INTRODUCTION

The main aim of this paper is to analyse and compare the tourism competitiveness of large islands in the Mediterranean using the prices of tourist accommodation as the main variable of analysis. To achieve this aim, it is necessary first to identify how the offer of tourist accommodation is distributed geographically and then to employ various analytical tools on the prices, such as weighted indexes, data clustering techniques, and graphs. The analysis will compare the changes in pricing experienced between two time periods: 2015 and 2019. Pursuing this strategy will make it possible to determine the existing market segmentation, cluster the islands as a function of their commercial position, assess their competitiveness, etc. For each island, the study will use the sets of prices available to potential tourists on the internet. These prices will be used as an indication of the competitiveness of the product on offer at each destination, that is, as a gauge of its brand value (Moon & Han, 2019; Winzar et al., 2018). An analysis of the distribution and evolution of prices in the period 2015-2019 will help to meet the following objectives:

To compare prices between 2015 and 2019, a dynamic scheme has been used to identify any patterns in tourism markets over the period. It is expected that the variations will not be homogeneous, but will instead affect different products (identified through Star-Board combinations) in different ways.

An additional interest lies in identifying the level of heterogeneity in the Mediterranean tourism market. If there is a single market, then this will also apply to the characteristics of the offers available on each island and their prices. If not, then there will be a non-random distribution in the type of offers and prices, and it will be possible to determine whether any identifiable geographical pattern exists.

The medium-term effect of the refugee crisis on tourist prices will be analysed and the extent to which the crisis has had general or only local effects will be determined.

The paper begins by situating the study’s object of analysis, the large islands of the Mediterranean, in the context of international tourism and setting out the main characteristics specific to them as tourism destinations, including a review of the key events that took place over the period in question. Next, a brief overview of the academic literature will look at the treatment of similar subjects, followed by a section on methodology that will give a detailed account of the characteristics of tourist prices in the Mediterranean sun-and-beach market, explain the process used to obtain prices, and weigh up the representativeness of the data used. The results will reveal the geographic distribution of the Mediterranean tourism offer and compare the prices in 2015 and 2019. Building weighted price indexes and applying the hierarchical agglomerative clustering (HAC) method will make it possible to distinguish two major geographical areas in the distribution of prices. Lastly, the paper will draw a number of conclusions and specify limitations in relation to the type of data used.

The World Tourism Organisation (2021) divides the globe into 14 tourism regions, one of which is “Southern/Mediterranean Europe”. According to the UNWTO, the Southern/Mediterranean Europe region received 304 million tourists in 2019, amounting to 21% of the worldwide total, a figure that puts the region prominently in the top position. Indeed, Mediterranean tourism destinations are notable not only for their large size, but also for their high levels of growth in recent years.

Table 1: International tourist arrivals. Mediterranean countries that have one or more large islands or are island states

Source: UNWTO: International Tourism Highlights 2016, 2020.

As Table 1 shows, with the exception of France, the rates of growth in tourist numbers between 2015 and 2019 were exceptional, especially for the two island states of Malta and Cyprus.

The enormous volume of tourists that visited southern Europe was distributed among a large number of tourism destinations with varied characteristics, most notably destinations located on large islands. A. Papatheodorou (2002) used the commercial offerings that appeared in the brochures of major tour operators to determine the chief tourism destinations of the Mediterranean. Papatheodorou identified 20 major destinations (core), of which 14 were located on islands, and he classified another 27 destinations as secondary (periphery), of which 15 were located on islands. As Table 2 shows, island destinations continued to play a prominent role in Mediterranean tourism in 2019.

Table 2: Number of bed-places by NUTS 2 regions. Year 2019. Mediterranean countries that have one or more large

islands or are island states

Country Bed-places Total (’000)

Mediterranean Islands

Bed-places in islands (’000)

% bed-places in islands

Source: Eurostat.

The data laid out above show that the large islands of the Mediterranean make up a very significant fraction of the world’s major

tourism destinations and are therefore a salient object of study.

Characteristics of tourism destinations on Mediterranean islands

Every island exerts some kind of innate attraction on anyone who feels the desire to travel. To this general attraction, the islands

of the Mediterranean add an image that identifies them with the paradigm of a hedonistic destination, one graced with a warm

climate, excellent beaches and a wide range of businesses ready and willing to cater to the desires of the tourist (Baldacchino, 2008; 2013; 2016; Bramwell, 2003; Koutra & Karyopouli, 2013; Moyà, 2015). In the island destinations of the Mediterranean, “landscape has been romanticised through tourism development interests as an idyllic insular Paradise” (Terkenli, 2005).

