INTRODUCTION

This paper deals with the spa industry, including not only specialized healthcare but also recreational dimension and travel motivated by health enhancement and wellness (Kemppainen et al., 2021). The spa industry thus plays a dual role – contributing to the healthcare sector while being part of the tourism sector. The COVID-19 pandemic significantly affected both sectors. While the healthcare industry faced increased demands for healthcare services, the tourism sector was hit hard economically. However, unlike many other tourism-related businesses, spa resorts that offer both medical treatments and recreational experiences may not solely rely on tourism revenue.

Tourism-related businesses have undergone many changes in the past few decades, from globalisation to internationalisation and digitisation. They have had to adapt to external factors such as economic crisis, political instability, terrorism, and various environmental issues whose frequency increased because of global warming (Kozak et al., 2007). All these effects have contributed in a certain way to the sectoral changes, both in terms of consumption and production. They have had a significant impact on tourism-related businesses, their competitiveness, and even survival or resilience (Halkier et al., 2014; Roxas et al., 2020). At the same time, they can be seen as long-term transformation processes and fundamental catalysts that affect the organisation of society and the future reality of the world (OECD, 2018). Therefore, some studies have investigated the effects of various external shocks on the survival of firms in the tourism industry, especially in terms of demand shifts, emerging consumer segments, and their new requirements (Dwyer et al., 2008).

The COVID-19 pandemic has further accelerated the need for change and adaptation. Strict regulations and measures applied by the government, as well as shifts in consumer patterns, have influenced many tourism service providers (Christou & Savva, 2021). To mitigate the effects of the pandemic on tourism, many countries have provided economic support in the form of subsidies, tax reliefs, and government interventions (Sigala, 2020). Measures taken by countries to support travel and tourism and mitigate the effects of the crisis have been recorded by UNWTO (2021). These measures aimed at tourism-related businesses and workers included various emergency packages, credit guarantees, unemployment benefits, wage cost allowances, and other forms of subsidies.

The paper focuses on the effects of subsidies provided by the state budget on the spa industry and their effectiveness in the case of the Czech Republic. It deals with the manifestation of external conditions stemming from the political (e.g., government measures and regulations), economic (decline in sales), and social (e.g., behaviour changes) environment during the COVID-

19 period on the operation of the Czech spas. Considering the differences between the traditional medical function of spa resorts and the increased role of the recreational dimension also reflected in the structure of the guests, it aims to evaluate differences between spa companies operated in defined spa resort categories in the Czech Republic in terms of their financial results, subsidies, and tourist attractiveness.

THEORETICAL BACKGROUND

In the face of a rapidly changing environment with both obstacles and potential opportunities emerging, it is increasingly important for the tourism industry to enhance resilience. Policymakers play a crucial role in fostering this resilience. As Jenkins (2015) asserts, policies for the tourism industry should reflect the opportunities, barriers, and conditions stemming from the external environment to encourage further tourism development. For these reasons, governments take measures to achieve the set objectives and create an enabling environment for the tourism industry (Jafari, 2000). Goeldner and Ritchie (1994) present the government's tourism policy as a selective opportunity to help economically or politically problem areas. The major goals of the policy include stable markets, economic prosperity, business development, and protection of employment (Dwyer, 2022). Scientific literature related to public tourism policies often discusses the effectiveness of measures taken or their legitimacy. Externalities, asymmetric information, or public goods as causes of market failures tend to be the rationale for government interventions (e.g., Greuter, 2000; Elliot, 2001).

However, Higgins-Desbiolles (2020) notes that various interventions accelerated changes to tourism processes but were insufficient to address ongoing exploitations and injustices enacted by tourism. Countries implement fiscal and monetary policies and offer incentive packages to maintain economic stability in crisis. Appropriate fiscal and monetary policies are essential to a destination’s macroeconomic stabilisation policy and provide an economic environment suitable for tourism industry expansion (Dwyer, 2022). Therefore, countries also implemented policies to support the tourism industry during the COVID-19 pandemic.

The effects of policies and individual subsidies differed. Chinetti (2022) observed differences in effects according to firms operating in the manufacturing or the service sector. Lost consumption in the service sector during the COVID-19 pandemic might not have been recovered, or the path to recovery might have been slower (OECD, 2020). The overall level of economic resilience of the country and the quality of risks were also important. Tourism-related businesses in high resilient countries were better prepared to cope with the disruptive challenges posed by the COVID-19 pandemic and thus needed less assistance from governments (Okafor et al., 2022a; Okafor et al., 2022b).

