Introduction

The organic food sector has been one of the fastest growing food industry sectors over the past 20 years. According to Lockie et al. (2004), organic certified food is defined as a food produced and processed in a manner that avoids the use of synthetic fertilisers, pesticides, hormones, genetically modified organisms and irradiation, and which strives to enhance natural biological cycles and to meet minimum animal welfare standards.

Organic agriculture is developing rapidly, and is now practiced in 187 countries with 3.1 million producers (IFOAM, 2020). In the Republic of Croatia, 5548 entities held an organic certificate in 2019, while the latest data indicate a further increase (5913) (Ministry of Agriculture, 2021).

The expanding organic food industry is a result of the permanent increase in a number of consumers who are concerned about conventional food production. During the past decade many consumers have started paying greater attention to their diet and health, so the demand for functional foods containing substances capable of improving the quality of life has increased as well (Rako et al., 2018). Accordingly, there has been an increase in research on the purchase and consumption of organic food, showing that the main motives for buying organic food are health care, environmental care, sensory properties of food, and food safety aspects (Anić, 2015; Liu and Zhang, 2019; Ditlevsen et al., 2020; Liu et al., Lin et al., 2021). In addition to quality and confidence, organic production is also associated with food safety (Lončarić et al., 2011; Liu et al., 2021), where the belief that organic food is healthier and safer compared with its conventional food is the main reason for choosing organic food (Hughner et al., 2007; Cerjak et al., 2010; Van Loo et al., 2010, 2013). Murphy et al. (2022) reported that consumers have high levels of trust in certified organic food chain and products, and strong beliefs in the benefits of certification bodies, but this differed among countries. Respondents from Italy and Poland reported a higher overall trust and preferred EU certification; whilst the UK and German respondents reported lower trust and preferred their national certification bodies. Marital status, age and household income significantly affect the intention to buy organic food. Families with children are more likely to buy organic products (Yiridoe et al., 2005). In terms of age, previous research has had conflicting findings. Lea and Worsley (2005) found that age had little to no impact on consumer purchases of organic foods, while other studies concluded that young people are more likely to purchase organic foods than older people (Zepeda and Li, 2007). Earlier studies found that buyers of organic foods exhibit higher income levels when compared to non-buyers (Krystallis et al., 2006; Roitner-Schobesberger et al., 2008). Organic shoppers are willing to pay a premium price for sustainable EU quality label foods, but recyclable packaging is mandatory to shape the intention to buy organic foods (De Canio and Martinelli, 2021).

Women have more positive attitudes toward buying organic food products (Lea and Worsley, 2005; Van Loo et al., 2013). Tsakiridou et al. (2008) found that the attitudes towards organic food products are directly related to both, consumer age and their education level. Young people are more environmentally conscious but less willing to pay more, while older people are more health conscious and more willing to pay a higher price for organic food (Tsakiridou et al., 2008). People with a higher education are more likely to express positive attitudes towards organic products. The main factors influencing the formation of negative attitudes in the purchase of organic products is the higher price compared to conventional food prices (Tregear et al., 1994; Marian et al., 2014; Orsini et al., 2020), the lack of confidence in the certification of organic products and brands (Van Loo et al., 2013), unfamiliarity of organic food logos, and the disbelief that organic food is better (Van Loo et al., 2013).

Organic dairy is the third largest organic food sector, following organic fruit and organic vegetables (Van Loo et al., 2013). According to Taylor Nelson Sofres Superpanel, n.d., organic dairy products account for about 30% of the total organic food market.

