INTRODUCTION

The primary motivation of this article is to explore the nature of the association between tourism expansion, foreign direct investment (FDI), and a fundamental measure of macroeconomic performance; namely economic growth rate in eleven EU member states in Eastern and Central Europe (EU11). A novel aspect of the present study is a comparison of the impacts of variations in GDP shares of tourism and foreign investments on economic growth rate in both short-run and long-run in the case of the Eastern European economies. In the remainder of this introduction section, we further elaborate on the motivation of the paper.

The engines of growth in EU11 economies need to be studied extensively because these countries have been facing challenging policy issues regarding the choice of optimal growth strategies to attain relatively higher levels of development. In this context, the potential role that tourism and FDI can play (in terms of socio-economic development) has been a controversial topic of interest for both policymakers and academics in these countries (Durán 2019).

EU11 economies whose transformation processes from socialist to capitalistic economies have been accelerated following their membership in European Union (EU) have started restructuring their tourism industries to become some of the main international tourism destinations of the EU (OECD 2020). These countries have also been trying to attract more FDI via improving their financial institutions and considering tax incentives for foreign investors (Durán 2019). The question is how successful these two engines of growth have been in stimulating economic growth and how their effects can be improved.

Given the fact that the results of past literature which have investigated ‘tourism-FDI- growth nexus’ for a variety of countries are mixed (e.g., Sokhanvar 2019;Sokhanvar and Jenkins 2022a,b), empirical examination of the potential effects of further expansion of the tourism sector and FDI inflows on EU11 economies seems to be of vital importance.

A strong theoretical framework for explaining the effect of tourism expansion on economic growth is the sectoral composition of output. Sectoral reallocation of resources out of other sectors into the tourism sector can be a significant component in the rapid growth of an economy if marginal product in the tourism industry is higher than in other industries (Weil 2005). The efficiency with which factors of production are employed explains country differences in productivity. If the new capital and labor adopted in the tourism sector are not channeled to their most productive use, not only there is no guarantee that tourism expansion strengthens the economic growth rate but also it can slow down the process of economic growth.

Efficiency is also a determining factor in whether or not FDI can accelerate the process of economic growth. Capital and labor can be misallocated not only between sectors but also among firms. Firms differ in productivity level due to the reasons such as bad management, poor organization, and inferior technology. The presence of foreign firms in a well-functioning economy can create price pressures in the market and force inefficient domestic firms to leave the market and consequently hasten resource transfer from less productive to more productive firms (Hill 2021). This process raises the overall productivity level in the economy.

However, this process of reallocation of resources can be interrupted in some cases. Sometimes, less productive firms stay in the market by getting government help in the form of trade protection, favored contracts, and subsidies. According toHarberger (1998), another condition under which FDI inflows can stimulate economic growth is that foreign investments’ rate of return is greater than the mean rate of return on investments in the country.

In light of the above-mentioned theoretical ambiguities, the ultimate impact of the expansion of tourism and FDI inflows have to be studied empirically. This, in turn, suggests that the empirical examination of the potential role that macro and micro policies aiming at the expansion of the tourism industry and FDI attraction in the EU11 economies can play in terms of economic growth is likely to be of critical value for policymakers of these countries. This insight forms the primary motivation of the current research which attempts to assess the nature of the association between the GDP contribution of tourism and FDI, and economic growth rate for the sample of EU11 economies.

The Pooled Mean Group (PMG) estimation is employed in this paper to investigate this relationship in both short-run and long-run. This is the first research to investigate, the effects of variations in GDP shares of FDI and tourism on economic growth rate by employing this methodology for the case of the EU11 economies.

The article is organized as follows: The review of relevant literature is presented in section 2. Section 3 explains the data and methodological framework. The analysis of empirical results is presented in section 4. Finally, conclusions and policy implications are provided in the last section.

1. LITERATURE REVIEW

Typically, the relationship between foreign direct investments, tourism, and economic growth is categorized into two hypotheses that have significant implications for policymakers. First, FDI-Led Tourism Growth Hypothesis: This hypothesis is focused on the relationship between FDI inflows and the expansion of tourism industry. The hypothesis states that foreign direct investments have a strong influence on tourism growth (Bezić and Nikšić Radić 2017;Perić and Nikšić Radić 2016). Second, Tourism-Led Growth Hypothesis: The hypothesis implies a one-directional impact of tourism on economic growth which means the expansion of the tourism sector stimulates economic growth (Tang and Tan 2018;Lee 2021).

