passenger traffic in both the short and long run. Also, the FSC airline flight movements, inbound traveller demand and outbound traveller demand have a significant effect on air passenger traffic demand in the long run.

5. DISCUSSION

This study aimed to identify the relationship between air transport demand and LHLC airlines. The results of the study are aligned with the Centre for Asia-Pacific Aviation analysis report which stated that LHLC airlines are becoming the main means of air travel (CAPA 2017). The study also confirms that LCCs have crowded out the FSCs and charter airlines in the British market (Eugenio-Martin and Perez-Granja 2021). The introduction of the LHLC airlines is generating traveller demand. A similar result was acknowledged in the study on the impact of LCCs on Thailand’s inbound traveller demand.Lai et al. (2019) had indicated that LCCs are the main factor for Thailand inbound traveller demand. In addition, the LHLC airlines are generating outbound traveller demand. This result is aligned with a previous study of outbound travel demand in the Australia–New Zealand market when airfare was a major component of the total travel cost and the destination choice. Price wars between airlines offer lower airfares which contribute to the volume of outbound travellers (Oppermann and Cooper 1999). The results of this study also aligned withGonzález-Gómez and Otero Giraldez (2021)’s findings that international tourists have contributed to the expansion of low cost air services.However, this study was unable to determine the statistical relationship between VFR and LHLC due to the absence of data.

The introduction of LHLC airlines has made long distance air travel more affordable which has motivated travellers travel intentions. This study of the Thailand–Japan and Thailand–South Korea routes has concluded that there has been a positive and significant increase in air travel demand for both short run and long run flights through the growth of LHLC airlines. As the LHLC airlines have motivated air passenger demand, one conclusion is that the introduction of LHLC airlines in Thailand has generated both inbound travellers from Japan and South Korea and outbound travellers from Thailand to Japan and South Korea in the long run. One can also conclude that FSCs have lost a significant portion of customers to the LCCs in the long-haul market.

There are still questions relating to the sustainability of the LHLC airlines’ operations as they have a lower cost efficiency and limits on aircraft utilisation compared with short haul operators. Airlines operating in various business models were under tremendous pressure during the COVID-19 era. Decreasing travel demand and border closure have placed the air transport industry almost to a standstill and 2020 is the worst year in the aviation industry ever (IATA 2021). As the vaccination rates begin to ramp up in late 2021, economic activities begin to resume in many countries. These countries also progressively reopen the country's borders for air travel and Airline company also begins to resume their services to selected destinations (Aratani and Duncan 2021). In the post-COVID-19 era, many airlines were evaluating their business model due to major changes to the air travellers flying pattern. The pressure on the travel budget for both leisure and business travellers is changing their airline choice (Pearson, Patel, and Wilkes 2021). In addition, air travellers are also exhibiting a stronger preference for flying the most direct route and minimising stopovers as it reduces the risk of exposure to the virus (Bauer, Bloch and Merkert 2020). The new travel trends have set out business opportunities for the LHLC airlines as they are offering long haul services at a lower fare compared with the FSC.

6. CONCLUSION AND SUGGESTIONS FOR FUTURE WORK

At an individual country level the introduction of LHLC airlines has benefited both the origin and destination countries. The increased connectivity has motivated air travel which has generated income which contributes to a country’s economic growth. It is recommended that governments should further liberalise the aviation industry because it can help boost travel demand. In Thailand the existing foreign ownership regulations restrict foreigners owning more than 49% of Thai airlines, which creates barriers to aviation development. Further relaxing airline ownership restrictions will attract foreign airline investment. In addition, the further expansion of the commercial aviation rights can also attract more flights to and from Thailand, especially by those airlines which are interested in operating fifth freedom flights. However, this will require an improvement in airport facilities. The government needs to invest further in expanding airports to increase their capacity. These steps will generate more employment opportunities and attract travellers which will contribute to the country’s economic growth. This study has concluded that LHLC airlines have attracted passengers away from the FSC airlines.

This study has highlighted several areas in which further research would be beneficial. Taking into account analysing the relationship of LHLC and tourism demand in Asia, it remains uncertain how the business model of LHLC will evolve in the near future. The questionable remains whether there are differences in the travel demand after the introduction of LHLC in the Asia Pacific market compared with other regions including the North America and European market. Further research can help to fill the knowledge gap helping to understand the foreseeable future of the LHLC business model and its impact on the tourism industry in an intercontinental context. In addition, future studies could investigate the specific group of customers, based on demographics, who are willing to forego comfort and service for a more attractive price by flying with a ‘no frill’ airline. That would add to an in-depth understanding of the LHLC airline market in Asia.