Organic milk production has increased from 2.4 million tons in 2007 to 4.4 million tons in 2015 (Wunsch, 2020). Organic milk has a higher content of unsaturated fatty acids and vitamin E (Manzi and Durazzo, 2017). The omega-6 to omega-3 fatty acids ratio is higher in conventionally (5.8) compared to organically (2.3) produced milk (Benbrook et al., 2013). Today's Western diet is characterized by a large amount of omega-6 fatty acids with a high ratio between omega-6 and omega-3 fatty acids of about 15:1 or 20:1, instead of 1:1, and reducing this ratio has a more beneficial effect on human health (Manzi and Durazzo, 2017). The main motives for the consumption of organic dairy products are health, freshness, taste, nutritional value, environmental motives, and food safety (Lusk, 2011; Faletar et al., 2016; Scozzafava et al., 2020). Milk and dairy products are extremely important for a balanced human diet during all phases of life. The European Dairy Association EDA (2021) recommends 2-3 servings of dairy products for adults per day and 3-4 servings for children (e.g., one serving is 200 mL milk, 125 g yoghurt, or 20-30 g cheese).

The demand for organic milk is higher for consumers who are more concerned about the environment and lower for those who are more conscious about the price (Lusk, 2011). The main reason for these results is the significant price premium of organic compared to traditional milk products. In the USA, Gulseven and Wohlgenant (2017) found that organic dairy products had an average price premium of 33%, while Loke et al. (2015) stated that in Hawaii, the price premium for organic milk compared to conventional milk was about 25 %. Information on animal welfare or environmental sustainability in organic farming has the greatest positive effect on consumer willingness to pay a higher price for organic milk than for conventional milk, which could be a possible strategy that stakeholders of the supply chain may enact to promote organic milk consumption (Scozzafava et al., 2020).

In the category of organic dairy products, yoghurt is the most popular fermented dairy product and the best-selling product in recent years (Statista Research Department, 2021). The trend of yoghurt consumption is constantly increasing with higher consumer awareness of the importance of diet (Raza et al., 2020) given yoghurt’s high nutritional value, with a significant content of proteins and essential minerals, such as calcium, phosphorus, potassium, magnesium and zinc (Weaver, 2014).

Consumers evaluate organic yoghurt as superior to conventional yoghurt based on healthiness, environmental friendliness, quality, safety, taste, trustworthiness and packaging, with the factors healthiness and environmentally friendliness as the most attributes setting organic yoghurt apart from conventional yoghurt (Van Loo, 2013). The key barriers for organic yoghurt purchase are price and availability (Van Loo, 2013).

Although organic dairy products, along with fresh fruits and vegetables, are the most popular products in the EU organic food market, there are few international studies examining consumer preferences and behaviour in buying and consuming yoghurt. Some studies have examined the satisfaction of customers who buy yoghurt (Wantasenet et al., 2017), or consumers behaviour in buying and consuming yoghurt (Košičiarová et al., 2017; Raza et al., 2020). Hlédik and Lógó (2017) explored product experiences and consumer preferences regard to selection of a yoghurt brand. One of the few studies that has examined consumer behaviour of organic yoghurt is the study by Van Loo (2013), who identified a positive relationship between knowledge, attitudes and frequency of buying and consuming organic yoghurt.

Croatia has a long tradition in milk and dairy product production, though few have addressed the consumers of dairy products, especially organic dairy products. Most studies in Croatia have generally examined consumer behaviour in organic food consumption (Cerjak et al., 2010; Martić Kuran, 2014), while one study aimed to identify the determinants of attitude and buying intention of organic milk consumers (Faletar, 2016).

Based on a literature review, we can conclude that studies on consumer behaviour concerning organic dairy product consumption are still insufficient, not only in Croatia but worldwide.

Therefore, the main objective of this study was to explore consumer organic yoghurt purchases and consumption behaviour, consumer motives for the purchase of organic yoghurt and their attitudes about buying organic yoghurt.

Materials and methods

Survey

An online survey was conducted on a sample of 196 organic yoghurt buyers. Therefore, o nly buyers of organic yoghurt were included in the study. A linear snowball sample was used, based on a target selection of a small number of respondents who then spread the sample, referring the researcher to other people who could be included. This type of sample enables access to the target group, since it is a specific group of consumers, more precisely buyers of organic yoghurt. The survey was conducted in the period from 15 November 2018 to 5 January 2019. The survey took about 7–10 minutes to complete and was anonymous.