Tourism is expected to influence the economic growth of countries through direct channels like improving the balance of payments, government tax revenues, employment, and alleviating poverty, and indirect channels like environmental and social impacts and stimulating the level of domestic demand for tourism services (Sokhanvar and Jenkins 2022b).

The effect of tourism development on the economy has been ambiguous in previous studies. Most of them report a positive impact (e.g., Sokhanvar and Çiftçioğlu 2022;Kožić 2019;Scheyvens and Russell 2012;Blake et al. 2008), and some of them report a negative impact (e.g., Riddington et al. 2010;Dwyer et al. 2013).

The development in tourism services may pose an adverse effect on economic growth due to its influence on the growth of total factor productivity. For instance, if the expansion in tourism results in a decrease in the total factor productivity growth, the net influence on the expansion of GDP growth will be negative. This situation arises if the growth in the tourism industry is associated with the decline in the GDP share of another sector with higher productivity (Weil 2005). In contrast,Chao et al. (2006) suggest a more detailed theoretical framework for the scenarios in which the expansion of the tourism sector affects the relative cost of nontraded products and revenues.

Environmental change through tourism activities (Pham et al. 2010), FDI in tourism sector (Sheng and Tsui 2010), Ineffective allocation of government’s tourism revenue (Blake et al. 2008), and Inefficiency of the tourism industry (Blake et al. 2008;Scheyvens and Russell 2012) are the other reasons of negative economic impacts of tourism development. Alleviating income inequality and reducing poverty have always been of vital importance for policymakers. Some studies in the literature show the ineffectiveness of tourism development in poverty reduction (e.g. Thomas 2014;Deller 2010).

Stanchev et al. (2015),Payne and Mervar (2010),Sokhanvar et al. (2018), andSokhanvar (2019) are the studies that assessed the association between economic growth and tourism in different post-communist economies.Sokhanvar, et al. (2018) explore the tourism-economic growth nexus in emerging market economies including Hungary and Poland; but they do not detect any causal association between these variables in those countries.Sokhanvar (2019) studies the tourism-economic growth nexus in seven European economies with a considerable share of tourism in their economies including Bulgaria, Croatia, Estonia and Hungary. He detects the influence of a rise in international tourism revenue on the economic growth of Bulgaria. Based on his findings, this effect is negative in Estonia. Similarly,Kožić et al. (2019) perform the econometric analysis of the demand for international tourism among the ten Mediterranean countries: Turkey, Tunisia, Spain, Morocco, Malta, Italy, Greece, France, Cyprus and Croatia. According to this study, international tourism has a positive impact on the growth and development, trade, life quality, employment, and FDI of a country.Kožić (2019) asserts one of the most significant factors of economic growth in Croatia is high-quality human capital that has also contributed to the tourism development in this country. Utilizing the dynamic panel data model with the System GMM estimator,Kožić et al. (2021) suggest that the initial poverty level and political freedom level have a significant effect on tourism-led growth.

Some articles in the literature study tourism services and potentials in Central and Eastern European (CEE) countries. A detailed explanation of these studies is provided below. CEE countries have been a part of the Eastern Bloc and their communist heritage could be used to attract international tourists as communist heritage tourism has experienced dramatic growth in CEE countries (Knudsen 2010). Although tourists have experienced both positive and negative emotions while visiting these sites (Isaac and Budryte-Ausiejiene 2015), and some countries have destroyed their communist heritage (e.g. Lenin’s statue was demolished in Romania in 1990, the name of Lenin’s Park in Ljubljana was changed to Argentina park, and Tito street became Slovenian street (Mihalic 2017)), studies indicate that younger generations in CEE countries consider communist cultural heritage as a part of ‘normal historical past’ and don’t show any ideological rejection of that (Stanciugelu et al. 2013).Caraba (2011) andPreda (2015) consider communist legacy tourism as a new type of tourism towards redesigning tourism services.

The transformation from communism to capitalism has helped the hotel industry in CEE countries to increase its performance via private ownership and more attractiveness for international investors (Assaf and Cvelbar 2011). Privatization has also been the most important factor in the growth of the tourism sector in Hungary (Szivás 2005) because it can improve efficiency and labor productivity by employing modern management skills (Assaf and Cvelbar 2011).

The future development of CEE economies is dependent on the advancement of technology, exporting and employing domestic technology, and enhancing their spot in the global scenario (Radosevic 2017). However, it is not reflected in the policies of these countries.Ciesielska-Maciągowska and Koltuniak (2021) assert enhancing the institutional environment of outward foreign direct investment (OFDI) can help in improving the scale of foreign capital of companies from the CEE countries.Radosevic (2017) suggests CEE region requires competitive policies that promote advancements in production capability, consequently, improving the demand for local innovation and R&D.