Higher public expenditures were directed to the healthcare sector. In terms of the allocation mechanism, it was essential to ensure that health resources were used carefully to meet equity and efficiency goals (WHO, 2021). Countries that traditionally spend more on health were also those allocating more resources in terms of fiscal and/or monetary packages to address the impact of the COVID-19 pandemic on their economies (Okafor et al., 2022a). Spas as establishments providing health services belong among recipients of health aid. The social and cultural attractiveness of the spas has been attracting tourists for years. Similarly, health improvement has been one of the reasons for traveling (Novotná & Kunc, 2019). The basic unit of the spa organisation is the so- called spa resort in which a given spa company operates (Vystoupil et al., 2017). In the European context, different types of spa resorts can be distinguished according to the source of financing for the stay or treatment. People visiting the resorts are divided into non-commercial patients whose visits are financed by health insurance companies, commercial patients paying for the stay on their own, and guests visiting spa resorts in terms of the recreative purpose of visit (Dryglas & Różycki, 2016).

This division is important since traditional spa resorts have undergone a transformation process triggered mainly by healthcare system reforms and cuts to the public funding of traditional treatments (Pillmayer et al., 2021). Some researchers see this transformation process as a part of a process of economisation of public health services, commoditisation of the body, and reinforcing gaps between societies (see Hall, 2011). Other researchers then draw attention to the health/leisure nexus, which the transformation brought accompanied by growing demand for recreational and health tourism-related competencies (see Pillmayer et al., 2021 and the transition from the first health market to the second health market).

Understanding the structure of the guests is crucial to destination management of spa resorts both in operational and financial terms, as patients financed by public funds cause lower income to resort than commercial ones (Dryglas & Różycki, 2016). During the pandemic, however, the spa resorts had to do without key income from tourism and commercial activities because they could only provide care covered by health insurance companies. On the other hand, they did not face a complete loss of customers. For that reason, spas do not have to be so sensitive to external shocks such as other tourism-related businesses like hotels and travel agencies that are used only by tourists (Türkcan & Erkuş-Öztürk, 2019). The health dimension of a spa may mitigate the negative effects of a global pandemic (Navarrete and Shaw, 2021). Similarly, the pandemic could bring several opportunities for this industry stemming from the government measures, shifts in tourists’ behaviour (Novotná et al., 2021), and the need for mental and physical reinvigoration (Sivanandamoorthy, 2021).

Despite these potential opportunities, the spas have also become an object of fiscal policy responses to the pandemic. Countries adopted different economic stimulus packages, including subsidies to both tourism and health sectors, to mitigate the impact of the COVID-19 pandemic (Khalid et al., 2021). On the other hand, these efforts have subsequently generated debates about

the effectiveness of such interventions, fairness of increased public expenditure, equal distribution amongst stakeholders (Higgins-Desbiolles, 2020), and their long-term impacts on austerity and cuts of public expenditures (Sigala, 2020).

The Czech context

During the COVID-19 pandemic, the tourism industry in the Czech Republic has experienced enormous financial losses. While international tourism receipts amounted to over 7.3 billion USD in 2018 and 2019, it was only 3.6 billion USD in 2020 (UNWTO, 2022). The impacts of the COVID-19 pandemic saw tourism GDP almost halve in 2020, with tourism’s share of GDP falling to 1.5% (OECD, 2022). The impacts of the pandemic were less severe for Czech domestic tourism. Due to closed borders and other related government measures, there were aggravated circumstances for international tourism. On the other hand, domestic tourism did not decrease so radically. The government agency CzechTourism (2021) declared that domestic tourism receipts decreased from approx. 3.9 to almost 3 billion USD in 2020. Czech tourists, who could not travel abroad, wanted to indulge themselves with at least an extraordinary experience in their homeland and thus supported domestic tourism (Novotná et al., 2021). In accordance with the expectations of Gössling et al. (2021), domestic markets recovered first.

Table 1 points to the relative strength in domestic tourism based on the statistics of overnight stays in all forms of paid collective accommodation establishments in the Czech Republic (Czech Statistical Office, 2022a). In 2020, the number of overnight stays in these establishments within internal tourism, i.e., the sum of domestic and inbound tourism, exceeded 31.3 million overnight stays. Compared to the year 2019, it dropped by 45%. However, in the case of domestic tourism, the drop was only around 20%, while in the case of inbound tourism, it was about 73%. In 2021, the number of overnight stays by domestic tourists increased by 5.8% compared to the previous year. In contrast, however, inbound tourism continued to decline also in 2021 by 11.4%. Czech tourists, however, cannot cover the shortfall in foreign visitors.

Table 1: Performance of tourism in the Czech Republic (2017–2021)

Source: Czech Statistical Office (2022a), own processing

To improve the situation and accelerate tourism recovery, the Czech Government adopted economic measures and provided state compensation to employers and entrepreneurs (e.g., the compensation programme Antivirus). The Government approved programmes of targeted support to help travel agencies (e.g., the COVID-Travel Agencies Guarantee programme) and promote tourism (e.g., the COVID-Tourism programme or the Vacation in the Czech Republic programme to support spending on domestic holidays). The Government implemented a fiscal package of approx. 13.5 billion USD (5.3% of GDP) in 2020 and another fiscal package of 10.5 billion USD in 2021 (UNWTO, 2021).