Questionnaire

Since the target group of respondents consisted exclusively of organic yoghurt buyers, the first question was a filter question ( Do you buy organic yoghurt?). Subjects who did not purchase organic yoghurt were therefore excluded from further research. A total of 231 respondents filled out the questionnaire, though 35 were no buyers of organic yoghurt and therefore excluded from further analysis.

The questionnaire contained questions from several different categories:

Behaviour in organic yoghurt purchase and consumption,

Motives for organic yoghurt purchase,

Attitudes about organic yoghurt, and

Socio-demographic characteristics.

Behaviour in organic yoghurt purchase and consumption was examined through questions about the frequency of purchase and consumption of organic yoghurt, place of organic yoghurt purchase, and the type of organic yoghurt that respondents most often consume (plus the packaging in which yoghurt is packaged and type of milk). The motives for organic yoghurt purchase are taken from the study by Hughner et al. (2007). Attitudes about organic yoghurt were measured using three items, taken from the earlier research by Hsu and Chen (2014) and adapted to the research topic. For each item, respondents expressed a degree of agreement on a 5-point Likert scale (1-strongly disagree, 5-strongly agree).

Sociodemographic characteristics included gender, age, education, employment status, and individual monthly income.

Data analysis

Data were analysed using the statistical program SPSS, version 23. An univariate analysis of the data was used, i.e., the frequency and distribution of obtained data. In addition to univariate analysis, the chi square test and the ANOVA test were used to determine whether there was a statistically significant association between sociodemographic characteristics and behaviour in organic yoghurt purchase and consumption, motives for organic yoghurt purchase, and attitudes about organic yoghurt. The chi square test was used to examine whether there is a relationship between the frequency of organic yoghurt consumption and behaviour in yoghurt purchase, while ANOVA was used to determine if there is relation between the frequency of organic yoghurt consumption and the motives for its purchase and the attitudes about organic yoghurt. The significance was set to the level of 5 %.

Results and discussion

Sample description

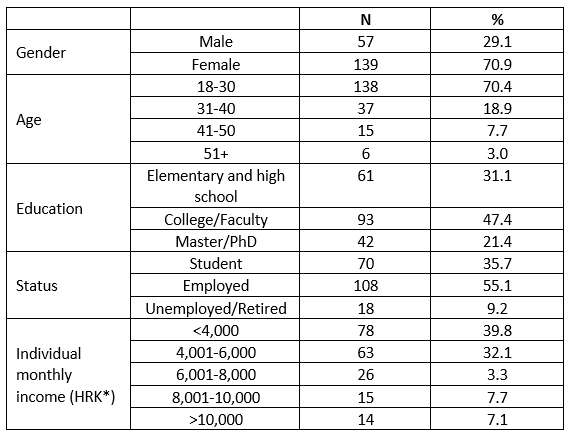

The study involved 196 respondents, 29.1 % men and 70.9 % women. Given that only buyers of organic yoghurt were included in the study, a significantly higher representation of women in the sample was expected. This is supported by the results of research by McEachern and Mcclean (2002), which reported that 80 % of customers who always buy organic dairy products are women. A similar distribution of respondents by gender was found in a study about organic yoghurt in Belgium (62 % female and 38 % male), which corresponds with females being the most responsible for food purchasing in households (Van Loo et al., 2013). The largest share of respondents (70.4 %) were between 18 and 30 years old. The largest percentage of respondents had a college or university degree (47.4 %), 30.1 % had high school qualifications, while 21.4 % had a master's/doctoral degree. The majority of surveyed consumers were employed (55.1 %), and only 8.2 % were unemployed. According to the level of individual monthly income, most respondents earn up to HRK 4,000 per month (39.8 %) or HRK 4,000 to 6,000 per month (32.1 %) (Table 1).