Concerning tourism taxation, some studies examine the association between city taxes and tourism inflows.Biagi et al. (2017) assert that the introduction of tourist tax results in a decrease in domestic tourism demand in the Italian municipalities. On the other hand, there is no impact of visitor taxation on international tourism inflows.

The theoretical framework for tracing the impacts of foreign investments on economic growth at the firms-level focuses on two transmission channels of FDI spillovers namely demonstration and linkages channels (Alfaro and Chen 2018). The demonstration channel helps local firms to replicate management skills or new technologies (adopted by multinationals) via hiring the workforce trained by foreign firms or simply via observation. The linkages channel enables domestic firms to become suppliers of foreign firms via direct contractual arrangements. The ability of local firms in different sectors to benefit from foreign investments depends on these two channels (Reyes 2018).

Fons-Rosen et al (2017) assert that not every firm in the developing world are benefited from these two channels. The firms that are more capable of recognizing the value of fresh knowledge, assimilating it, and employing it for production process improvements take the advantage of FDI more than others. It is mainly the high-growth domestic companies that can internalize foreign direct investment spillovers using both demonstration and linkages channels. These firms contribute to a sizable share of productivity gains and job creation in developing countries (Reyes 2018).

Theoretically, it is believed that FDI has a growth-enhancing impact. However, current empirical studies do not show a strong connection between economic growth and FDI.Demir (2016) explores the bilateral FDI flows between 134 nations and various institutional development initiatives from 1990 to 2009. The empirical results do not show any impact of foreign direct investment flows from developing or developed nations to developing nations. Similarly,Makiela and Ouattara (2018) explore the effect of foreign investment on growth based on a sample of developed and developing nations over four decades. The research demonstrates that sometimes factors besides the FDI affects economic growth. This situation is evident in developing countries where the increased productivity is attributed to the input accumulation rather than the total factor productivity growth.

Motivated by the above-mentioned theoretical ambiguities, the present study helps better understand if a greater share of international tourism and foreign investments in EU11 economies can accelerate economic growth. This aspect of the study provides further information about the potential impacts of tourism and foreign investments on the economic growth rate.

2. DATA AND METHODOLOGY

2.1. Data and Variables

The current research adopts annual time series data on GDP growth (EG), FDI inflows (% of GDP) (FDI), international tourism receipts (% of GDP) (T), net exports (X), and GDP share of growth capital formation (GCF) for EU11 economies. The sample includes Baltic states (Estonia, Lithuania, Latvia), Slovakia, Poland, Slovenia, Hungary, Romania, Bulgaria, Croatia, and the Czech Republic. The selected proxies have a greater potential in providing policy implications on if ‘choosing to specialize in tourism’ or ‘attracting more FDI’ improves the economic growth process (Sokhanvar and Jenkins 2022b).

It is worth noting that international tourism receipts are a part of total exports. Hence, we excluded international tourism receipts from net exports. The time horizon of data includes the period between 1995 and 2019, and the data source is theWorld Bank Open Data (2021).