Various incentives were directed to the spa companies (e.g., the COVID-Spa programme), which provide not only leisure and wellness facilities for tourists but also health stays for patients entirely or partly paid by the health insurance company. In other words, spa companies do not have to rely only on income from tourism-oriented services. This dual role of spas, i.e., traditional medical and ever-increasing tourist function, and related income diversity is their specificity, which has also become the object of this paper. The spa industry in the Czech Republic is an essential part of the healthcare sector. Spa tourism also plays an important role in the overall tourist offer of the Czech Republic. Approximately 5% of the total bed capacities in collective accommodation establishments are located in spa resorts. As for the performance of beds in spa resorts, they generated almost 3 million overnight stays in 2021, which is more than 9% of all overnight stays in Czech collective accommodation establishments (Czech Statistical Office, 2022a). It means the double performance of spa bed capacities compared to bed capacities in other accommodation establishments.

The occurrence of COVID-19 pandemic also affected the spa industry in 2020 and 2021, especially due to the decrease in the number of foreign visitors. Based on the Balneological care report by the Institute of Health Information and Statistics of the Czech Republic (2022a), the performance of the Czech spa industry, expressed by the number of overnight stays during these pandemic years, decreased by 40% compared to 2019 (Table 2). The report distinguishes between two types of spa treatment:

i) comprehensive spa treatment fully covered by health insurance, ii) subsidized spa care with only treatment covered by health insurance when the patients usually pay themselves for accommodation and meals. Self-paying domestic clients and self-paying foreign clients reflect more the recreational dimension of the Czech spas. In the case of domestic clients, the decrease amounted to just over 23% in 2020 and 13% in 2021. However, the decline in foreign clients was much more serious, by 74% in 2020 and even by almost 82% in 2021 compared to 2019.

Table 2: Performance of the Czech spa industry (2017–2021)

Source: Institute of Health Information and Statistics of the Czech Republic (2022a), own processing

The most attractive spa resorts oriented to affluent foreign clientele were thus the most affected by the COVID-19 pandemic. This tourist attractiveness predetermined the spa tourism development in the Czech Republic, which was characterized by significant differences. Activities in the most important spa resorts developed dynamically. Especially the so-called spa triangle of cities Karlovy Vary, Mariánské Lázně, and Františkovy Lázně had significant tourist potential. Therefore, they were together with eight other European spa cities included in the UNESCO World Cultural and Natural Heritage List in 2021. These localities with supportive cultural heritage resources and above-average business activity in the tourism industry also have a significant concentration of foreign visitors. They are traditional destinations for business meetings and congresses. For this reason, it is possible to classify these spa resorts in the higher category (i.e., international, or global) of tourist attractiveness (Kunc, 2011; Vystoupil et al., 2017). Appendix A schematically represents the spatial organisation of all spa resorts in the Czech Republic.

METHODOLOGY AND DATA

The paper is based on the assessment of the Czech spa resorts in terms of their significance for tourism and the evaluation of the economic impacts of the COVID-19 pandemic on spa companies operating in different types of defined spa resorts. It aims to find a connection between tourist attractiveness, economic performance, and fiscal policy effectiveness. In other words, the paper answers the following research questions (RQs):

RQ1) Was there a change in sales of the spa companies due to the COVID-19 pandemic depending on the tourist attractiveness of the spa resorts?

RQ2) What was the effect of state aid on the economic result of the spa companies?

Categories of spa resorts are defined according to their tourist attractiveness. As tourist attractiveness by spa resort category regards, it reflects the differentiation of the functional use (purely medical or significantly recreational function complemented by cultural and historical potential or significance of a spa resort for the MICE segment), number of beds and the total number of patients or guests, incl. their geographical structure (Kunc, 2011). Accordingly, the spa resorts are divided into five categories (i.e., category 1 – local; 2 – regional; 3 – national; 4 – international; 5 – global level of tourist attractiveness). National data provided by the authorities of the state statistical service and business register are used for the analysis (Table 3).

Table 3: Definition of data and data sources Variable Data sources

Source: own processing

The information on the structure of the guests distinguishes not only between domestic and foreign tourists (Czech Statistical Office, 2022a) but also between pure medical treatment entirely or partly paid by the health insurance company and guests visiting the spa resort for recreation, leisure time activities, or medical treatment on the self-payment basis (Institute of Health

Information and Statistics of the Czech Republic, 2022b). For evaluation of economic performance and changes in sales, the financial results of individual spa companies and subsidies provided by the state budget are considered. Table 4 presents descriptive characteristics of variables used for evaluation of the performance changes and effectiveness of government subsidies within defined categories of spa resorts (Spa_category).