Table 1. Sample description

*1HRK= 0.13€

Behaviour in organic yoghurt purchase and consumption

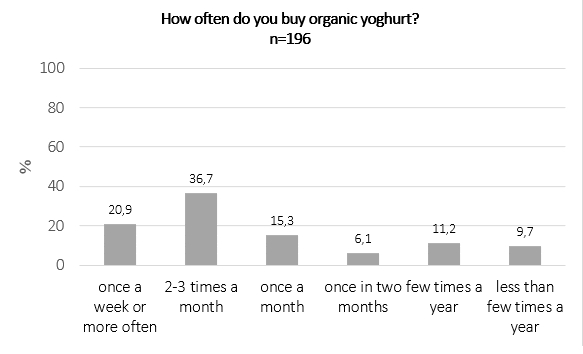

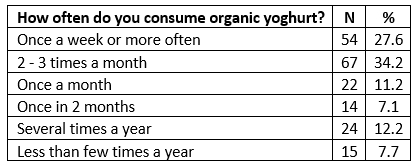

The highest percentage of respondents buy organic yoghurt two to three times a month (36.7 %). The share of respondents who buy organic yoghurt once a week or even more often was 20.9 %, while the lowest number of respondents buy organic yoghurt once every two months (6.1 %). The results indicate a more frequent purchase of organic yoghurt compared to the UK where a study found that 39 % of respondents buy organic yoghurt at least once a month (Statista, 2017). This is the only European study with comparable results. Therefore, there is a need for more research on the topic of organic yoghurt – Figure 1.

Figure 1. Frequency of organic yoghurt purchase

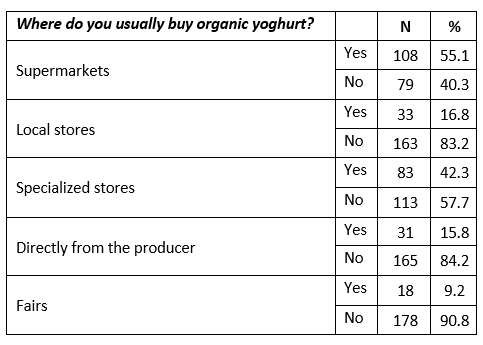

Supermarkets (N = 108) and specialty stores (N = 83) were the first choice where most respondents buy organic yoghurt. The obtained results are similar to those in Italy, where supermarkets and specialty stores were the most common channels for organic food purchase (Gambelli et al., 2003). A survey conducted in Slovakia found that most respondents (44.8 %) prefer to buy yoghurt and other fermented dairy products in the hypermarket or supermarket (Košičiarová et al., 2017). Only a small number of respondents buy organic yoghurt in local stores (N = 33), at fairs (N = 18) or directly from producers (N = 31) (Table 2). A possible reason for this is the lower availability of organic yoghurt through these sales channels. Such findings were also observed in Turkey (Gulseven, 2018), where the unavailability of organic milk in local stores was reported to be a major barrier for organic milk consumers.

Table 2. The most common places to buy organic yoghurt

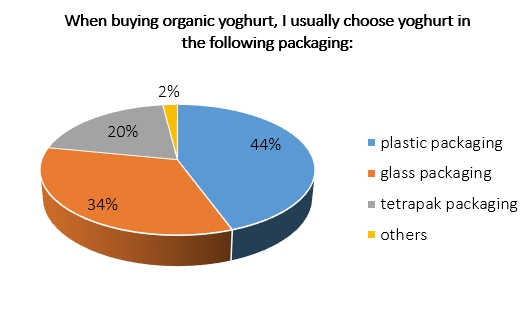

The largest number of respondents buy organic yoghurt in plastic packaging (44.4 %), followed by glass packaging (33.7 %). Tetra Pak packaging was indicated by 19.9 % of respondents, and only 2.0 % of respondents indicated other types of packaging (Figure 2). Similar results were obtained in a study in Slovakia where 60.1 % of respondents said they prefer plastic packaging of yoghurt and fermented milk products (Košičiarová et al., 2017). Since glass is considered more environmentally friendly than plastic, Chrysochou and Festila (2019) noted that the choice of packaging material for organic products should be based on whether such materials enhance the values that the products aim to convey (i.e., environmental friendliness).