Based on the data, Mediterranean islands are a key object of study to understand mass tourism in Southern Europe. That said, the Mediterranean Sea is the setting of hundreds of islands, and tourism has not developed alike on each of them. The most important condition is to have enough connectivity to Northern Europe. Mass tourism cannot thrive on an island if tourists cannot reach the island cheaply. As a result, it is necessary for the island to have an international airport.

Fourteen Mediterranean islands have an international airport with a high degree of summer connections to the leading European feeder markets. While each island obviously has its own personality, all of the islands share a wide range of characteristics in common:

All of the literature that analyses island tourism highlights its strong seasonality (Ebejer, 2020; Karampela et al., 2017; Méndez, 2017; Pulina & Santoni, 2018; Tzanopoulos & Vogiatzakis, 2011). This characteristic reflects the predominance of sun-and-beach tourism on the islands of the Mediterranean.

Their natural resources (physiography, climate and scenery) can be regarded as common (Dwyer & Kim, 2003). All 14 islands share the special attraction of islands located in warm climates (Baldacchino, 2013; 2016).

The cultural resources of each island are obviously distinct. In reality, however, this is a secondary matter because the lion’s share of tourists who visit the islands are keen to spend their time sunbathing on the beach or lounging by the pool, cultivating social relations in bars and restaurants, and visiting shopping centres and nightclubs (Andriotis et al., 2007; Brščić & Šugar, 2020; Caletrío, 2009; Jacobsen & Dann, 2009; Jacobsen et al., 2015; Obrador et al., 2009; Valls et al., 2018). Travellers wishing to learn more about cultural heritage tend to visit the large cities that are home to prominent museums and other cultural attractions, and those cities are located on the European mainland.

Unlike Barcelona, Rome or Athens, none of the 14 analysed islands is a major commercial centre that attracts a

significant number of professional travellers.

5. As Table 3 shows, the majority of tourists who visit any of the large Mediterranean islands come from abroad, with the exception of Corsica. Indeed, only in Sicily and Sardinia are half of the tourists domestic in origin, while the share of foreign tourists visiting the remaining islands exceeds 90%.

Table 3: Nights spent at tourist accommodation establishments by NUTS 2 regions. Year 2019.

Mediterranean Islands Domestic (’000)

Foreign (’000)

Total (’000)

% Domestic % Foreign

Source: Eurostat.

This set of common characteristics shared among the large Mediterranean islands in the study ensures their relative homogeneity.

That is, they offer tourists a similar range of products that make it possible to undertake a comparative analysis based on prices.

A turbulent period for Mediterranean tourism: 2015–2019

The year 2015 was not just any year in the history of Mediterranean tourism. Rather, it marked the start of a period of major disruptions: refugees, Brexit, terrorist attacks, etc. The most notable upheaval came with the refugee crisis that kicked off in the spring of 2015 and caused tourism to plummet instantly not only in Sicily but even more prominently in Greece’s Aegean islands off the coast of Turkey (Cirer-Costa, 2017). At first, the islands in question recorded falls in the number of tourists in the region of 22%, but the drop was as severe as 40% in some cases (Ivanov & Stavrinoudis, 2018; Tsartas et al., 2020). Eventually, the mobilisation of resources for refugee assistance alleviated the situation to some extent. In the short run, however, the tourism crisis was very negative for the affected islands, which were forced to reduce their prices sharply in response to lower

demand (Cirer-Costa, 2017; Zenker et al., 2019). Nevertheless, the data in Table 1 show that tourism as a whole underwent

vigorous growth in the Mediterranean over the period in question.

The year 2019 has become the necessary end point because of the emergence of the Covid-19 pandemic, which practically

halted all tourism worldwide (WTO, 2022; WTCC, 2022).

LITERATURE REVIEW

This paper, which sets out to analyse and compare large Mediterranean tourism destinations, shares its aim with a host of previous studies in the scientific literature. In the first place, it is important to highlight studies that have sought to determine the elements that attract tourists to the Mediterranean. Authors such as Alegre & Garau (2011) and Jacobsen & Dann (2009) have administered surveys whose results indicate that tourists have in mind a “recreational” model of holidaymaking focused on the beach, swimming pool and social activities, which also lie at the heart of the sun-and-beach tourism analysis undertaken in the present study. To such a model of Mediterranean holidaymaking, it is possible to add the special characteristics that distinguish island destinations from mainland destinations, which is a field marked by the notable contributions of Baldacchino (2013; 2016).