Table 4: Descriptive characteristics of variables (n=61)

[1 – local; 5 – global]

Source: own processing and calculations

A total of 86 spa companies in 36 spa resorts were in operation in 2021. All the required data are obtained for 61 companies (71%). In terms of tourist attractiveness, 39% of companies from the examined sample were located in spa resorts of global importance, 21% in spa resorts of international importance, 7% of national, 18% of regional, and 15% of local importance for tourism development. Statistical methods are used to test the statistical hypotheses (H0, H1) and analyse the results. Where the assumptions are met, parametric tests are used. In case of non-compliance with the requirements for the assumptions for using the parametric tests, the non-parametric tests for some variables are used.

For comparison differences in sales before and after the COVID-19 pandemic (to compare the mean values of two variables on one sample set), the Paired-Sample T Test is designed. Since the assumptions of using the model (normality of distribution and equal variance) were not met, a non-parametric variant of this test, Wilcoxon test and Sign, is used. They test the hypothesis that the medians of the two variables are equal. The order of cases is derived based on the absolute values of the difference of the tested variables. We calculate the test statistic t as the difference of the sample means divided by the standard error of the difference:

𝑑̅

𝑡 = √𝑛 , 𝑑𝑑𝑑 = 𝑛 − 1

𝑑

where d ... the average difference of sample means of X, Y; ds ... sample standard deviations of the difference X, Y; n ... number of cases in the sample; df ... degrees of freedom.

For identifying the impact of tourist attractiveness of the spa resorts on the change in sales during the COVID-19 pandemic, Analysis of Variance (ANOVA) is used. This statistical method can test the differences in means for two or more independent groups. ANOVA tests the hypothesis that the means are equal in several independent groups. The method is based on the proportion of between-group variability and variability within groups, that is expressed by F statistics:

F = between−group variability variability within groups

Subsequently, the correlation dependence between the analysed variables is determined. Due to the non-compliance with the requirements for the assumptions for using the parametric Pearson correlation coefficient, the variables are analysed using the non-parametric Spearman correlation. The coefficient ρ is based on calculating the coefficient from the order and mutual position of the values:

6 ∑𝑛 𝑑2

𝜌 = 1 − 𝑖𝑖=1 𝑖 𝑖 ,

𝑛3−𝑛

where di is the difference between the order of the values xi and yi of the correlation pairs, and n is the number of correlation pairs.

Linear regression was used for the exploring the effect of state aid on the economic results of spa companies. We can formally write the multiple regression model as (formula 1):

𝑌 = 𝑏0 + 𝑏1𝑋𝑋1 + 𝜀𝜀𝑛,

where 𝑌 is a dependent variable, 𝑏0 is a constant, 𝑏1 is regression coefficient, 𝑋𝑋1 is an independent variable, and 𝜀𝜀 is random error. Parameters are estimated by the ordinary least squares’ method (OLS), formally written as (formula 2):

𝑚𝑚𝑚𝑛 ∑(𝑌𝑖𝑖 − 𝛽0 − 𝛽1𝑋𝑋𝑖𝑖1 )2

The aim of this method is to find those parameters 𝛽 (estimates for 𝑏), for which the error term is minimized (formula 3):

𝑛 𝑛

𝛽̂ = min ∑(𝑦𝑖𝑖 − 𝛽0 − 𝛽𝑋𝑋𝑖𝑖 )2 = min ∑ 𝜀𝜀𝑖𝑖2

RESULTS

The results of this paper point to possible consequences of the transformation of the spa industry (by Pillmayer et al., 2021) driven by the preference for recreation and health tourism-related competencies to traditional treatments. This section focuses on performance changes (in the number of treatment days and sales) of the analysed spa companies in connection with their tourist attractiveness (RQ1). Table 5 points to the development tendencies of the sample of Czech spa companies in a five-year period. In this case, the performance is represented by the annual percentage change in the number of treatment days in the division by self-paying domestic and foreign clients and clients with their stay covered by health insurance.

Table 5: Development of treatment days number in the analysed spa resorts (2017=100%)

Source: Institute of Health Information and Statistics of the Czech Republic (2022b), own calculations

Compared to 2017, the largest percentage decrease is observed in the category of foreign self-payers, both in 2020 and especially in 2021, when further declines in the number of foreign visitors and their treatment days occurred. This is what particularly reflects a decline in the recreational dimension of Czech spas due to the reduced number of foreign visitors. On the contrary, the number of treatment days by domestic self-payers in the sample of the Czech spa companies in 2021 began to approach the value of 2017.