Figure 2. Purchase of organic yoghurt with regard to the type of packaging

The largest percentage of respondents (34.2%) consume organic yoghurt two to three times a month, while 27.6 % consume organic yoghurt once a week or more often, 12.2 % several times a year and 11.2 % once a month (Table 3). A study conducted in Brazil on the frequency of yoghurt consumption found that most respondents (45 %) consume yoghurt just once a week, as opposed to 11 % who consume it daily (e Castro et al., 2007). Therefore, we can conclude that organic yoghurt is much less consumed compared to conventional yoghurt.

Table 3. Frequency of organic yoghurt consumption

Respondents most often consume organic cow milk yoghurt (82.7 %), followed by the organic goat milk yoghurt (12.2 %) and organic sheep milk yoghurt (4.6 %). These results are consistent with a previous study showing that consumers prefer cow’s milk yoghurt (Monteiro et al., 2019), though it showed that those consumers enjoy goat and sheep milk yoghurts as well. However, it is important to emphasize that organic cow milk yoghurt is more available compared to organic goat and sheep milk yoghurts.

Many (80.1 %) respondents stated their intent to buy organic yoghurt in the next month, while 9.9 % did not. This strong intention to buy organic food has also been established in previous studies (Marques Vieira et al., 2013).

The data were analysed to determine if there was a correlation between sociodemographic characteristics and behaviour in the purchase of organic yoghurt. More respondents with an individual income exceeding HRK 6,000 (56.4 %) buy organic yoghurt in specialized stores compared to those with an income of less than HRK 6,000 (36.9 %), which can be associated with the higher food prices in specialty stores compared to supermarkets and other sales channels. No statistically significant correlation was found between sociodemographic characteristics and other patterns of behaviour in the purchase and consumption of organic yoghurt (p>0.05).

Respondents were then divided according to the frequency of organic yoghurt consumption into two groups: frequent consumers (once a week or more often, and 2-3 times a month) and occasional consumers (once a month or less). Among the respondents, 61.7 % were frequent consumers and 38.3 % occasional consumers of organic yoghurt. We examined whether there was a difference in the behaviour of frequent and occasional consumers of organic yoghurt. Frequent consumers of organic yoghurt are more likely to buy organic yoghurt in supermarkets and specialty stores, while occasional consumers are more likely to choose fairs as a place to buy organic yoghurt. Among frequent consumers, 97.5% intended to buy yoghurt in the next month, as opposed to 52% of occasional consumers.

Motives for organic yoghurt purchase

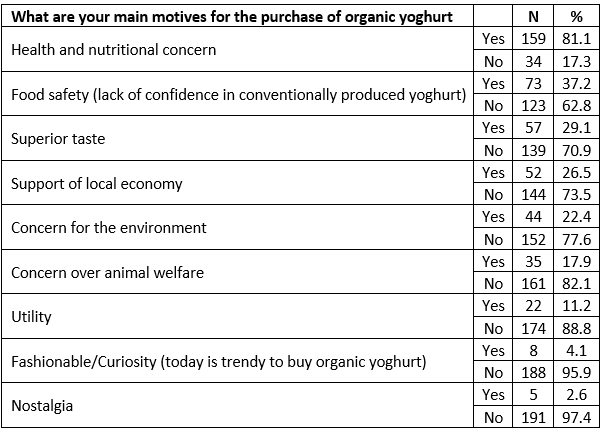

The majority of respondents (N = 159) cited the health and nutritional value of organic yoghurt as the main motives for buying organic yoghurt, which corroborates the results of Padel and Foster (2005). Following this, an important motive was food safety, i.e., as a lack of confidence in conventionally produced yoghurt (N = 73), which is contrary to the research of Van Loo et al. (2013) and Ozguven (2012), where the main motives were taste, quality and trust. For almost 30 % of respondents, the main motive for buying organic yoghurt was a superior taste. Nostalgia (N = 5) and fashion (N = 8) were the most important motives for buying organic yoghurt for the fewest respondents (Table 4).