In the early years of the twenty-first century, Espinet et al. (2005) and Papatheodorou (2002) carried out comparative analyses of different Mediterranean tourism destinations, producing clear forerunners of the current analysis. In their research, they used data from market intermediaries (tour operators and online travel agencies, or OTAs) and applied the hedonic methodology, which is distinct from the strategy pursued in the present study, and their conclusions already situate the Balearic Islands as an expensive, luxurious destination within the Mediterranean setting, a result that is later confirmed in studies by Bardolet and Sheldon (2008), Inchausti et al. (2021) and Prieto-Rodriguez & González-Díaz (2008).

Along the same lines, Karampela et al. (2014) and Ruggieri (2011) compared major groups of Mediterranean island destinations,

but they left aside commercial factors and instead focused on strictly geographic factors, such as size and accessibility.

Analysing the competitiveness of different tourist destinations is a common goal that a variety of scholars have pursued. Dwyer & Kim (2003), Ritchie & Crouch (2003), Crouch (2011) and Bauman et al. (2019) are only a few of the authors who have developed theoretical models that underlie the analysis conducted in the present paper. These theoretical models propose the use of a set of common characteristics to be able to compare the competitiveness of each destination, since from the point of view of the potential tourist, competition is established between individual destinations and not between countries or large geographical areas (Lopes et al., 2018; Mazurek, 2014).

With respect to previous studies, the present paper furnishes a much more extensive data set, which encompasses the entirety of the Mediterranean basin and adds a dynamic aspect through the comparison of two different periods, 2015 and 2019, so that it is also possible to examine the evolution of prices over time. In addition, the use of strictly quantitative data means that it is not necessary to introduce weightings or subjective valuations of qualitative characteristics that are always debatable (Božič & Knežević, 2016).

The upheavals that shook island tourism between 2015 and 2019 have been a major focus of academic attention. The initial effects of Brexit on tourism, for instance, have been addressed by Cirer-Costa (2017), Hall (2020) and Pappas (2019). Also, the refugee crisis has received a great deal of attention, most notably in studies by Cirer-Costa (2017), Glyptou (2021), Ivanov & Stavrinou (2018), Tsartas et al. (2020) and Zenker et al. (2019).

In this section, the present study’s contribution lies in identifying the effect of the refugee crisis in the medium term and

verifying that the impact has been fundamentally local and concentrated in Greece’s Aegean islands.

The two major cost components of holidays in the Mediterranean are air transport and accommodation. Until the closing years of the twentieth century, most tourists bought package holidays from major tour operators. The packages lumped the two cost components together into a single price. With the advent of the twenty-first century, however, matters changed radically. Since then, low-cost airlines and OTAs have elbowed aside traditional package holidays in the Mediterranean (Alegre et al., 2012; Mitas et al., 2015). In the years under scrutiny in the present study, most travellers coming to the Mediterranean in search of sun and beaches booked their accommodation and air transport separately (Alderighi et al., 2016; Ferrer-Rosell et al., 2015; Moreno-Izquerdo et al., 2015; Seguí & Martínez, 2013).

Tourists book well in advance and have enough time to gather information, so low-cost airlines and hotels have little room to apply dynamic pricing strategies (Bilotkach et al., 2015; Chen & Farias, 2019; Zhang & Zhang, 2017). Holidaymakers purchase cheap, undifferentiated flights on routes where a few providers, who are very similar to one another, engage in fierce competition. As a result of this market structure, the price of air transport between Northern Europe and the Mediterranean tends to be stable and there are few variations among low-cost airlines that fly to the same destination (Alderighi et al., 2016; Calmon et al., 2020; Lazarev, 2013). Similarly, hotel operators in the leading sun-and-beach destinations prefer to apply stable pricing policies that incentivise early booking (Alegre & Sard, 2015; Cirer-Costa, 2021; Ivanov & Ayas, 2017; Melis & Piga, 2016).

However, while the cost of air transport tends toward monotonicity, the same thing does not occur with the cost of accommodation. For each major destination, there is a very wide range of prices as a result of the dispersion of the offering in terms of modalities, categories, room-and-board options, the relative location of accommodations within the destination, etc. (Cruz-Milán, 2019; Valls et al., 2018). As a consequence, booking accommodation is a much bigger challenge for the buyer (Alegre & Garau, 2011; Jun et al., 2007; Park et al., 2019). In addition, the price is not merely an indicator of cost; rather, buyers use price as an indicator of quality too, associating high prices with a high level of quality (Xu et al., 2017).