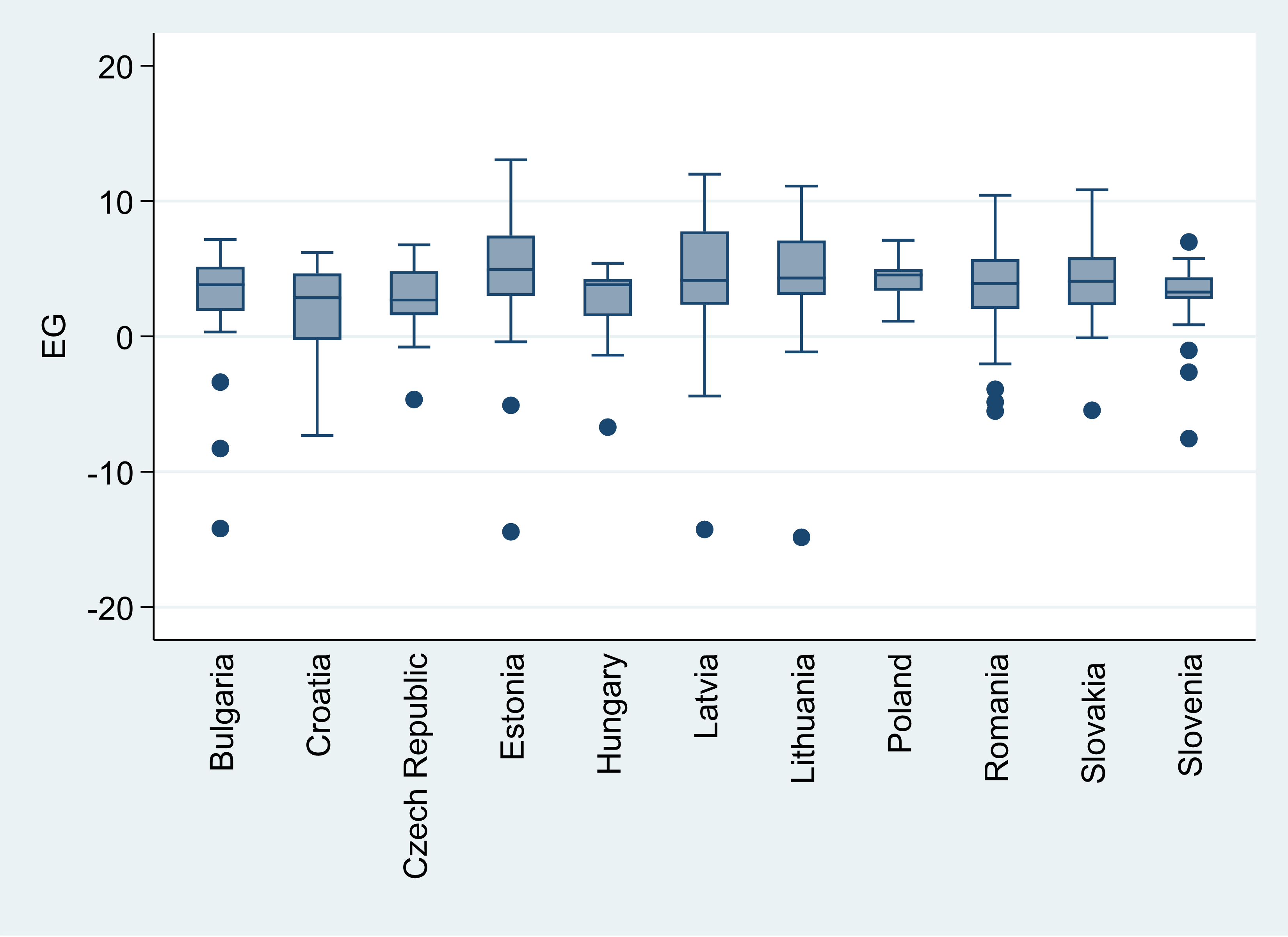

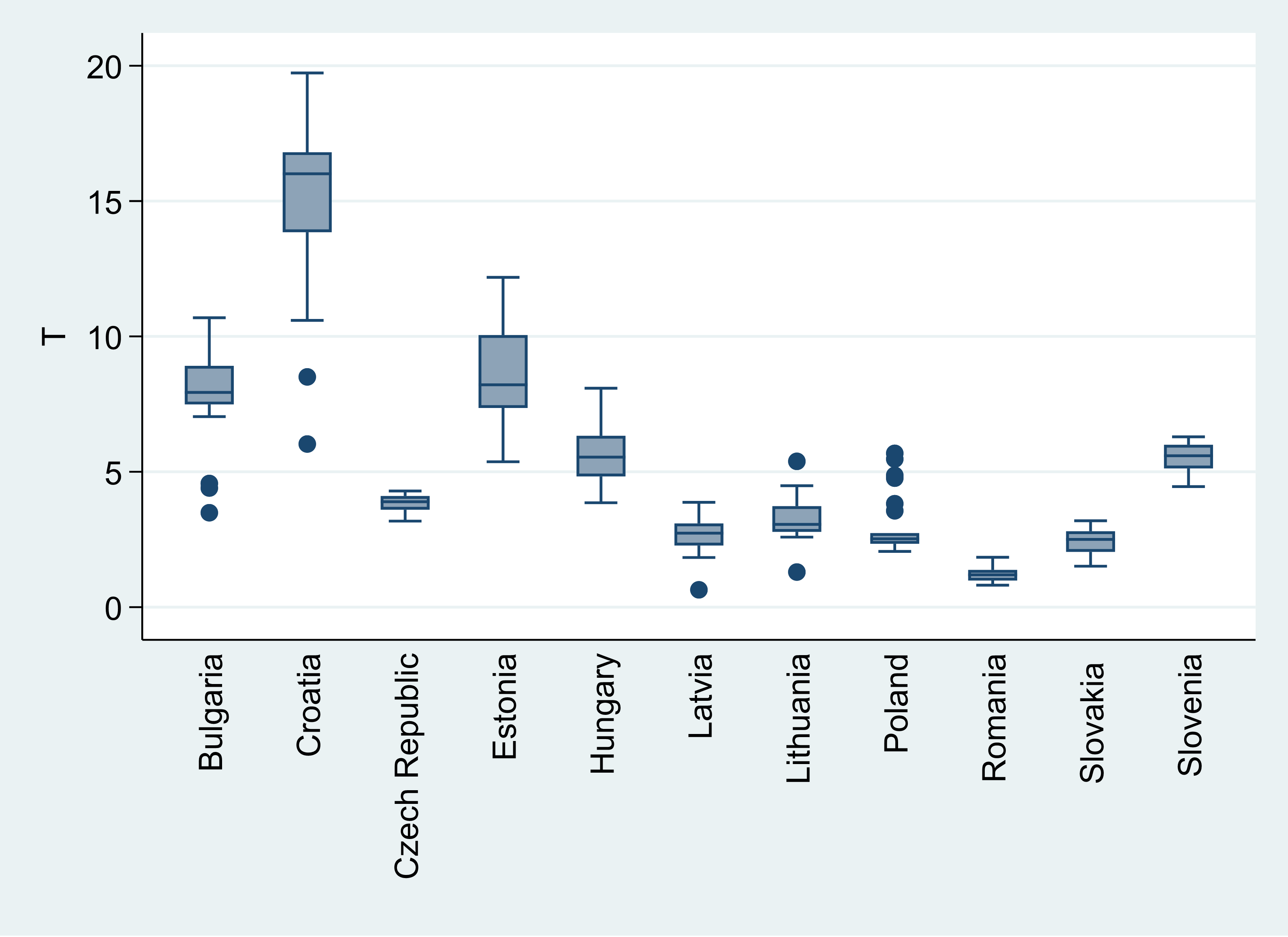

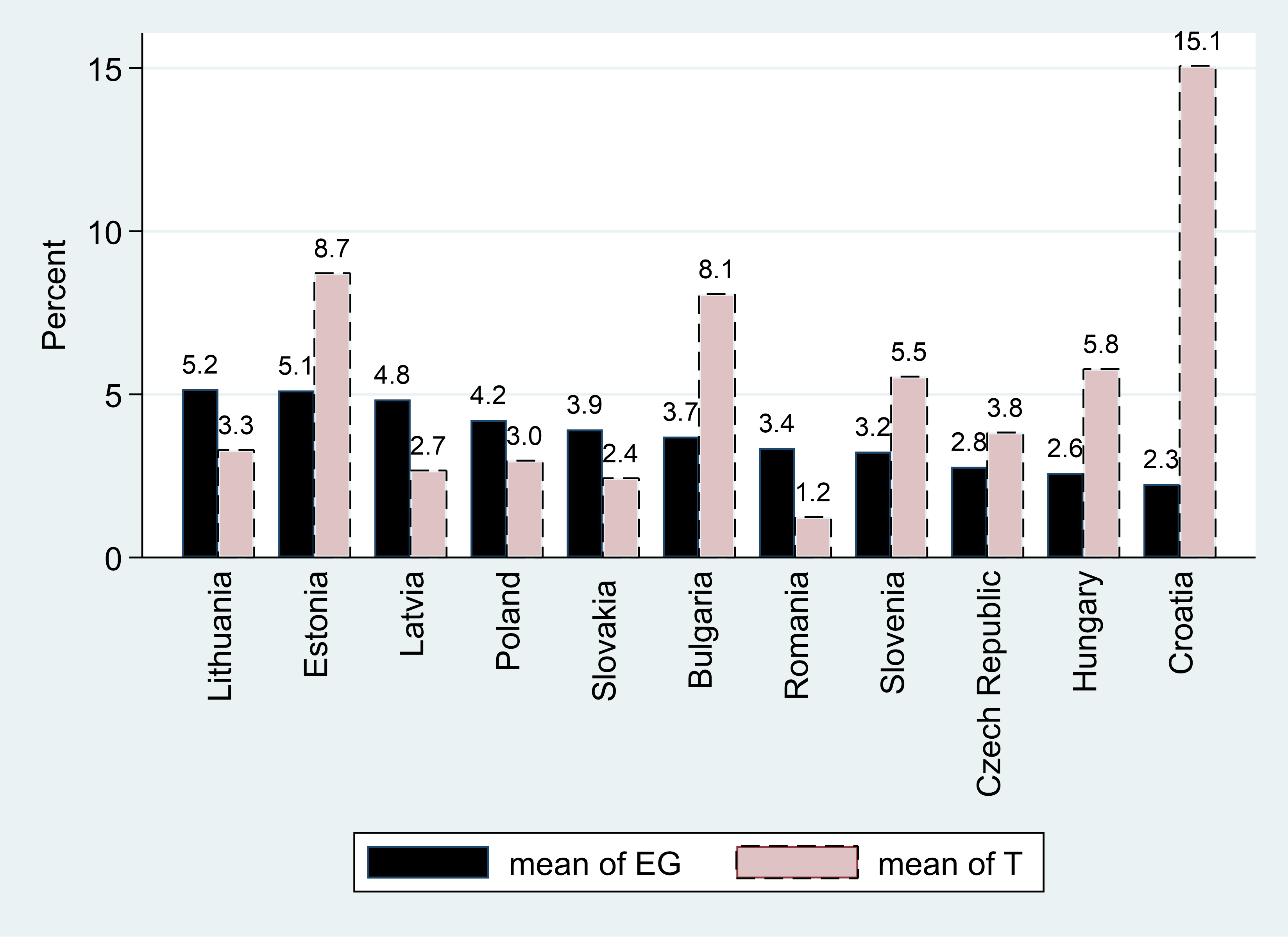

The boxplots in Figure 1 depict EG through its quartiles for different countries. The dots indicate the outliers. The distribution of data in each box is illustrated by five horizontal lines that show minimum, 1st quartile, median, 3rd quartile, and maximum. Boxplots in Figure 2 depict T through its