The economic performance of the analysed spa companies in terms of sales has also been affected by the COVID-19 pandemic, as evidenced by a significant decrease in sales in 2020 (Table 6). However, it is worth noting that the drop in sales varied by categories of spa resorts, where the analysed spa companies operate (Spa_category). The most affected were the spa resorts in Categories 4 and 5, which are oriented primarily to affluent foreign clients. These resorts experienced a considerable decrease in sales (Sales_2020) due to the restrictions on businesses and travel imposed by the government during the state of emergency, which limited free movement and restricted the entry for foreigners into the Czech Republic. Although the sales data for the year 2021 are not available in the necessary structure, it is evident that the situation has not improved, given the continued decrease in the number of treatment days for foreign self-paying clients. The crisis measures that were extended in 2021, including restrictions on free movement and border crossing for foreigners, have contributed to the ongoing economic challenges faced by the spa industry.

Table 6. Development of sales in the Czech spa resorts (2017=100%)

Source: Business Register (2022), own calculations

To investigate how the decline in sales varied across different types of spa resorts based on their tourist appeal, we performed an analysis of variance (ANOVA) given that the data satisfied the required assumptions such as normality and homoscedasticity. The null hypothesis about the equality of the mean values of percentage change in sales in 2020 compared to average sales in 2017–2019 (Change_sales_%) for Spa_category is tested. The result of the analysis (Table 7) is the F statistic, with a value of 17.018 and a significance of 0.000, indicating that the hypothesis about the similarity of the averages in the group is rejected. Therefore, it can be concluded that there is a significant difference between the categories.

Table 7. Analysis of variance (ANOVA) for Change_sales_% across Spa_Category

|

Sum of Squares |

df |

Mean Square |

F |

Sig. | |

|---|---|---|---|---|---|

|

Between Groups |

2.514 |

4 |

0.628 |

17.018 |

0.000 |

|

Within Groups |

2.105 |

57 |

0.037 | ||

|

Total |

4.619 |

61 |

Table 8 presents a comparison of the average sales values across different categories of spa resorts. It follows from the above- described restrictions and significant impacts of the COVID-19 pandemic especially on international tourism. As a result, a clear trend can be observed in the sales performance of spa resorts of varying importance. The data shows that the more significant the spa resort, the greater the percentage decrease in sales. Specifically, the change in Sales_2020 compared to the change in Sales_2017–2019 indicates a massive drop in performance for spa resorts of global importance.

Table 8: Average and median change in Sales_2020/Sales_2017–2019 [%]

|

Description /Spa_Category |

1 |

2 |

3 |

4 |

5 |

|---|---|---|---|---|---|

|

Mean |

-18.06 |

-10.16 |

-14.91 |

-35.63 |

-58.92 |

|

Median |

-19.02 |

-16.94 |

-13.16 |

-33.97 |

-62.42 |

Source: own calculation

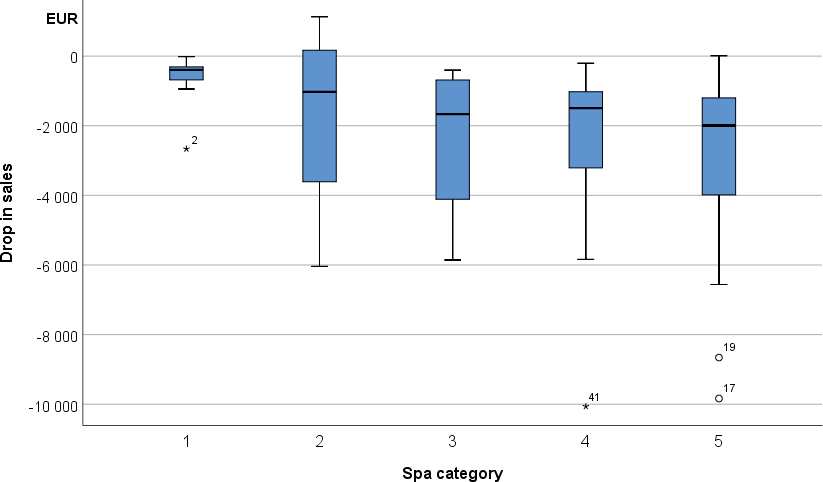

Figure 1 displays the drop in sales in 2020 (Sales_2020) by Spa_category, represented by the median, minimum, and maximum values, and interquartile range. The median value of the drop was 395 EUR in the category of local importance (category 1) and 1,994 EUR in the category of global importance (category 5), indicating a higher drop in sales for more tourist-attractive spa resorts. The category of national importance (category 3) had the second-highest median value of sales decline (1,666 EUR). In terms of the arithmetic mean, the average drop in sales was higher in more important categories for tourist attractivity. In the category of global importance, the average value was over 2,800 EUR, with two outliers among the top 15 companies based on the average sales for 2017–2019 [Sales_2017_2019], which recorded a drop in sales of 9,800 EUR and 8,600 EUR, respectively.