In the decision-making process, price is the only strictly quantitative criteria. Since it is easily comparable, therefore, it becomes the key attribute that potential customers associate with a specific offer (Song & Zahedi, 2006). Pricing information always stands out over the other variables, reflecting the importance placed on price by consumers of tourism products (Mohammed et al., 2019; Qiu et al., 2018).

For this reason, the present study adopts accommodation price as the variable to analyse in order to determine the relative commercial position of each of the selected islands.

Process to obtain the utilised prices

All of the data used in the study have been obtained directly from the internet under the same conditions that would confront any potential customer searching for a holiday in the Mediterranean.

This is an option that has advantages, but also limitations. The main advantage is that in a market as competitive as the Mediterranean tourism market, prices are an excellent indicator of the commercial position of each destination, while the drawbacks are linked to the difficulty of extracting and compiling the data. The web pages of OTAs, much like most webpages of internet vendors, put intentional roadblocks in the way of using their information in data analysis packages and they apply practices to obfuscate information (Bock et al., 2007; Ellison & Ellison, 2009; Haroutunian et al., 2005; Salop & Stiglitz, 1977). In the face of such technical difficulties, there is no choice but to use prices from a single OTA in order to ensure the homogeneity of the data (Abrate et al., 2012). In addition, Alpharooms.com was chosen because it presented clear information that made it possible to distinguish confidently between the prices of different room-and-board types within the same establishment.

It should be noted that in early 2022 the business group Travel Giants, which included the OTA Alpharooms, ceased activity and went into liquidation because it was unable to survive the crisis triggered by the Covid-19 pandemic.

The search unit (i.e. the observation) is the offer made by each hotel for a seven-night stay in a double room (for two people) during the middle week of June and August in 2015 and 2019, if booked two months in advance. The data collection makes use of the best available rate, which is a common practice in studies on tourism prices (Mattila & Gao, 2016; Mohammed et al., 2019). In this way, every collected price is linked to a category (the category of the establishment), a room-and-board option and a specific month (June or August). Also, making use of the best available rate (BAR) eliminates the dispersion generated by the existence of different room types in each hotel.

Notably, the data for 2015 were obtained shortly before the outbreak of the refugee crisis that affected the Greek islands and

Sicily and also before the terrorist attacks against tourists in Tunisia and Turkey.

Given that the aim is to carry out the most comprehensive possible analysis of sun-and-beach tourism, the present study has excluded hotels in rural areas and Star-Board (S-B) combinations that were not present in at least 12 islands. Using this filter, it has been possible to eliminate 11 of the 30 possible S-B combinations, including all offers involving one-star hotels and one- key apartments. The final number of valid offers is 21,628 from somewhat more than 4,000 tourist accommodations (hotels and blocks of tourist apartments of a category equal to or greater than two stars). The geographic distribution of the data appears in Table 4.

Table 4: Distribution by island and year for the prices used in the study. (The islands appear in order according to the number of prices contributed to the study.)

2015

Note: Prices appear in euros for a one-week stay in a double room. Best available rate (BAR).

For 13 islands, the data are sufficient to carry out a complete statistical analysis. The one exception is Corsica. Indeed, it was already possible to see back in Table 3 that Corsica is clearly distinct from the remaining large Mediterranean islands because it is the only one with a predominance of domestic tourists, not international tourists. As a result, Corsica will be missing from several sections of the study.

The main conclusions are drawn on the basis of: (i) an analysis of the graphs presenting the collected data, (ii) the construction of price indices and (iii) the use of data mining techniques (HAC) to cluster different destinations into subsets that have shared commercial characteristics.

Representativeness of the data used

The final result of the online search is a non-exhaustive but genuinely broad database that is much better than a simple random sample. In order to ensure that the database is representative, two parallel analyses were carried out. The first was a survey of 19 randomly selected major holiday destinations in the Mediterranean so as to compare the number of prices obtained

through Alpharooms.com with what would have been obtained through Booking.com, which is often regarded as the most comprehensive OTA. According to the survey, Alpharooms.com brought up 88% of the hotels that had met the requirements and also appeared in Booking.com.

The second, much more thorough analysis consisted of identifying all the offers in the Balearic Islands based on official data and comparing them with the offers appearing on Alpharooms.com. The second analysis confirmed that the database captured 70% of the hotels that met the required criteria and that these hotels represented 81% of all the rooms in existence in the Balearic Islands, which is very high percentage.

Methodology

After producing the databases that correspond to the two years under scrutiny, it is necessary to construct comparative graphs to determine the structure of the offer that exists on each island and identify any changes that affect the offer between 2015 and 2019. It is also possible to construct comparative price graphs and use the z-test to verify whether any detected changes are statistically significant.