quartiles for different countries. Figure 3 presents the mean EG and T for each country in the sample. The countries are sorted from the highest to lowest mean EG from left to right.

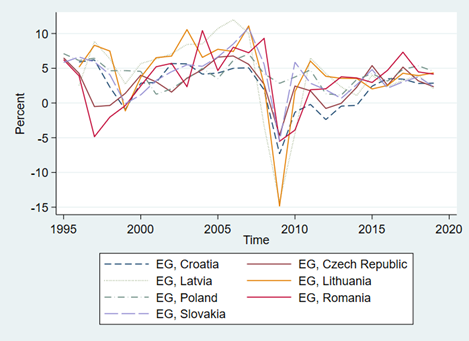

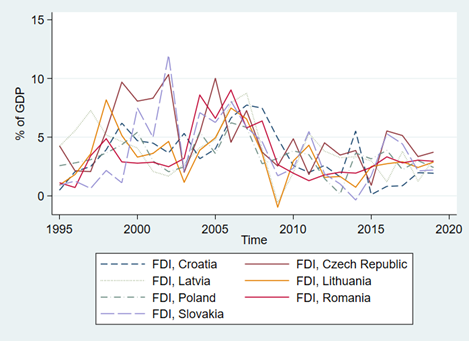

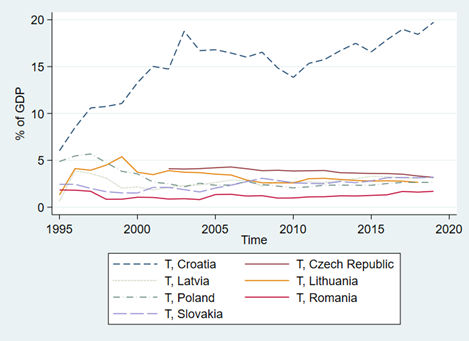

Figures 4, 5, and 6 illustrate the variation of economic growth and the GDP shares of FDI and tourism over time for different countries in our sample.

The panel unit‐root test introduced byIm et al. (2005) is utilized to identify the integration order of the above-mentioned series. This test takes the possible structural breaks of the series into account. The results, illustrated in Table 1, show the maximum order of integration of the adopted series is I(1). Therefore, the PMG approach can be used to estimate the relationship among the variables.