Table 4. Motives for the purchase of organic yoghurt

The results of the chi-square test showed that there were no statistically significant correlations between all sociodemographic characteristics and motives for buying organic yoghurt (p>0.05). It was only found that a higher proportion of women (30.2 %) cite support for the local economy as a motive for buying organic yoghurt compared to men (17.5 %). Similar results have been recorded in research related to local foods which, like organic food, belong to sustainable food products. Memery (2015) found that female shoppers purchase local food more often as a sign of local support (i.e., the need to support local producers, local retailers and the local community). Frequent and occasional consumers of organic yoghurt did not differ concerning the importance of individual motives for buying organic yoghurt (p> 0.05).

Attitudes about organic yoghurt purchase

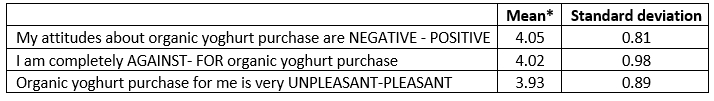

Respondents had positive attitudes about organic yoghurt purchase (mean 4.05), confirming previous research on organic food (Van Loo et al., 2013; Kamenidou et al., 2020) and were strongly in favor of buying organic yoghurt (mean 4.02), and considered the purchase of organic yoghurt as pleasant (mean value 3.93) (Table 5).

Table 5. Attitudes about organic yoghurt purchase

*1 - strongly disagree, 5 - strongly agree

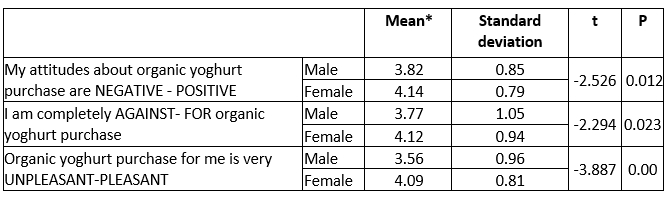

As shown in Table 6, women generally had more positive attitudes about organic yoghurt purchase, which is in line with the results of a Swedish study (Magnusson et al., 2001). Women were more likely to agree that their attitudes about buying organic yoghurt are positive, they are more in favour of buying organic yoghurt, and find buying organic yoghurt pleasant (Table 6).

Table 6. Impact of sociodemographic characteristics on attitudes about organic yoghurt purchase

*1 - strongly disagree, 5 - strongly agree

Furthermore, respondents with a monthly income over HRK 10,000 have more positive attitudes about buying organic yoghurt compared to respondents with lower incomes. However, income level did not affect the attitude of respondents as to whether the purchase of organic yoghurt is pleasant or unpleasant and that they are for or against the purchase of organic yoghurt (p>0.05). For other socio-demographic characteristics (age, education, status) no statistically significant difference was found between the attitudes towards the purchase of organic yoghurt (p>0.05).

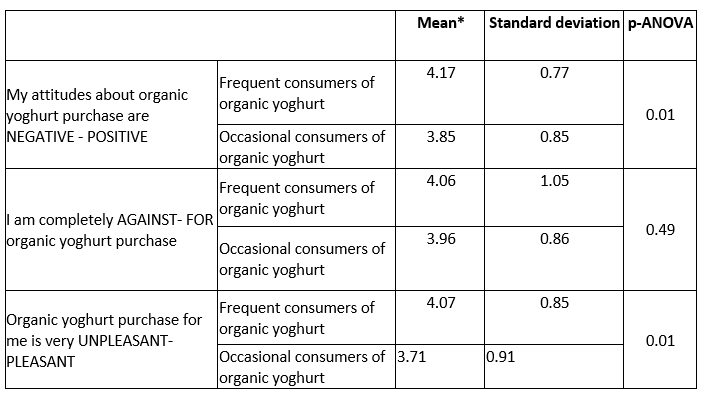

The results of the research showed that frequent consumers of organic yoghurt had more positive attitudes about organic yoghurt compared to occasional consumers, and that buying such yoghurt was more pleasant for them (Table 7).