In addition, two synthetic variables are constructed that are unique for each island: a (Paasche) weighted price index and the average weekly spending on accommodation per couple on each island. The first variable is used directly (see Figure 3), while the second one is used to supplement the hierarchical agglomerative clustering (HAC) method that is employed to sort and cluster the different islands into two major groups according to their relative prices.

Lastly, quality indexes are constructed based on accommodation category and the different added value of each room-and-board

option. The variation of the indexes is used to detect the evolution of the destinations in terms of quality.

Figure 1: Distribution of the 21,628 offers by island and hotel category

Figure 1 shows the distribution of the 21,628 offers by island and category. As can be observed in the figure, no island has specialised in a single category and all have highly diverse offers. This diversity points to the importance of regarding a large destination as a complex entity that must attract tourists from different income segments in order to achieve and maintain competitiveness in the market (Knežević et al., 2015; Miah et al., 2017; Qiu et al., 2018; Valls et al., 2018).

Overall, when analysing the changes that took place between the summers of 2015 and 2019, some instances of consistency can be observed:

While the time interval is relatively short, there are significant variations in the volume of the islands’ tourism offer. There are falls in the volume on Corsica, Cyprus and Majorca, and there are minor changes on Ibiza, Malta,

Crete and Kos. By contrast, there is major growth on Corfu, Sicily, Sardinia and Minorca and extraordinary growth on Rhodes, Kefalonia and Zakynthos. The growth experienced by the tourist offer in the Ionian Islands stands out. It is a region of low income and poor tourism results before the turn of the century (Artelaris, 2017; Courtis & Mylonakis 2008).

2. The category whose offer sees the greatest growth is four-star hotels (18%), followed by five-star hotels (15%). The growth in the offer of luxury establishments is spectacular on Zakynthos, where it increased by a factor of seven.

3. As for room-and-board options, there is a notable decline in the FB and RO options and a notable increase in the AI and SC options.

Evolution of average prices for each S-B combination between 2015 and 2019

The second result of the research relates to a comparison of the prevailing prices in 2015 and 2019. Figure 2 shows that tourist prices for all S-B combinations rose systematically between 2015 and 2019 and that the statistical significance of this growth is greater than 99% in nearly every case. Only the five-star category shows non-significant growth or even deterioration.

These data confirm a common assessment in the scientific literature that the customers of luxury hotels have a specific profile that distinguishes such establishments from others and that, as a result, their pricing policy can be expected to be different (Mohammed et al., 2019).

Figure 2. Comparison of average prices in the Mediterranean Basin between 2015 and 2019

Note: The numbers 2, 3, 4 and 5 correspond to the average category in stars. The room-and-board option is indicated by abbreviations: SC=self-catering; RO=room only; BB=bed and breakfast; HB=half board; FB=full board; AI=all inclusive.

Then, in order to study the variation in prices between 2015 and 2019, the next step was to create a weighted price index for each island, which is shown in Figure 3. The price index was constructed using the Paasche formula island by island, employing as quantities the number of offers that appeared for each S-B combination in each island. From the obtained index, the variation in the consumer price index (CPI) for each country is subtracted to obtain the real variation in tourism prices. The CPI data come from Eurostat.

Figure 3. Weighted price index by island in 2015 and 2019

They reflect the variation in the price of tourist accommodation between the two years. The indices have been obtained using

the Paasche formula and subtracting the CPI for each country.

As Figure 3 shows, the real prices of tourist accommodation rose sharply over the period. After accounting for inflation, prices went up by 15% on average in the set of 13 islands included in the analysis (the data corresponding to Corsica were not sufficient for inclusion). Widespread price rises at this level are indicative of solid upward growth in demand (Radulescu & Meleca, 2020). While the upswing in demand is clearly greater at some island destinations than at others, it is not concentrated by country, given that some Spanish and Greek destinations see above-average growth, while others see below-average growth (Benítez-Aurioles, 2020).

When examining the results individually by island, there is a marked increase in tourist accommodation prices in the Greek Ionian islands of Zakynthos, Kefalonia and, to a lesser extent, Corfu. Minorca, Majorca and Malta also experienced price rises slightly above average. By contrast, the increase in tourist accommodation prices in the three Greek islands in the Aegean, namely Rhodes, Kos and Crete, is below average, as it is in Cyprus, Ibiza and the Italian islands.