Figure 1: Distribution of drops in Sales_2020 by Spa_category

Source: own processing

To examine if there is a significant difference between the 2017–2019 average sales and the sales value in 2020, a comparison of paired variables is conducted. As the assumptions of the paired test, such as normality of distribution and agreement of variances, are not met, non-parametric Two-Related-Samples Tests based on comparison of medians are used. The findings indicate a negative change in 57 cases and a positive change in only 4 cases, demonstrating a clear downward trend. The correlation between the variables was found to be very strong at the level of 0.89 and the significance of 0.000. The results of the tests conducted are presented in Table 9.

Table 9: Non-parametric Wilcoxon test and Sign test results

Test Wilcoxon Sign

Z -6.496 -6.477

Significance 0.000 0.000

Source: own processing and calculations

The results of the Two-Related-Samples Tests revealed a significant drop in sales between 2017–2019 and 2020. The strong correlation between the two variables (r = 0.89, p < 0.001) suggests that the COVID-19 pandemic had a substantial impact on the spa industry, with negative changes in sales being more common than positive changes. Both tests had a significance level significantly less than 0.05, leading to the rejection of the null hypothesis that the median Sales_2017_2019 is the same as the median Sales_2020 at the 95% confidence level. These findings provide evidence that the pandemic had a significant effect on the spa industry's sales. To further explore trends, Appendices B, C, and D display the number of treatment days and sales by Spa_category and individual categories of clients, including those paid for by health insurance, domestic self-payers, and foreign self-payers.

The COVID-19 pandemic had significant impacts on the spa industry, with a noticeable drop in sales observed across all categories of spa resorts. However, amidst these challenges, there were some positive manifestations of the pandemic in the individual categories of the importance of spas for tourism. For instance, the support of tourism by domestic self-payers was observed. This trend of strengthening domestic tourism was generally confirmed also by Novotná et al., 2021.

During the pandemic, the spa industry in the Czech Republic received financial support that aimed to compensate for the decline, especially in international inbound tourism (OECD, 2022). The government implemented various measures to support the economic activity of businesses in the country, such as reimbursing a portion of operating expenses or offering demand-side stimulus through a described mechanism (e.g., Motta & Peitz, 2020). One of the most notable programs was the COVID-Spa initiative of the Ministry of Regional Development, which aimed to support spa tourism and address the lack of foreign clientele by providing vouchers to domestic clients (Ministry of Regional Development of the Czech Republic, 2020). Other programs that provided aid to affected companies include the Antivirus program administered by the Ministry of Labour and Social Affairs of the Czech Republic (2022), which offered wage compensation to employees, and various COVID-19 pandemic programs by the Ministry of Industry and Trade of the Czech Republic (2022) and the Ministry of Health of the Czech Republic (2021).

The following section aims to assess whether state support had an impact on the economic results in 2020 (RQ2). Specifically, the effectiveness of government subsidies for the year 2020 (Subsidy_2020) was evaluated within five defined categories of spa resorts (Spa_category). Simple linear regression was used to analyse the data. One outlier was removed to obtain a more accurate model (Table 10). Although this adjustment was made, the data did not exhibit a normal distribution. However, data linearity and homoscedasticity were confirmed, indicating that the results of the regression analysis can still be used for interpretation.

Table 10: Linear regression analysis

|

Statistics |

R |

R Square |

Adjusted R Square |

Std. Error |

F |

Sig. |

|---|---|---|---|---|---|---|

|

Model |

0.536 |

0.287 |

0.263 |

56,343.15. |

11.692 |

0.000 |

Source: own calculation

Table 10 presents statistics that evaluate the quality of the model used to assess the effectiveness of government subsidies in 2020 (Subsidy_2020). The statistics show how well the model agrees with the observed data. The correlation coefficient (R) of

0.536 indicates a moderately strong correlation between the two variables. The coefficient of determination (R Square) represents the percentage of the dependent variable's variability explained by the model. In this case, the model explains 28.7% of the variance in the data. The statistical significance of F indicates that the model is suitable for predicting the dependent variable based on the COVID-19 subsidies in 2020.