Table 2 shows the correlation matrix of the variables. The correlation coefficients in this table are all less than 60%, indicating there is no potential multicollinearity problem in the analysis.

| EG | T | FDI | X | GCF | |

| EG | 100% | 12% | 29% | 47% | 46% |

| T | 12% | 100% | 42% | -35% | 36% |

| FDI | 29% | 42% | 100% | 38% | 56% |

| X | 47% | -35% | 38% | 100% | -58% |

| GCF | 46% | 36% | 56% | -58% | 100% |

2.2. Methodology

The generalized method of moments (GMM) estimators can generate misleading and inconsistent estimates of the average values of the parameters in dynamic panel data models when the panels have a small number of cross-sectional units and many time-series observations. In these cases, the ARDL models based on the PMG estimator ofPesaran et al. (1999) are suitable. This estimator allows the regression intercept and short run coefficients to be country-specific but restricts the long-run coefficients to be the same across countries. The ARDL model considered in our analysis is presented by Equation 1.

The error-correction equation is presented by Equation 2.

where

Δ indicates the 1st difference, ε_it is white noise error term, θ_1i and θ_2i are long-run coefficients, δ_1i and δ_2i are ARDL short-run coefficients, ϕ_i is the ‘speed of adjustment’ and should be negative and significant. This coefficient shows the speed of adjustment of any disequilibrium towards long-run equilibrium. As the time horizon of our data is not long, the Bayesian information criterion (BIC) is utilized to find the optimal number of lags of the variables in our ARDL model.

3. RESULTS AND DISCUSSION

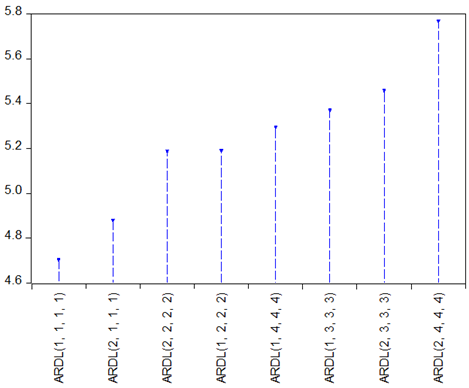

PMG estimation results are presented in Table 3. EG is analyzed as a function of T, FDI, and X, and the short-run and long-run coefficients are estimated. ARDL (1,1,1,1) is selected as the most appropriate model by using the Bayesian information criterion (BIC). Thecalculated BIC for different models with different numbers of lags is illustrated in Figure 7. The less BIC estimator, the higher the quality of the model.

Notes: ***, **, * indicate significance in the 1%, 5%, and 10% levels; Δ indicates the 1st difference.

The estimated coefficients of the short-run equations indicate that T and X both have a strong positive impact on EG. The coefficients of these two variables are significant at 1% and 10% levels respectively. FDI doesn’t have any significant impact on EG in the short run. These findings are consistent with whatMakiela and Ouattara (2018),Rojec and Knell (2018),Zhang (2017),Demir (2016) report on the effect of FDI on economic growth.

The estimated coefficients of the long-run equations indicate that T, X, and FDI all have positive impacts on EG. The coefficients of T and X are significant at 10% level and the coefficient of FDI is significant at 5% level. These findings are consistent withSokhanvar and Jenkins (2022 b) andÇiftçioğlu and Sokhanvar (2021) that report positive impacts of tourism revenues and FDI inflows on the economic growth rate in the long run.

International tourists provide foreign exchange to the domestic economy and it has an immediate positive impact on the economic growth. On the other hand, FDI inflows are injected into domestic projects. The positive impact of these investments on economic growth is detectable after a few periods (Sokhanvar and Jenkins 2022 a). These could be the reasons behind a more significant positive coefficient of tourism in the short-run and a more significant positive coefficient of FDI in the long-run detected in our study.

The coefficient of ECT (Error Correction Term) is –0.6613 and significant at 1% level. It means the speed of adjustment of any disequilibrium towards a long-run equilibrium is about 66% in each period.

To test the robustness of our estimated results, FDI is replaced with GCF in the next step. The coefficients in the second estimation are consistent with those of the first estimation. T and X have significant positive effects on EG in both the short-run and long-run.

EU11 economies experienced improvements in the tourism industry due to the political transformations after the dissolution of the Soviet Union. Tourism development in this region was accelerated after the establishment and enlargement of the European Union, and more international cultural and sports events such as the ‘Eurovision Song Contest’ and ‘UEFA European Football Championship’ hastened this process (Banaszkiewicz et al. 2017). Besides, The common recent historical background makes a unique experience for international tourists in Eastern Europe (Cottrell and Cottrell 2015) that has been an important destination actively promoted by Russian and American tour operators who target English-speaking travelers (Stepchenkova et al. 2009).