According to the data in Figure 3, it appears that the effects of the refugee crisis were still being felt in the tourism markets of the affected islands in 2019. Specifically, Rhodes, Kos and Sicily all showed prices that had risen less than average. In any case, however, all of the islands affected by the refugee crisis had undergone significant growth in their real prices between 2015 and 2019, which is an indication that their tourism demand did not fall, but in fact grew – albeit not to the extent that might be expected in light of the evolution of prices on the Ionian islands.

Prices as indicators of growing market segmentation

Looking at the data in Figure 1, which is exclusively based on the category of hotels and apartments, it is not possible to say whether there was any geographic segmentation of the tourism offer in the Mediterranean in 2015 or 2019. However, if prices are introduced, then the geographic segmentation becomes clearly visible. Verification involves the use of two different tools: the overall average prices by island and the dendrograms produced from the relative position of the prices on each island within the Mediterranean context, that is, the rank order of prices by island within the group.

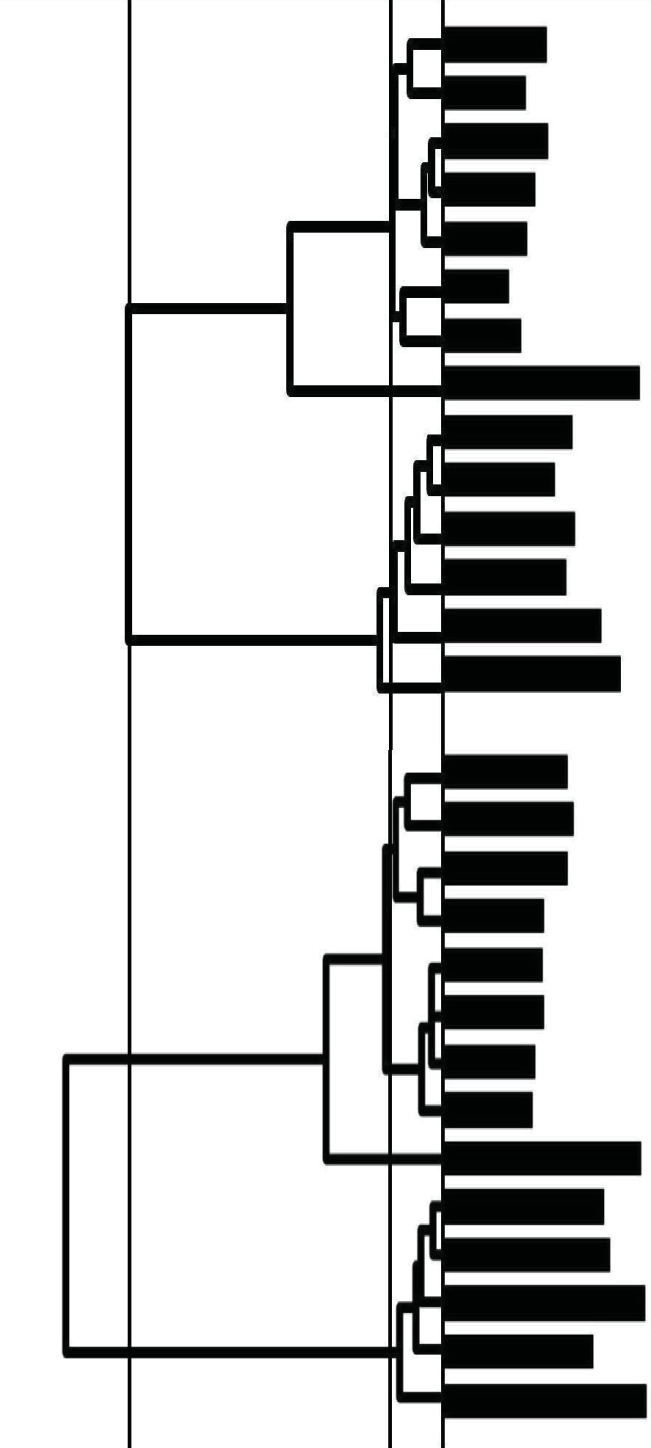

To that end, the dendrograms in Figure 4 were created by calculating the average prevailing prices on each island for each of the 19 S-B combinations at the four times considered (June and August 2015 and June and August 2019). These prices were then arranged in descending order from largest to smallest, assigning a value of 1 to the most expensive island and a value of 14 to the least expensive island for each S-B combination. According to this procedure, each of the 14 islands was assigned a total of 38 ordinal variables for 2015 and again for 2019.

Then, the hierarchical agglomerative clustering (HAC) procedure was applied to the resulting data, using the Euclidean distance and Ward’s Agglomeration method. The procedure uses the distance to successively cluster different observations into subsets that minimise the internal variance of the group and maximise the differences between any constructed subsets. The statistical analysis program XLSTAT was used. The results can be seen in the two dendrograms in Figure 4.