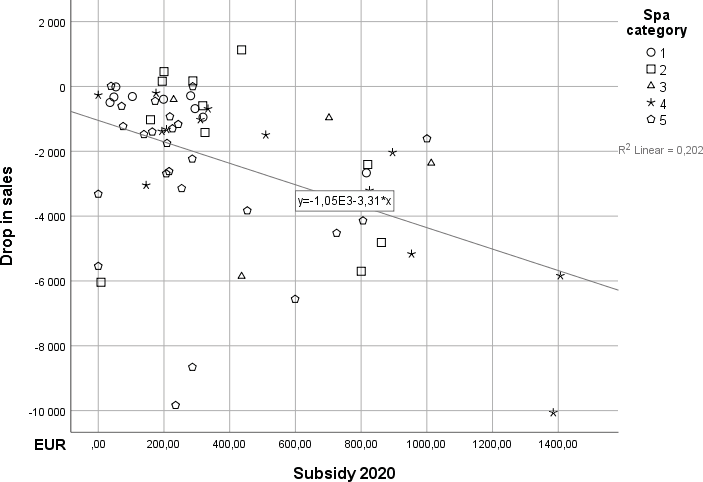

Table 11 and Figure 2 show the main results of the model, providing evidence for the negative relationship between Change_sales_abs and Subsidy_2020. Coefficient B represents the influence of the independent variable on the dependent variable. There is a negative relationship between Change_sales_abs, Subsidy_2020 and Spa_Category. Thus, as the COVID- 19 subsidy increased, the drop in sales in 2020 decreased. The influence of the independent variable is statistically significant at the 95% confidence level. From the above model can be therefore concluded that the amount of the COVID-19 subsidy in 2020 had a significant effect on the reduction of the decrease in sales. Spa category had a positive effect on the sales as well. However, it is important to note that the COVID-19 subsidy explains only partly the variance in the drop in sales in 2020. This suggests that other factors also played an important role in the decline of sales. The external environment, which includes factors such as global travel restrictions, changes in consumer behaviour, and economic uncertainty, has a significant impact on tourism-related businesses' competitiveness and even survival (Halkier et al., 2014; Roxas et al., 2020). Therefore, the impact of the COVID-19 subsidy should be considered in the context of these broader external factors.

Table 11: Relationship between drop in sales and subsidies

Figure 2: Relationship between drop in sales and subsidies (EUR thousand)

Source: own processing

To assess the effects of state aid for companies affected by the COVID-19 pandemic (RQ2) and fairness of increased public expenditure, it is important to consider whether such aid can fully cover the drop in sales that these companies have experienced. Based on the structure of typical operating expenses in a spa company, it is possible to calculate the optimal amount of aid needed to cover the drop in sales, while also accounting for the company's ability to reduce operating expenses in response to changes in sales (Table 12).

Table 12: Operating expenses and share of fixed costs (typical spa company)

Source: eCBA (2022), own calculation

For example, over a medium-term period of approximately one year, a drop in sales could be offset by reducing operating expenses by up to 30%, if 70% of these expenses are fixed. With state aid amounting to 70% of the drop in sales, a typical spa company could fully cover the reduction in income, including the payment of profit.

On average, the observed sample of companies in the spa industry had a profit and sales share of 4.8% between 2017 and 2019, or 8.3% if only companies with positive economic results are considered. Using these assumptions, aid categories can be defined to guide the distribution of state aid to affected companies (Table 13). It is important to note, however, that the ability of companies to reduce variable costs in response to adverse circumstances remains a key factor in determining the effectiveness of state aid interventions.

Table 13: Average volume of the state aid in defined categories

Source: own calculation

The distribution of companies across the defined aid categories is quite interesting. More than half of the analysed companies (52.5%) were in the minor category, indicating a relatively small drop in sales in 2020. The fair category, with a 19.7% share, follows. A partial surprise is the relatively significant representation of the excessive category, with a share of 14.8% (9 companies). For a large part of these companies, there was no drop in sales in 2020, or the drop in sales remained small. For this reason, any amount of state aid appeared to be disproportionate. It is worth noting that the average aid per company in this category was the lowest. A study by Okafor et al. (2022b) found that the tourism sector benefited more from monetary policy interventions than from fiscal responses, with both measures effective in reviving the sector, particularly in less resilient countries.

The average amount of state aid in the observed sample of companies represented only 14% of the drop in sales. The average amount of aid in absolute values was 385.6 thousand EUR per company. This suggests that the state aid provided was not sufficient to fully compensate for the drop in sales caused by the pandemic. Compensation in the form of state aid for measures related to COVID-19 thus represented only a negligible part of the drop in sales. In absolute terms, however, it was already a non-negligible burden on public budgets (23.5 million EUR for the monitored sample of companies). From the point of view of solving the drop in sales, the aid provided had only a minor benefit for many companies. The public measures introduced to aid businesses were not adequate for those facing more severe challenges (Almeida et al., 2022). As Higgins-Desbiolles (2020) pointed out, various interventions were insufficient to address ongoing problems. On the other hand, supporting spa tourism and replacing the lack of foreign clientele in spa facilities through the payment of vouchers served its purpose, and domestic clientele significantly eliminated drops in sales (UNWTO, 2021).

But still, it implies that many companies had to rely on other measures, such as reducing costs or taking out loans, to cope with the negative impact of the pandemic on their business. At the same time, there is still an opportunity for spa resorts in post- pandemic tourism recovery to differentiate themselves from mass tourism destinations, guarantee quality and safety in facilities and services and thus attract foreign clientele again (Navarrete & Shaw, 2021). However, given the experience that private companies from spa resorts have gained thanks to the pandemic, they should not rely on self-financing guests from abroad as many of them did (Štefko et al., 2020).