Table 7. Difference between frequent and occasional consumers of organic yoghurt concerning attitudes about buying organic yoghurt

*1 - strongly disagree, 5 - strongly agree

Conclusions

Globally, the market for organic dairy products is still very poorly researched. Therefore, this research contributes to the literature related to organic dairy products.

Most of the surveyed consumers buy and consume organic yoghurt two to three times a month, from supermarkets and specialty stores, and in plastic packaging. The type of yoghurt most often consumed was convincingly organic cow milk yoghurt. A very high share of respondents intends to buy organic yoghurt in the next month, which is an indicator of the development of the organic yoghurt market. The most important motives for purchasing organic yoghurt were health and nutritional value, food safety, and finally better taste than conventional yoghurt. Attitudes towards buying organic yoghurt were generally positive, as seen by the statement that they consider buying organic yoghurt pleasant. Based on the results, it is possible to give recommendations for marketing practices.

This study provides the organic food producers, especially producers of organic yoghurt, valuable information that could be applied in planning the production, promotion and distribution of their products. The results are also useful for food marketing experts for the purpose of designing and implementing promotional activities.

To the best of our knowledge, this study is the first to provide empirical evidence about organic yoghurt purchase behaviour in Croatia. However, certain limitations should be kept in mind. First, the sample is not representative. Future research building upon this study could address these limitations using a larger and more representative sample. Further research should include non-organic yoghurt consumers to identify who the consumers of organic yoghurt are, their motives for purchasing organic yoghurt, and whether they have any distinguishable characteristics from non-organic yoghurt consumers.

Acknowlegent

The data used in this study were collected for the purpose of the student thesis of Anamarija Pavlina: “The factors of organic yoghurt purchase”, University of Zagreb, Faculty of Agriculture, Zagreb, Croatia defended on 28 February 2019 under mentorship of Assistant Professor Dr. Željka Mesić.

Stavovi, motivi i ponašanje hrvatskih potrošača o ekološkom jogurtu

Sažetak

Tržište ekološke hrane je u stalnom porastu, a ekološki jogurt pripada kategoriji najprodavanijih ekoloških mliječnih proizvoda. Cilj ovog istraživanja bio je utvrditi ponašanje potrošača u kupnji i konzumaciji ekološkog jogurta, stavove prema ekološkom jogurtu, te motive za kupnju ekološkog jogurta. Među kupcima ekološkog jogurta provedeno je ispitivanje temeljem on-line ankete. Više od trećine ispitanika kupuje i konzumira ekološki jogurt 2-3 puta mjesečno. Ispitanici najčešće kupuju ekološki jogurt od kravljeg mlijeka, u plastičnom pakiranju, u supermarketima i specijaliziranim trgovinama. Najvažniji motivi za kupnju ekološkog jogurta su zdravlje, nutritivna vrijednost i sigurnost hrane. Ispitanici imaju pozitivne stavove o ekološkom jogurtu. Rezultati ovog istraživanja korisni su za proizvođače ekološke hrane (posebice proizvođače ekološkog jogurta) kako bi mogli planirati i unaprijediti proizvodnju, ali i za stručnjake u marketingu hrane u svrhu kreiranja i implementacije promotivnih aktivnosti.

Ključne riječi: ekološki jogurt; ponašanje potrošača; anketa; motivi; stavovi

References

e Castro, L.T., Teixeira, L., Caldeira, M., Neves, M.F., Consoli, M.A. (2007): Challenges for increasing milk and yoghurt consumption in Brazil. International food and agribusiness management association (annual forum and symposium) 16, 10-13.

Zepeda, L., Li, J. (2007): Characteristics of organic food shoppers. Journal of Agricultural and Applied Economics 29 (1), 17-28.

https://doi.org/10.1017/S1074070800022720

Weaver, C.M. (2014): How sound is the science behind the dietary recommendations for dairy?. The American Journal of Clinical Nutrition 99 (5), 1217S-1222S.https://doi.org/10.3945/ajcn.113.073007