Figure 4: Island clusters based on the HAC method

Dendrograms with islands clustered according to the relative ranking of their prices in 2015 and 2019. On the right are the average weighted prices for each island for the two years in question, which offer an approximation of the average weekly spending on accommodation by any pair of tourists who visit the island.

From a comparison of the two dendrograms in Figure 4, it is possible to observe that both graphs appear as well-defined blocks: one includes the lowest prices (top block) while the other includes the highest prices (bottom block). Corsica does not fit clearly into either block.

More specifically, the 2015 dendrogram shows a clear geographical pattern since all of the western islands appear in the bottom group (with the highest prices) and the eastern islands appear in the top group (with the lowest prices). Only Cyprus diverged from the pattern in 2015, and even then, the anomaly has disappeared by 2019. Another important change affects Zakynthos and Kefalonia. In 2015, they stood out as the least expensive islands in the Mediterranean. Only four years later, however, their prices had risen significantly and they were fully in line with the prices that prevailed on the remaining Greek islands.

In the western group, there is a generalised increase in prices, but the prices have also become significantly more concentrated. In 2015, the least expensive western island was Minorca and yet it was precisely Minorca whose prices saw the greatest increase (30%). The opposite occurred in Sardinia, which was the island with the highest prices in 2015 but also the one that experienced the least growth in prices (only 14%).

Based on a comparison of the results for 2015 and 2019, the price dispersion among the islands in the eastern group has remained at the same level, but it has diminished among the islands in the western group. Indeed, as Figure 4 shows, the internal dissimilarity in the western group has fallen. At the same time, however, there is a significant rise in the dissimilarity between the western islands and the eastern islands. The conclusion is that the offer for each of the two groups of islands is becoming internally more homogeneous at the same time that the two groups are becoming systematically more separate from one another and the model is shifting toward a bipolar structure (see Figure 5).

Figure 5: Geographic and commercial location of the 14 islands in the study

Map of the Mediterranean Sea with the 14 islands in the study, indicating their inclusion in the western or eastern group as a function of the results obtained from the HAC analysis. From the data, Corsica cannot be put conclusively in either group.

Accommodation categories and room-and-board options evolve in line with prices

Another example of the above-mentioned evolution appears in Figure 6. To construct the figure, four categories of hotels and tourist apartments have been clustered in two blocks: a lower category (2 and 3 stars) and a higher category (4 and 5 stars). Similarly, the six room-and-board options have also been clustered in two blocks: lower added value (SC, RO and BB) and higher added value (HB, FB, AI). Figure 6 shows the variations in the two blocks experienced on each island between 2015 and 2019. According to the figure, three sets of islands offer well-defined variations in line with the two groups identified in the dendrograms in Figure 4.

Figure 6: Variations in the offer of low-category accommodation and lower added value room-and-board options experienced by each island

On the islands of Ibiza and Majorca, the low-category establishments fell significantly as a proportion of all accommodation. On Ibiza, they fell by 16 points, while on Majorca, the fall was 14 points.

By contrast, Sardinia and Sicily do not present any notable variation in terms of the category of tourism establishments, but they

do show a significant reduction in room-and-board options of lower added value.

Lastly, the third set of islands, which covers the Greek islands of Corfu, Crete, Kefalonia and Rhodes, shows a robust trend. On all four islands, the proportion of low-category hotels is growing at the same time that the offer of room-and-board options of lower added value is also growing. This trend indicates that the islands are specialising in customers who have lower purchasing power.

In the case of Kefalonia and Zakynthos, prices have risen a good deal (see Figure 2), but only on Zakynthos has there been a relative improvement in the quality of the product (see Figure 6). The driving force between the increase in prices has, in both cases, been the two islands’ geographic distance from the waves of refugees that affected Greece’s Aegean islands, which are located closer to the Turkish coast. That said, the initial prices on the two islands were very low, so that any increase has only served to bring them up to a position similar to the other Greek islands, not to overtake them.

DISCUSSION

The obtained data confirm that “tourism has become an increasingly specialised industry, with new niche markets developing” (Ferrer-Rosell et al., 2021, 189). Each island is assuming a specific role in the Mediterranean tourism market. Ibiza has now become a fully differentiated destination that has customised its offer in terms of luxury and nightlife (Cirer-Costa, 2021). Minorca now tends to attract family tourism among those with higher purchasing power (Pérez, 2012). Crete holds steady as a bastion of the Mediterranean’s traditional major tour operators, which does not imply any backwardness but is rather the result of the major tour operators’ complete adaptation to present demands (Andriotis et al., 2007; Tom Dieck et al., 2018). Lastly, the large Greek islands have increasingly specialised in catering for European family tourism among those with lower purchasing power – a trend that appears likely to continue in the years ahead.