CONCLUSION

This paper aimed to reflect on the recent unprecedented situation that has caused an economic downturn in the entire tourism industry and tourism-related businesses. It focused on a specific segment of the spa industry, which is not only based on the provision of leisure and wellness facilities for tourists but also on health stays for patients entirely or partly paid for by the health insurance company. Therefore, the services provided are not exclusively tourist-oriented and can be used by residents, patients, or other clients outside the tourism industry. This multifaceted approach sets spa resorts apart, allowing them to withstand the challenges posed by the economic downturn and the impact of the COVID-19 pandemic. Their ability to offer both medical treatments and recreational experiences positions them as resilient establishments that are not solely dependent on tourism revenue.

From this point of view, the paper first dealt with the structure of spa resorts according to their guests and the importance of tourism based on its category of tourist attractiveness. This characteristic was among the assumed variables influencing business performance and subsequently survival. This assumption was confirmed when spa companies in the highest categories of tourist importance were among the most affected by the COVID-19 pandemic. These companies were operating in resorts of international or global tourist importance and were oriented towards international tourism. They could be perceived as world- class congress tourism destinations providing numerous cultural and social events, a wide range of accommodation and catering facilities for business meetings, incentive events, and medium-sized congresses. Using analysis of variance, the change in performance of the spa companies due to the COVID-19 pandemic depending on the tourist attractiveness of the spa resorts was confirmed (RQ1).

To minimize the negative effects of the pandemic and keep tourism businesses alive, the government implemented several policies. The effect of state aid on the economic result of the spa companies was, however, marginal. The programme COVID- Spa intended for the Czech spa companies aimed at supporting spa tourism and replacing the lack of foreign clientele. Overall, state aid provided helped to slightly mitigate the negative economic impact of the crisis, however, the effectiveness varied. Based on the analysis, more than half of the analysed spa companies were in the minor aid category. Compensation in the form of state aid represented only a negligible part of their drops in sales (RQ2).

On the other hand, the excessive aid category included companies with little or no drop in sales, so any amount of state aid appeared to be disproportionate. Thus, the government should carefully consider the specific needs and circumstances of each spa company when implementing state aid programs. As emphasized by Okafor et al. (2022a, 2022b), improving a country's resilience to shocks is an important strategy to minimize the impact of future negative shocks in the tourism sector. The form of state aid used in the Czech Republic, based on vouchers provided to citizens or the number of employees, should probably have been more narrowly targeted only at companies affected by the drop in sales of spa care; for example, by creating a list of eligible beneficiaries, including their categorisation according to the real drop in sales. The integration of spa treatments into the healthcare system is recommended because of the crucial role of spa resorts, which could provide relief to strained medical services during crises and improving overall healthcare efficiency (Szromek, 2021). While implementing measures, it is essential to acknowledge the limitations of this study, particularly its focus on the Czech Republic, which restricts the generalizability of the findings. Additionally, the study may be limited by factors such as the unique economic and political context of the Czech Republic, requiring caution when applying these findings to different geographical and cultural contexts.

The paper's findings indicate a significant decline in sales for spa resorts with higher tourism importance compared to those with lower regional importance during the COVID-19 pandemic. On the other hand, the domestic tourism market, along with medical treatments and health-related services, remained a stable source of revenue for these spa resorts. Therefore, the role of domestic tourism in the recovery process and its potential for transforming destinations into more resilient ones is an essential area of further investigation. Similarly, the travellers’ intent (medical/wellness) and status (patient/tourist), which could provide new ways to approach the issue, could be taken into consideration (Kemppainen et al., 2021).

The pandemic has emphasized the importance of resilience and adaptability in the tourism industry and the significance of sustainable tourism practices. The dual nature of spa resorts, combining medical treatments with recreational experiences, highlights the need to balance these functions to ensure resilience in the face of global disruptions and changing consumer behaviour. To increase its competitiveness, the spa industry needs to adapt. The shift towards wellness and outdoor tourism has accelerated, and spa resorts that can adapt their services to meet these changing needs are benefitting. Adapting to changing market conditions and customer preferences is crucial for businesses to quickly recover and withstand external shocks such as economic downturns and pandemics. Post-pandemic tourism offers spa resorts a unique opportunity to reassess the former model of global growth in tourism volume and distinguish themselves from mass tourism destinations, prioritizing quality and safety in their facilities and services. This reconsideration is driven by interconnected factors, including the risks associated with global travel and the tourism sector's contribution to climate change (Gössling et al., 2021). The pandemic's implications extend beyond immediate economic challenges, underscoring the vital role of strategic planning and adaptation for the long- term sustainability of spa resorts.