During the last decades, the potential of tourism sector in eastern European countries has attracted international tourists, generated employment and foreign exchange income, and expanded the economy. For example, in 2019, the tourism industry generated 75.1, 80.2, and 75.1 thousand jobs, and accounted for 11.3, 5.8, and 8.3 percent of total employment in Estonia, Lithuania, and Latvia respectively. In the same year, visitors spent 2256.7, 1506.5, and 1118.1 million USD in Estonia, Lithuania, and Latvia respectively (World Travel and Tourism Council 2020). These improvements are reflected in the strong influence of tourism development on the economic growth rate of EU11 countries identified by our analysis.

FDI in developing economies provides benefits to citizens and firms by improving technology transfers, creating decent-paid jobs, and making stronger connections to global value chains. A generally well-educated workforce, political stability, a relatively developed infrastructure, and proximity to West European markets are the main elements that make the EU11 economies attractive to foreign investors (World Bank 2020). The effects of more FDI in these economies are well reflected in the results of our study that show a positive effect of FDI inflows on the economic growth rate of EU11 countries.

4. CONCLUSION AND POLICY IMPLICATIONS

This study contributes to the literature on the connection between tourism, foreign investments, and economic growth particularly in relation to the following points: i) comparison of the extent of the impacts of GDP contributions of foreign investments and tourism to the rate of economic growth in both long-run and short-run. ii) It especially focuses on a sample of EU11 economies that are similar in terms of culture, geographical characteristics, and the level of socioeconomic development. Considering this, the important findings of the study can be summed up as follows:

An increase in the share of foreign investments in an economy doesn’t have any significant impact in the short-run, but it can stimulate economic growth in the long term. Tourism expansion can improve the rate of economic growth both in the long-run and short-run, however, its immediate impact is more significant.

The short-run positive effect of tourism expansion on these economies could be due to the improvements in employment levels and household incomes. It encourages consumer spending and increases the demand for different products and services that ultimately enhance economic growth. Besides, the improvements in the foreign exchange earnings in tourism industry can promote investments in different industries of the economy in the long run.

The main policy implications of our statistical results for the EU11 economies can be stated as follows: these countries are likely to benefit from further specialization in tourism in terms of higher per capita income. Therefore, policymakers in these countries may find it welfare improving to allocate a proportionally larger number of public resources to the development of tourism sector.

A destination-led development plan has to be designed to improve internationally competitive tourism services and products across the country. A coordinated strategy is needed to employ related facilities and infrastructure in a wider destination plan. Marketing and branding expertise provided by the government can encourage destinations to improve the visitor experience. Some of the policies that underpin the delivery of this strategy include:

(i) Emphasis on the sustainability of tourism.

(ii) Attracting international visitors to highly profitable tourism places with the greatest potential via identifying high-priority tourism development areas.

(iii) Supporting tourism and hospitality businesses in the innovative and creative use of technology via digital applications.

(iv) Comprehensive guidance and clear offers for tourists, including multilingual signage and information.

In the literature, tax rules and public grants are mentioned as effective tools to attract more tourism. General and specific tourism taxation and tourism grants are known to improve the tourism demand within the region (Gago et al. 2009;Srhoj et al. 2021). Tourism taxations show improvement in the cost internalization and revenues without impacting the economy. However, general indirect taxation is proven to be more equitable, neutral, and feasible to gain profits from tourism campaigns and activities in Spain (Gago et al. 2009). Besides, tourism grants have a strong impact on tourism by improving sales, capital, value-added, and employment, in areas with high tourism demand (Srhoj et al. 2021).

We are living in a period of economic uncertainty. The COVID crisis has changed the patterns of international production and investment via declines in revenues, disruptions in supply chains, and making a challenging global policy environment. Even before this crisis, trade and investment preferences were shifted by rising protectionism. Policy uncertainties and erosion of investor confidence due to protectionism and economic nationalism have been threatening the global FDI, especially after 2017.

The 1st question is how FDI inflows can help EU11 Economies to survive in this situation? FDI boosts countries’ economic resilience by 1-offering an important source of external capital, 2-boosting productivity, 3- lifting people out of poverty via creating more and better-paid jobs.

The 2nd question is what the governments can do to boost and take advantage of FDI inflows? The main goals are to 1- enhance the investment competitiveness of these economies. 2- improve the confidence of investors. 3- amplify the investments’ shares for inclusive growth. According to the Global Investment Competitiveness Report (2020), targeted investment promotion, regulatory certainty, policy predictability, and reducing investor risk can rebuild investor confidence.