This is a process that poses obvious risks for destinations that specialise in catering to tourists who have lower economic capacity. Such destinations run heightened risks with respect to future shocks to tourism demand, because the tourists in question cannot sustain their holidaymaking habits if their income falls. In an environment in which crises appear to be endemic (Cheer et al., 2021), a recurring series of shocks caused by economic depressions, pandemics or sudden disruptions in air traffic could subject these destinations to continual stress, ultimately exhausting their resilience (Filimonau & De Coteau, 2020; Martin et al., 2016).

To the pressures generated by the tourism market itself, it is also necessary to add external pressures, such as climate change and the adoption of alternative energies as well as the gradual implementation of a circular economy model (Ferrer-Rosell et al., 2021). The new external factors, however, will not have symmetrical effects in every Mediterranean destination. Rather, they will exert distinct pressures on each of them, amplifying the potential for dispersion and market segmentation (Saarinen et al., 2017).

CONCLUSIONS

At the outset, the objectives of the study were framed in relation to three sets of questions, which it is now possible to answer:

Regarding the overall evolution of prices, the analysis shows that prices increased well above inflation in all cases except for luxury hotels. This pattern shows robust demand and the attachment of northern Europeans to their Mediterranean holidays.

The second conclusion is that it was already possible to identify an east-west gradation from lower to higher prices for tourist accommodation in 2015. By 2019, the price gradation was starker and the eastern destinations tended toward specialising in customers with lower purchasing power. This trend has two key aspects. On one hand, the new establishments that opened in the eastern group tended to be low-category and offered room-and-board options of lower added value. On the other hand, the price indices show that the prices for any S-B combination tended to be lower in the east than in the west. The Mediterranean tourism market is evolving, abandoning the model of undifferentiated sun-and-beach destinations (Gilbert, 1990; Picazo & Moreno, 2018).

The flood of refugees in 2015 had a serious impact on Greece’s islands in the Aegean, but between that year and 2019 the offer has grown in all them and, in no case did prices plummet. In general, the analysis has pointed to the resilience of destinations that are characterised by diversity, maturity and a greater dependency on tourism (Baldacchino, 2013; 2016; Gaki & Koufodontis, 2022; Psycharis et al., 2014).

As a whole, the results point to the great strength and growth capacity of sun-and-beach tourism in the Mediterranean, even when confronted by critical situations. Demand is robust and growing, but it is also met with different responses in each place. The Balearic Islands, which are a mature and saturated destination, have seen demand pressure lead to higher prices and a systematic substitution of lower-priced accommodation by other much more expensive accommodation (Inchausti et al., 2021; Obrador, 2017).

A similar situation is now occurring in Malta and, to a lesser extent, in Cyprus (Ayres, 2000; Briguglio & Avellino, 2019;

Ebejer, 2020). As a consequence, Malta and Cyprus may well undergo an evolution akin to that of the Balearic Islands in the

near future, leading the former two islands to distance themselves from the eastern tourism model and draw more closely to the western model through a transition that is marked by the elimination of rooms in low-category establishments, an improvement in the quality of the product on offer, a general rise in prices, etc. This would enable Malta and Cyprus to customise their tourism offer and create their own market segments, heightening the progressive diversification that is observed in the eastern destinations.

Study limitations and future research

The methodology used in the study, which consists of tracking the accommodation prices of establishments on large Mediterranean islands, has made it possible to recognise the differences in competitiveness that they present and to approximate the evolution of their commercial position in recent years. The findings are significant but not without limitations, especially in terms of their use in the future.

The limitations are twofold. First, by focusing on large islands, it is possible to analyse a highly significant fraction of the sun-and-beach market, but not all of it. The mainland and secondary island destinations are left aside. That said, this limitation would appear to be practically inevitable in light of the enormous size and diversity of the Mediterranean tourism market. The second and more significant limitation concerns the origin of the data. By using a single source of prices, it is necessary to verify their representativeness and accept the risk posed by a potential rupture in time. In the present case, the rupture has taken the form of Alpharooms’ liquidation and disappearance, which will clearly impede any potential continuation of the study in subsequent years.

In any event, the present study provides tools to use prices as a basic variable in future studies that seek to compare large

tourism destinations or determine the evolution of specific destinations over time.